Why AI is Reshaping Real Estate Investing

For decades, real estate investing has relied on market intuition, local knowledge, and manual analysis. But in today’s data-driven world, that approach no longer scales. Artificial intelligence (AI) is transforming real estate investing by enabling smarter, faster, and more predictive decisions—powered by data, not guesswork.

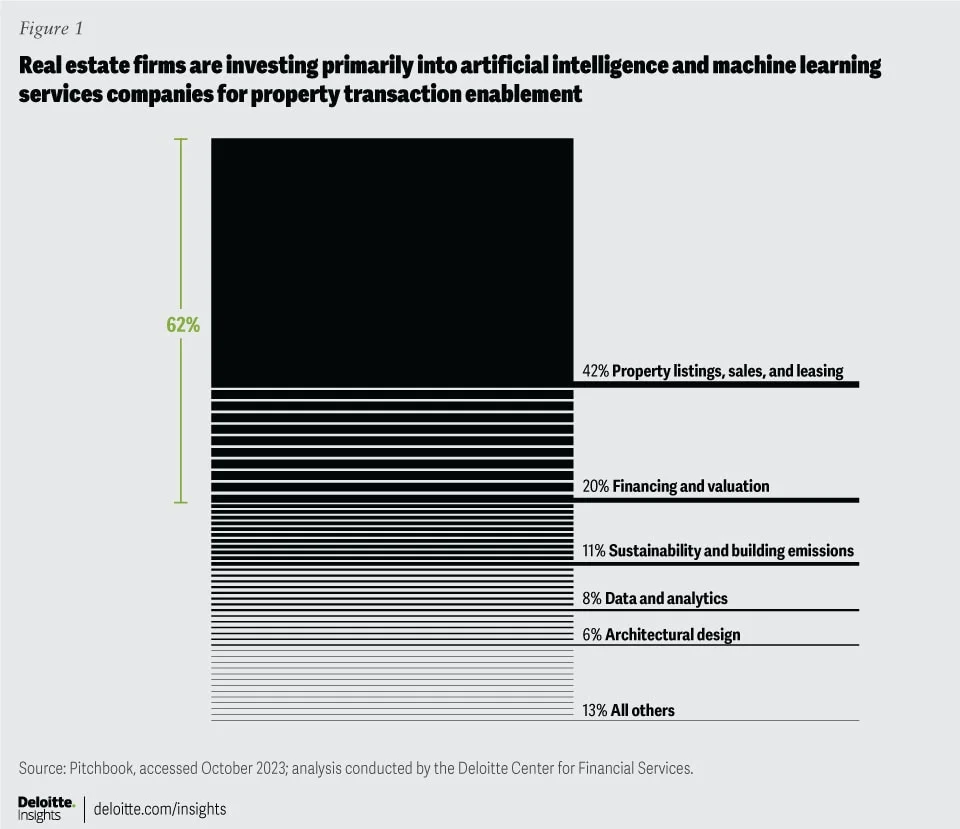

Whether it’s identifying undervalued properties, analyzing offering memorandums, or forecasting long-term cash flow, AI gives investors a powerful advantage. This shift is already underway. According to Deloitte’s 2024 Commercial Real Estate Outlook, over 60% of real estate firms plan to increase investment in AI and automation. Those who adopt early will unlock a new era of growth and operational efficiency.

- Why AI is Reshaping Real Estate Investing

- What Is AI in Real Estate Investing?

- Smarter Deal Sourcing with AI

- Faster and More Accurate Due Diligence

- Financial Modeling Powered by Machine Learning

- Operational Efficiency Across the Portfolio

- Real-Time Risk Management

- Who’s Using AI in Real Estate?

- Choosing the Right AI Platform

- What’s Next for AI in Real Estate?

- AI Is the Future of Real Estate Investing

What Is AI in Real Estate Investing?

