What Is Defeasance?

Defeasance is a prepayment method used in commercial real estate finance to release a borrower from an existing mortgage loan without violating the terms of a securitized loan. Rather than paying off the loan directly, the borrower substitutes the original collateral—typically the real estate—with a portfolio of U.S. Treasury securities. These securities are structured to generate the same cash flows that the lender would have received from the original loan.

This process is especially prevalent in the context of commercial mortgage-backed securities (CMBS) loans, where prepayment is often restricted by lockout periods or yield maintenance provisions. Defeasance offers a workaround that satisfies the lender’s financial expectations while giving the borrower flexibility to sell or refinance the property.

- What Is Defeasance?

- Why Defeasance Matters in Real Estate Finance

- The Defeasance Process: Step-by-Step

- Costs Associated With Defeasance

- Benefits of Defeasance

- Risks and Considerations

- A Real-World Case Study: Unlocking Equity via Defeasance

- How AI Is Modernizing the Defeasance Workflow

- Defeasance vs. Yield Maintenance

- When Should You Consider Defeasance?

- Conclusion: A Strategic Tool for Unlocking Trapped Value

Why Defeasance Matters in Real Estate Finance

In commercial real estate, flexibility is a strategic asset. Properties are often held, sold, or refinanced as market conditions shift, and the ability to unlock equity or reposition assets is central to maximizing returns. However, CMBS loans are structured to provide predictable income streams to bondholders and, as such, are notoriously inflexible.

Defeasance provides a legal and financially viable pathway to navigate around these restrictions. For borrowers, it is a mechanism to pursue opportunistic sales or refinancings without incurring harsh penalties. For lenders, it preserves the cash flow promised to investors. For both, it offers a means to balance the long-term contractual structure of CMBS loans with the dynamic nature of real estate investing.

