What Is the ACORD 140 Form?

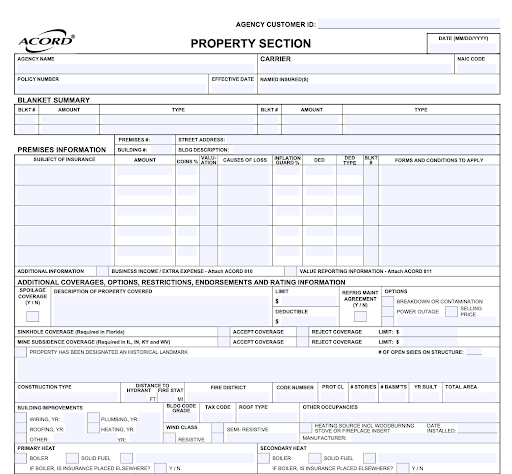

The ACORD 140 is a standardized insurance form used as the Property Section of a commercial insurance application. It captures detailed information about a business's real estate and property exposures to help insurers assess risk and determine coverage.

The form is used in conjunction with the ACORD 125, which provides general applicant information. Information requested in ACORD 140 includes the building's characteristics, location, construction type, occupancy details, and requested coverage limits and deductibles. Brokers, agents, and underwriters use this consistent format to streamline the application and underwriting process.

Here are the key sections of ACORD 140, described in more detail below:

Applicant and producer information: Captures names, contact details, and licensing data for both the insured and the submitting agent or broker.

Location and building identification: Provides structured numbering for each insured premises and building, along with address and classification details like construction type and occupancy.

COPE data elements: Collects critical underwriting information on construction, occupancy, protection (e.g., sprinklers, alarms), and exposure risks for each property.

Coverage selections and limits: Specifies the coverages requested per location or building, including limits for buildings, contents, income loss, and endorsements.

Cause of loss and valuation options: Allows selection of loss types (basic, broad, or special), valuation basis (replacement cost or actual cash value), and coinsurance provisions.

Deductibles and special conditions: Records deductible amounts, including any separate wind/hail or named storm deductibles, and outlines time element coverage details.

Additional interests: Documents third-party stakeholders such as mortgagees and loss payees with full identification and interest type.

Remarks and supporting documentation: Provides space to include clarifications, supplemental explanations, and references to attachments relevant to underwriting.

Signature and attestation: Final section requiring signature and date from both applicant and producer to validate the submission.

Automating ACORD 140 with AI

Manually completing the ACORD 140 form is labor-intensive and prone to errors due to the volume and complexity of required data. AI tools can streamline this process by extracting key information from source documents, such as property schedules, inspection reports, and COPE data, and automatically populating the corresponding fields on the form. This reduces manual entry, enforces consistency, and speeds up submission turnaround.

This is part of a series of articles about ACORD forms

Form Structure and Required Sections on ACORD 140

Applicant and Producer Information Requirements

The ACORD 140 starts with identification data for the insured and the producer. This section establishes who is requesting coverage and who is authorized to submit the application. It includes legal names, mailing addresses, phone numbers, email contacts, and producer license details used by carriers to route, review, and validate the submission.

This information also anchors the application to regulatory and compliance requirements. Carriers rely on accurate applicant and producer details to confirm licensing authority, surplus lines placement where applicable, and responsibility for follow-up. Errors or inconsistencies at this stage often result in processing delays or returned submissions.

Tips for filling in:

Use the legal entity name and tax ID that will appear on the issued policy

Confirm producer license numbers match the jurisdiction of the risk

Clearly identify the primary contact for underwriting questions

Include wholesale or surplus lines broker details when applicable

Location Numbering, Premises, and Building Identifiers

The ACORD 140 requires each insured location and building to be uniquely identified. Locations and buildings are numbered sequentially to distinguish individual exposures within a single policy. This structure allows carriers to associate values, coverages, and loss activity with the correct premises.

Consistent and standardized building identifiers are critical for multi-location risks. Address details, construction attributes, and occupancy classifications must align with prior submissions and schedules of values. Stable identifiers support renewals, endorsements, audits, and claims handling without rework or confusion.

