Highview Insurance set out to solve a problem familiar to many underwriting teams: how to move faster, handle more complex accounts, and scale the business without sacrificing accuracy or burning out staff. This post explores how intelligent automation helped Highview increase efficiency, reduce stress, and unlock sustainable growth without adding headcount.

The Transformative Results

The impact of implementing Kolena AI was immediate and measurable across multiple dimensions:

Sustainable Business Growth

"It's allowing us to scale faster without the need to do additional training and hire additional underwriters," the client shared. For a small company with big ambitions, this means being able to pursue growth opportunities without the traditional constraints of headcount expansion.

The Human Impact: From Stress to Confidence

Perhaps the most meaningful transformation wasn't measured in percentages, it was felt in the daily experience of the underwriting team.

"It's greatly impacted my ability to handle more stressful accounts with a greater sense of confidence. The way that we've been able to set up Kolena is to help us get all that information right in front of the underwriter's fingertips so that we can have that holistic approach, holistic view of the account. The amount of stress that that reduces is great."

Underwriters can now approach complex accounts with comfort rather than anxiety, knowing they have a comprehensive view of every account at their fingertips.

Kolena AI Agent: A New Best Friend for Underwriters

The journey from being time-crunched and stressed to efficient, confident, and scalable represents a fundamental shift in how underwriting can be done. With intelligent automation handling the heavy lifting of analysis and information synthesis, underwriters can focus on what they do best: making informed decisions and serving their clients.

When asked to sum up the experience, the client's enthusiasm was unmistakable:

The Underwriting Challenge

In the fast-paced world of insurance underwriting, professionals face a daily balancing act. They must deliver speed without sacrificing accuracy, manage overwhelming volumes of information, and handle increasingly complex accounts, all while meeting tight deadlines that seem to get tighter every year.

For many underwriting firms, especially smaller teams looking to grow, these challenges create a painful bottleneck. Manual processes consume hours of valuable time, last-minute submissions get turned away, and scaling the business means the daunting prospect of hiring and training additional staff.

Highview Insurance decided there had to be a better way. Here's their story of transformation with Kolena AI.

The Pain Points That Demanded a Solution

Before implementing Kolena AI, the underwriting team faced critical challenges that were limiting their potential:

Rush Account Frustrations

Last-minute submissions were a constant source of stress. When a client needed urgent turnaround, the manual processes often couldn't keep pace with the clock.

Information Overload and Fragmented Data

"Trying to get all those ducks in a row to make sure that you're getting the full picture of the account can be very challenging," the client explained. Gathering comprehensive information from multiple sources and synthesizing it into actionable insights was exhausting and time-consuming.

High Stress and Eroded Confidence

Complex accounts brought anxiety. Without the right tools, underwriters struggled to feel confident in their assessments, second-guessing their work and spending additional time double-checking their analysis.

Barriers to Business Growth

As a small company with ambitions to grow, every new account meant more strain on the existing team. The traditional path forward, hiring and training additional underwriters, is slow, expensive, and unsustainable.

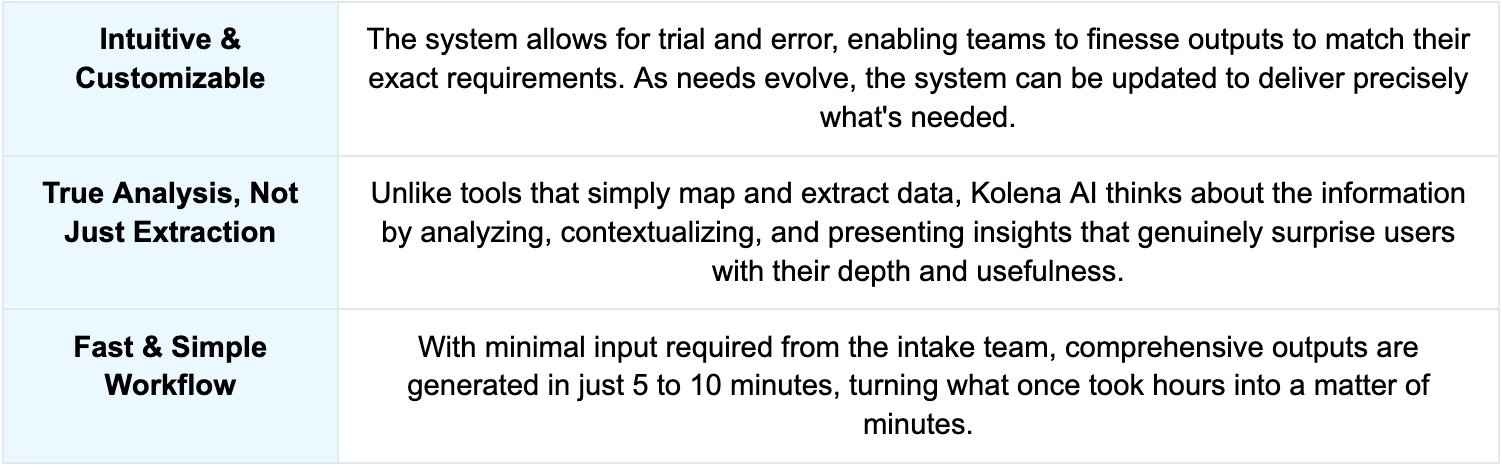

The Kolena AI Solution: Beyond Simple Data Extraction

What makes Kolena AI different from other tools on the market? As the client put it: "A lot of programs out there can pull information from an accord and can take that information because it's mapped everything out, but this is actually like somebody that's analyzing it and taking that information and thinking about it and then presenting it in a way that kind of surprises me every time I use it."

Three key attributes set Kolena AI apart:

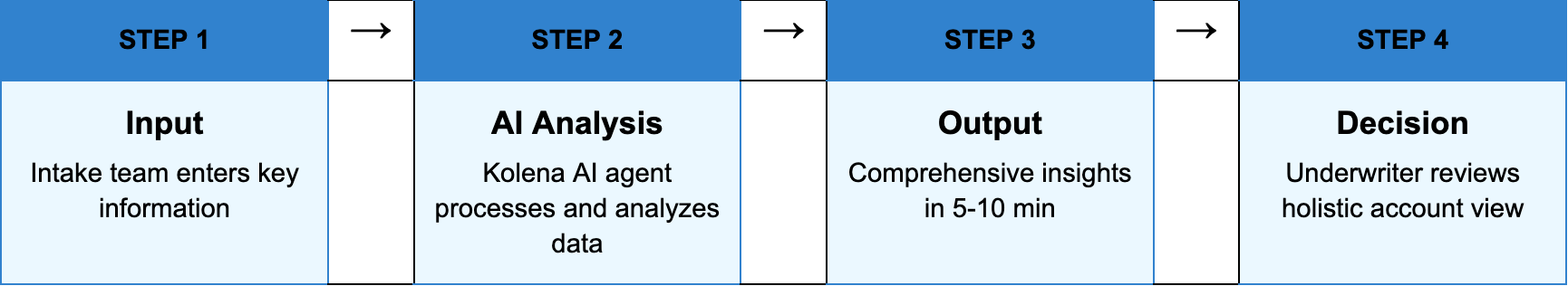

How It Works: A Streamlined Workflow

The implementation is designed for simplicity. The intake team inputs a few key pieces of required information, and Kolena AI handles the rest by analyzing, synthesizing, and presenting a comprehensive output that gives underwriters exactly what they need.

Ready to Transform Your Underwriting Operations?

Discover how Kolena AI agents designed for Insurance companies can help your team save time, reduce stress, and scale your business. Book time with us to see intelligent automation in action.