AI in real estate investing refers to using machine learning, natural language processing (NLP), and automation to streamline key workflows across the property investment lifecycle. From due diligence and deal sourcing to financial modeling and portfolio management, AI can process massive volumes of structured and unstructured data to surface patterns and insights that humans would miss or take days to uncover.

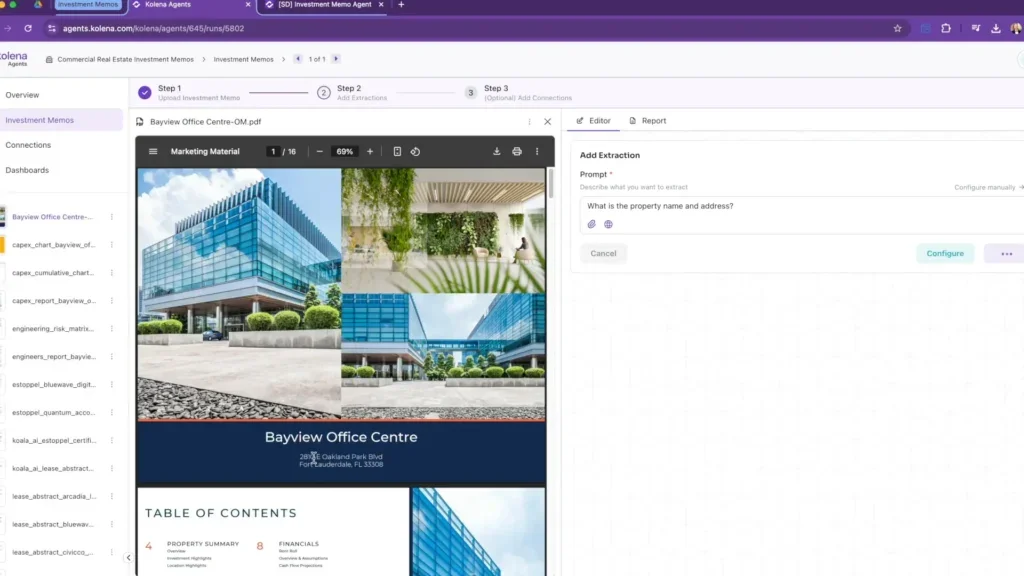

A prime example is Kolena’s AI-powered agent platform, which helps investors instantly analyze lease agreements, extract insights from offering memorandums, and benchmark property performance. In this AI-driven model, real estate becomes more about strategic decision-making and less about data wrangling.

Smarter Deal Sourcing with AI

Sourcing quality investment opportunities has always been a blend of network access and market timing. AI changes that by enabling scalable, data-backed deal discovery. Modern AI tools can scan thousands of property listings, zoning records, economic reports, and satellite images to find emerging opportunities faster than any human team.

Investors can now proactively identify off-market deals, predict neighborhood growth based on foot traffic and infrastructure plans, or even flag properties under financial distress. For example, Skyline AI (acquired by JLL) used machine learning to process over 10,000 data points per asset to identify undervalued commercial real estate opportunities with superior precision.

In this context, Kolena’s offering memorandum analysis further accelerates evaluation by automatically extracting cap rates, rent roll details, and lease terms—saving hours of manual review and making it easier to prioritize the most promising opportunities.

Faster and More Accurate Due Diligence

Due diligence is often the bottleneck in closing a deal. Reviewing leases, insurance documents, environmental reports, and maintenance logs can take days—especially in large multifamily or commercial acquisitions. AI slashes that timeline.

Using NLP, AI systems can rapidly extract key clauses from lease agreements, flag high-risk tenants, and summarize critical deal terms. This eliminates manual errors and ensures nothing gets missed. According to Propmodo, AI-driven due diligence can reduce underwriting time by up to 50%, while surfacing deeper insights from previously ignored data like handwritten lease addenda or scanned PDFs.

