If you’re managing rental properties or overseeing real estate investments, having a clear record of payment history is crucial. That’s where the rent ledger comes in. This document provides a detailed view of a tenant’s payment history, including rent charges, payments, balances, and late fees. It’s one of the most important tools for tracking cash flow and ensuring rent roll accuracy.

This article is part of a comprehensive series on Rent Roll.

What Is a Rent Ledger?

A rent ledger (aka “tenant ledger” or “lease ledger”) is a chronological record of a tenant’s rental payments over the course of their lease. Unlike a one-time invoice or receipt, a rent ledger accumulates data over time, offering a comprehensive financial snapshot. At a minimum, it includes information such as lease start and end dates, rent charges, payment dates and amounts, outstanding balances, late fees, and any special adjustments like concessions or credits.

This document is typically maintained by landlords, property managers, or real estate investment teams. It enables them to easily monitor whether tenants are current on their rent, identify patterns of late payment, and resolve disputes quickly with accurate historical records. Tenants, too, benefit from access to a rent ledger when applying for future housing or disputing claims about payment history. verify their payment history.

DateTransaction TypeChargePaymentBalanceNotes2025-06-01Rent Charge$2,000.00–$2,000.00June Rent Due2025-06-03Payment Received–$2,000.00$0.00Paid via bank transfer2025-07-01Rent Charge$2,000.00–$2,000.00July Rent Due2025-07-10Payment Received–$2,000.00$0.00Late payment2025-07-10Late Fee$50.00–$50.00Late fee assessed per lease terms2025-07-15Payment Received–$50.00$0.00Late fee paid

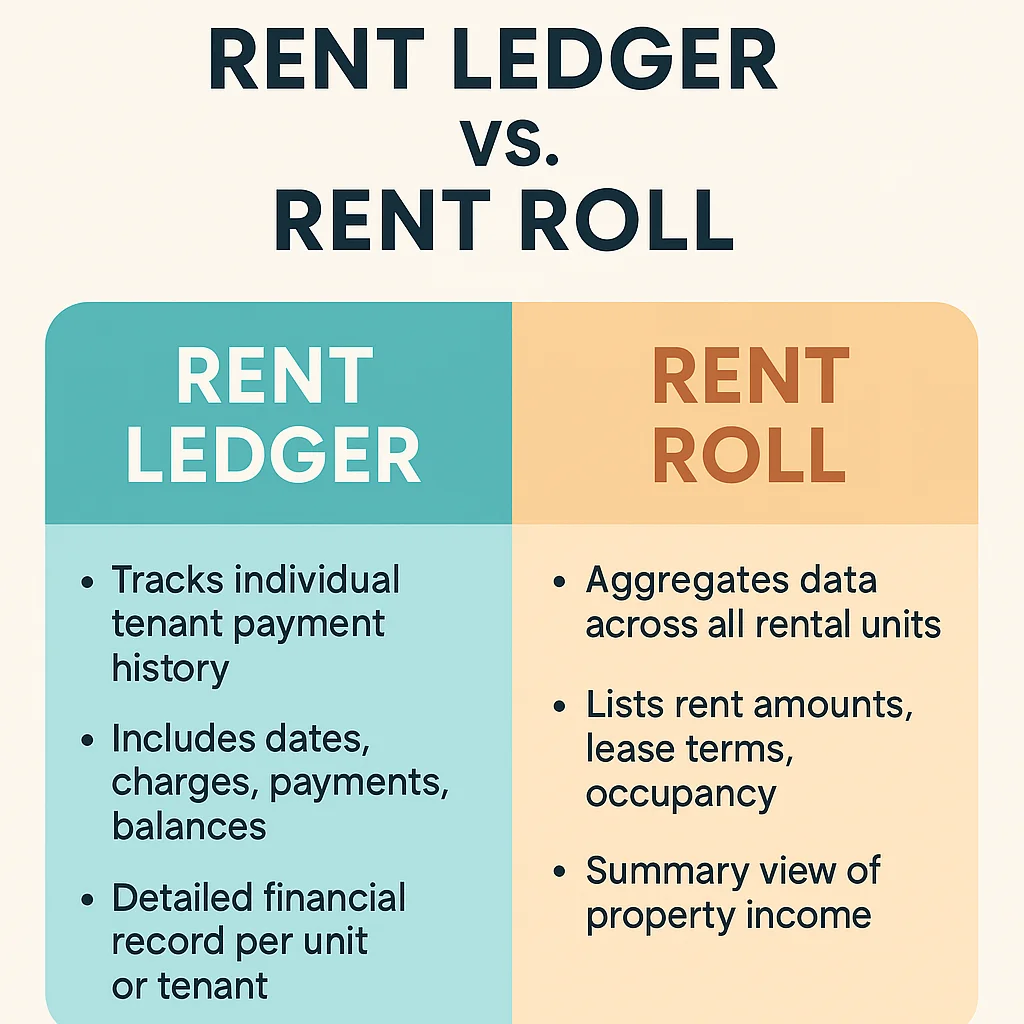

Rent Ledger vs. Rent Roll

While both documents relate to rental income and cash flow, they serve distinctly different functions in real estate operations. The rent roll offers a big-picture view: it outlines all rental units within a property, current tenants, lease terms, and expected income across the entire portfolio. It is frequently used by asset managers, brokers, and investors to evaluate the performance of a property.