Tips for filling in:

Start numbering locations and buildings consistently and avoid renumbering on renewal

Match addresses and building descriptions to the SOV and prior policies

Use standardized address formats and include city and county where required

Keep building identifiers consistent across all supporting documents

COPE Data Elements Required for Each Building

The COPE section captures the core underwriting data used to evaluate property risk. Construction details such as materials, roof type, square footage, and number of stories influence fire, wind, and catastrophe modeling. This data directly affects eligibility, pricing, and capacity decisions.

Occupancy, protection, and exposure details provide context for how the building is used, how losses may be mitigated, and what external hazards exist. Incomplete or generalized COPE data often triggers follow-up requests because carriers depend on this information for accurate risk scoring.

Tips for filling in:

Verify construction details against engineering reports or inspections

Describe occupancy based on actual use, not generic categories

Document protection features such as sprinklers, alarms, and hydrant distance

Identify relevant exposures like flood zones or adjacent high-risk operations

Coverage Selections and Limit Fields

This section defines what property coverages are requested and the limits applied to each building or location. Common coverages include building, business personal property, and time element coverages. Each selected coverage must be paired with a clear limit to avoid ambiguity.

Limits are evaluated against reported values and underwriting guidelines. Carriers expect limits to be supported by valuation methodologies such as appraisals or replacement cost estimates. Unsupported or rounded limits frequently result in clarification requests or pricing adjustments.

Tips for filling in:

Assign limits at the building level unless the carrier allows blanket coverage

Align limits with documented replacement cost or appraisal data

Avoid estimates without supporting documentation

Confirm coverage types and limits match the SOV and requested endorsements

Additional Interests (Mortgagee, Loss Payee, Additional Insured)

Additional interests identify third parties with financial or contractual rights under the policy. Mortgagees, loss payees, and additional insureds must be listed accurately to ensure their interests are recognized in the event of a loss.

This information is often required to satisfy loan agreements, leases, or contractual insurance requirements. Incorrect naming or missing details can delay policy issuance or cause disputes during claims settlement.

Tips for filling in:

Use the exact legal name required by loan or lease agreements

Include full addresses for each additional interest

Specify the correct interest type for each entity

Review this section against current contracts before submission

Additional Remarks and Supplemental Information

The remarks section provides space to explain information that does not fit cleanly into standard fields. It is commonly used to clarify unusual exposures, explain valuation assumptions, or note underwriting considerations that affect how the risk should be reviewed.

Remarks should also reference supporting documents included with the submission. Clear cross-references help underwriters quickly locate appraisals, photos, loss runs, or engineering reports tied to specific locations or buildings.

Tips for filling in:

Use remarks to explain exceptions or non-standard entries

Reference attachments by name and relevance

Keep explanations factual and concise

Avoid repeating information already captured elsewhere on the form

Signature and Attestation Fields

The signature section confirms that the information provided is accurate to the best of the applicant’s and producer’s knowledge. Signatures and dates establish accountability and create a formal record of submission.

Unsigned or undated ACORD 140 forms are commonly rejected by carriers. Attestation has legal and regulatory implications, particularly if misstatements are later discovered during underwriting or claims review.

Tips for filling in:

Ensure both applicant and producer signatures are present

Verify dates reflect the actual submission timing

Confirm names match those listed earlier in the form

Review the full application for accuracy before signing

Coverage Selections on ACORD 140

Here are some important guidelines about how to select coverage for an insurance buyer on the ACORD 140 form.

Cause of Loss Options and Special Perils

The ACORD 140 allows the applicant to select from multiple cause of loss forms, typically including “Basic,” “Broad,” and “Special.” Basic covers designated perils such as fire or vandalism, Broad adds further perils like falling objects or water damage, while Special provides the most extensive coverage by including all risks except those explicitly excluded. Accurate election of the intended cause of loss is essential for setting expectations and avoiding coverage disputes.

Some risks require selection of special perils, like earthquake, flood, or named storm, which may be excluded or sub-limited under standard policies. The form enables documentation of these additional requests, but applicants should be aware that such options usually require supplemental endorsements, higher premiums, or approval from specialty markets. Clarifying these selections up front informs underwriters of desired risk transfer scope and prompts them to quote accordingly.