Financial Modeling Powered by Machine Learning

AI helps investors build more accurate and flexible financial models by incorporating historical performance, macroeconomic trends, and market comparables. Machine learning models can project rental income, operating expenses, and cash flow under different assumptions, enabling dynamic scenario analysis.

Rather than relying on static spreadsheets, investors can now simulate the impact of interest rate shifts, tenant turnover, or capital improvements with far greater precision. These insights drive better decision-making and improve investor confidence in underwriting assumptions.

Platforms like Kolena take this even further by enabling automated loan underwriting analysis using document-extracted data and real-time market inputs. This helps investors not just model deals, but also assess financing risks before entering contract.

McKinsey notes in its AI in Real Estate research that AI-driven forecasting has helped institutional investors reduce error margins in valuation models and better align financing terms with expected asset performance.

Operational Efficiency Across the Portfolio

AI continues to provide value long after a deal is closed. Real estate operators are using AI to automate routine portfolio tasks, optimize expenses, and ensure compliance. By analyzing utility bills, maintenance logs, and tenant communications, AI tools can flag cost overruns, benchmark property performance, and even predict turnover risk.

Kolena’s utility bill analysis agent gives operators instant comparisons across properties—highlighting excessive charges or unusual consumption trends. This helps streamline budgeting and cut operational waste.

According to JLL, AI-led property management can improve operating margins by up to 20% in multifamily and office portfolios, thanks to automation of low-level tasks and real-time monitoring.

Real-Time Risk Management

Every investor faces risk, but AI can now help monitor, predict, and mitigate it more proactively. AI models can detect early warning signs such as declining tenant credit scores, crime rate shifts in target areas, or overexposure to variable debt. These red flags, often buried in unstructured data, become visible through continuous AI monitoring.

For example, an AI tool might correlate online reviews with tenant churn or analyze zoning board minutes to detect controversial projects near your property. AI tools can even flag compliance risks, gaps in insurance coverage, or problematic lease clauses.

A National Association of Realtors (NAR) analysis showed that investors using predictive AI models reduced capital losses on underperforming assets by identifying deterioration earlier than traditional metrics allowed.

Who’s Using AI in Real Estate?

While institutional investors were early adopters, AI in real estate investing is quickly spreading across mid-size firms and even individual investors. Large real estate investment trusts (REITs) use AI to rebalance portfolios and manage risk. Private equity firms rely on AI to automate rent roll audits and extract terms from hundreds of leases. Brokerages use AI to price listings and match buyers to properties more effectively.

The rise of no-code platforms and industry-specific agents is driving adoption. Kolena offers tailored workflows for lease review, rent roll automation, and underwriting—all accessible without technical expertise—helping more real estate teams make AI part of their daily operations.

Choosing the Right AI Platform

Not all AI platforms are built for real estate. Investors should prioritize tools designed for real estate workflows that offer transparency, security, and seamless integration. Key features include support for unstructured document processing, explainable AI outputs, customizable dashboards, and compliance with privacy and data regulations.

What’s Next for AI in Real Estate?

The future of AI in real estate investing is being shaped by innovations in generative AI, retrieval-augmented generation (RAG), and multimodal intelligence. Generative AI models will draft offering memorandums and investment reports based on minimal input. RAG systems will allow investors to search their entire document archive and get contextual answers instantly.

Multimodal AI, combining text, visual, and geospatial data, will offer deeper insights by analyzing property photos, drone footage, and maps alongside leases and financials. These advancements are turning AI from a helpful tool into a strategic partner for investors.

AI Is the Future of Real Estate Investing

AI is no longer just a competitive advantage—it’s becoming a requirement. Investors who embrace AI are sourcing deals faster, conducting better due diligence, reducing risk, and optimizing operations. The result is a smarter, more agile investment strategy with higher ROI potential.

Whether you’re operating a large fund or just starting to scale, the tools are now available to help you automate the grunt work and focus on what matters most—strategy, growth, and returns.

To explore how AI can streamline your real estate workflows, visit Kolena’s AI agent platform and start building your edge today.