On the other hand, the rent ledger zooms in on a single tenant or unit. It reveals what has actually been paid—on time or late—compared to what’s owed. Where the rent roll tells you what “should” happen, the rent ledger tells you what “did” happen.

This distinction is especially important during audits or legal reviews, where historical accuracy is critical. The rent roll might claim a tenant is paying $2,000 monthly, but the ledger may show irregular payments, bounced checks, or missed months—offering a far more realistic assessment of risk.

Why Rent Ledgers Are Crucial for Real Estate Operations

1. Financial Accuracy

A rent ledger acts as a financial truth serum. It keeps property managers honest about incoming revenue and enables them to reconcile their books with actual payments received. Without a reliable ledger, discrepancies between forecasted and real income may persist unnoticed for months. This not only distorts property performance metrics but can also throw off investor reporting and budgeting efforts.

2. Legal Protection

In the unfortunate event of a legal dispute—whether it involves eviction proceedings, claims of nonpayment, or disagreement over lease terms—the rent ledger serves as a first line of defense. Its time-stamped entries provide evidence of payments (or lack thereof) that courts often recognize as legally binding. A well-maintained ledger can make the difference between a drawn-out dispute and a quick resolution.

3. Tenant Communication

Transparency matters. When tenants receive a clear, itemized statement of charges and payments, it reduces the likelihood of misunderstandings or payment disputes. A rent ledger creates accountability and makes it easier to address questions like “Did you receive my payment on the 5th?” or “Why was I charged a late fee?” By eliminating ambiguity, property managers can foster better relationships with tenants.

4. Cash Flow Management

Cash flow is the lifeblood of real estate operations. Rent ledgers provide the real-time data needed to assess whether income is arriving as expected. Managers can easily spot patterns of delinquency, determine how much rent is in arrears, and trigger follow-up actions like reminder notices or collections. When integrated with rent roll data, ledgers also help forecast income more accurately for future planning.

Common Rent Ledger Formats

Property managers and landlords use various formats depending on portfolio size and operational maturity:

While many small landlords still rely on spreadsheets like Excel or Google Sheets to manually record rent data, this approach is error-prone and hard to scale. Missed entries, forgotten updates, and inconsistent formatting can cause costly oversights. Spreadsheets also lack automated alerts or integrations with accounting tools.

For larger portfolios, professional property management platforms such as Yardi, AppFolio, and Buildium offer built-in ledger tracking. These platforms automatically generate entries as tenants make payments online, applying logic to late fees, partial payments, and credits. They also support exporting ledger data for audits or owner reporting.

A growing number of real estate firms are adopting AI-powered solutions like Kolena to take ledger accuracy to the next level. These platforms extract structured data from leases, scanned checks, or payment receipts and automate ledger population without manual entry.

How AI Enhances Rent Ledger Accuracy

Artificial intelligence plays a transformative role in ledger creation and maintenance. Instead of relying on human data entry, AI tools can read scanned documents—such as lease agreements or payment stubs—and automatically extract rent amounts, due dates, payment activity, and remaining balances. This enables rent ledgers to be built or verified in minutes, not hours.

Kolena’s AI agents do more than just extract data. They analyze it. By comparing actual payment behavior to the lease schedule, the platform can identify missed payments, flag discrepancies, and even track rent increases over time. This level of intelligence helps property teams proactively manage risk, reduce compliance concerns, and deliver cleaner reports to investors.

Because Kolena integrates with existing systems, users can view clean rent ledger data in accounting dashboards or sync it directly into rent roll reports—ensuring consistency across operational and financial metrics.

How Kolena Helps

Kolena AI agents help automate the extraction, verification, and analysis of rent ledger data. Users can upload scanned documents, invoices, or spreadsheets, and the platform will detect line-by-line payment activity, flag outstanding balances, and identify inconsistencies across files or months.

This allows teams to focus on resolving issues rather than finding them. The data is presented in clean dashboards, exported to accounting software, or used to update rent roll entries automatically. In high-volume portfolios, this automation translates to thousands of hours saved annually.

Conclusion

A rent ledger is more than a record—it’s a vital financial and operational tool. Whether you’re managing one unit or 10,000, accuracy in rent tracking matters. By integrating AI tools like Kolena, property professionals can automate the ledger process, reduce errors, and operate with confidence.

The result is not just cleaner books—but better business decisions, stronger tenant relationships, and a portfolio that performs at its full potential.