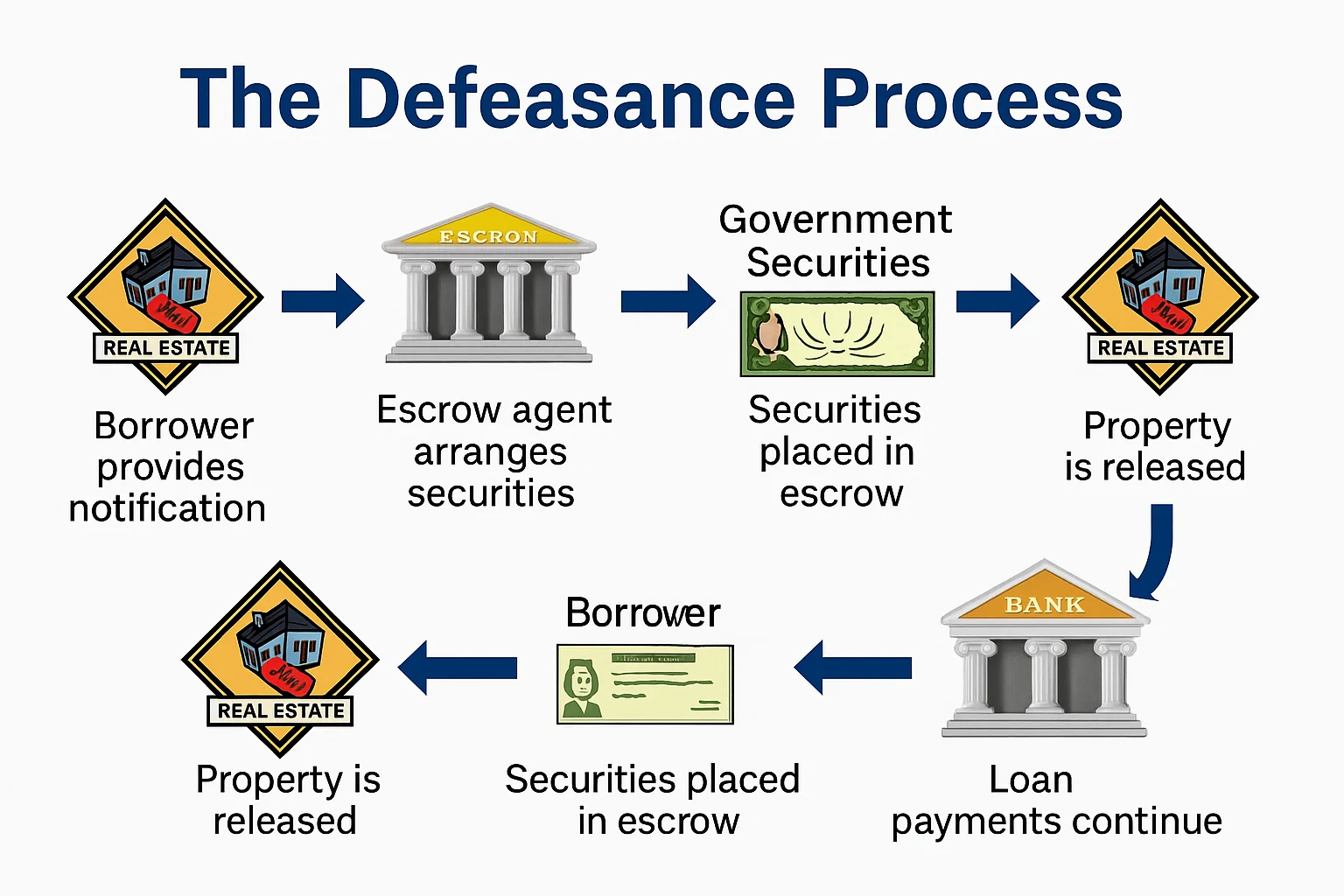

The Defeasance Process: Step-by-Step

Loan Review & Cost Analysis

The borrower initiates the process with a review of loan documents and a cost assessment with a defeasance consultant.

Engaging a Consultant

Consultants source the correct U.S. Treasury securities and time the purchase based on rate conditions.

Structuring the Securities Portfolio

A customized basket of securities replicates the original debt service.

Creating a Successor Borrower Entity

An SPE is formed to assume the loan using the securities as collateral.

Closing

Legal teams finalize documents, securities are funded, and the original property is released.

Costs Associated With Defeasance

Component | Typical Cost Range |

|---|---|

Treasury Securities | Market-dependent |

Legal Fees | $10,000 – $20,000 |

Consultant Fees | $15,000 – $25,000 |

Title & Verification | $5,000 – $10,000 |

Total | $30,000 – $50,000+ |

Additional factors include timing risks and potential residual value clauses.

Benefits of Defeasance

Enables Asset Liquidity: Unlock capital from CMBS-restricted properties.

Preserves Lender Income: Maintains the integrity of securitized cash flows.

Improves Borrower Flexibility: Essential for strategic acquisitions or redeployments.

Risks and Considerations

Interest Rate Volatility: Affects the cost of purchasing Treasury securities.

Process Complexity: Requires precise coordination and documentation.

Residual Value Disputes: Must be addressed clearly in loan agreements.

A Real-World Case Study: Unlocking Equity via Defeasance

A private equity sponsor holding a CMBS-encumbered retail asset sought to refinance and extract capital. Despite $520,000 in defeasance costs, refinancing generated $3.2M in proceeds, enabling reinvestment into an adjacent center. Rapid coordination and market timing allowed the transaction to close smoothly.

How AI Is Modernizing the Defeasance Workflow

The traditional defeasance process is labor-intensive, heavily reliant on legal counsel and manual analysis. AI is transforming this landscape by introducing speed, precision, and automation to formerly time-consuming tasks.

Key AI-Driven Enhancements

Contract Intelligence

AI can instantly extract, interpret, and categorize defeasance provisions from hundreds of loan documents. This allows asset managers to quickly assess whether a loan permits defeasance, and under what conditions, without waiting on legal review.

Real-Time Cost Estimation

Machine learning models can ingest live U.S. Treasury data and simulate defeasance costs in real time. This enables acquisition and finance teams to model “what-if” scenarios and time the transaction to optimize costs.

Workflow Automation

AI agents can generate checklists, identify missing documentation, and pre-fill key legal and closing forms, reducing human error and accelerating execution.

Portfolio-Level Insight

For firms managing multiple CMBS loans, AI enables portfolio-wide scanning to identify which properties are eligible for defeasance, how soon, and under what financial impact—supporting more strategic capital planning.

Kolena’s Contribution

Kolena’s AI-driven platform empowers real estate professionals to:

Upload and analyze loan packages to detect defeasance and prepayment language automatically.

Run cost models based on live market conditions and customized assumptions.

Configure extraction agents without coding to suit the needs of different lenders or property types.

Receive alerts when favorable defeasance conditions arise, streamlining the window for action.

By embedding AI directly into the transaction workflow, Kolena reduces reliance on external consultants and shortens the time from decision to execution.

Defeasance vs. Yield Maintenance

AspectDefeasanceYield MaintenanceStructureSubstitute loan payments with TreasuriesDirect monetary penaltyComplexityHigh (requires coordination)ModerateLoan TypeCMBSBank / Life Co.Tax ImplicationsOften tax-neutralMay trigger gain recognition

When Should You Consider Defeasance?

When refinancing can unlock substantial equity

When asset disposition is timed to peak valuations

When CMBS lockout prevents traditional prepayment

Conclusion: A Strategic Tool for Unlocking Trapped Value

Defeasance, while complex, is a powerful strategy for sophisticated real estate operators seeking to enhance asset liquidity without breaching loan terms. When executed well, it provides a compliant, investor-friendly path to refinance or sell encumbered assets. With AI-enabled tools now removing much of the friction around document analysis, cost modeling, and execution logistics, the barriers to defeasance are falling.

For teams managing portfolios financed with CMBS debt, defeasance should be seen not just as a technical process, but as a strategic lever to accelerate growth and capital deployment.