Valuation, Coinsurance, Agreed Value, and Margin Clause

The valuation section on the ACORD 140 specifies how the insurer will determine recovery following a loss—either replacement cost, actual cash value, or another method. Replacement cost pays to rebuild with materials of like kind and quality, whereas actual cash value accounts for depreciation. Supplementing this choice, the form also allows entry of coinsurance percentages, which mandate the policyholder carry insurance up to a specified portion of property value to avoid penalties at claim time.

The agreed value option allows for coinsurance waivers when the insurer and policyholder concur on the property’s insurable value, provided documentation supports the declared value. Margin clauses can also be reflected—these set limits on pay-outs for fluctuations between scheduled and actual values. Precise documentation of valuation approach, coinsurance, or margin application ensures transparency and supports accurate premium calculation.

Deductible Structures Including Wind/Hail and Named Storm

Deductibles determine the amount the policyholder is responsible for before the insurer pays on a claim. The ACORD 140 form provides fields for flat dollar or percentage-based deductibles, enabling customization for different covered perils. For catastrophic exposures, like wind/hail or named storm, higher deductibles are frequently mandatory and can be indicated separately from standard property deductibles.

Accurate specification of each deductible helps define the risk sharing arrangement and directly impacts premium costs. Noting separate deductibles for wind/hail or named storm ensures carrier requirements align with the applicant’s risk tolerance and mortgagee stipulations. This level of transparency also avoids claim-time confusion by making all potential out-of-pocket costs clear upfront.

Time Element Coverage: Business Income, Extra Expense, Waiting Periods

Time element coverage, such as business income (also called business interruption) and extra expense, protects the insured against lost income and additional costs incurred due to interruption of operations following a covered property loss. The ACORD 140 form includes fields to indicate limits, period of indemnity, and whether coverages like ordinary payroll inclusion or extended period of indemnity are sought.

Applicants must also specify waiting periods—usually a set number of hours or days before coverage begins after a disruption. These choices affect both cost and adequacy of protection and must be tailored to the insured’s business model. Clearly documenting these options supports proper risk assessment by underwriters and ensures that policy terms match the insured’s recovery needs and cash flow requirements.

Key Property Endorsements: Ordinance or Law, Equipment Breakdown, Spoilage

The ACORD 140 enables selection of key property endorsements that modify the coverage provided by the base policy. Ordinance or law endorsements pay for increased costs if building codes require upgrades during reconstruction, a crucial coverage for older properties. Applicants should specify required limits for different sections of this endorsement—demolition, increased cost of construction, and undamaged portion coverage.

Equipment breakdown and spoilage endorsements are essential for risks dependent on operational machinery or inventory subject to temperature sensitivity. The form allows inclusion of these exposures, signaling to underwriters the necessity for specialty underwriting or risk engineering input. Accurately specifying endorsements ensures comprehensive protection and accommodates unique risk profiles that standard forms alone cannot address.

Automating ACORD 140 Generation With AI

The ACORD 140 requires large volumes of structured and unstructured data, much of it sourced from separate documents and systems. Manual completion increases the risk of omissions, inconsistencies, and delays, especially for multi-location or complex property schedules. AI-based automation addresses these issues by handling data intake, normalization, and validation before the form is generated.

AI automation supports ACORD 140 preparation in several key ways:

Automated data extraction: AI models extract property, coverage, and COPE data from loss runs, inspection reports, schedules of values, and compliance documents without manual rekeying.

Field-level mapping: Extracted data is mapped directly to the correct ACORD 140 fields, preserving location and building structure and reducing formatting errors.

Cross-document consistency checks: AI compares values across documents to identify mismatches, such as limits that do not align with reported values or COPE details that conflict with inspection data.

Missing and invalid data detection: Required fields are checked for completeness, with flags raised for missing entries, unsupported limits, or incomplete supporting documentation.

Anomaly and risk flagging: Pattern analysis highlights unusual values or discrepancies that may require underwriter review before submission.

Audit-ready output generation: The final ACORD 140 is produced in a standardized, traceable format suitable for carrier review and regulatory audits.

By automating data preparation and validation before the ACORD 140 is generated, insurers and brokers reduce correction cycles and underwriter follow-up. This shortens submission turnaround times, improves data quality, and allows underwriting teams to focus on risk evaluation rather than manual form assembly.

Automate ACORD 140 forms with Kolena. Get started now!

Best Practices for an Underwriter-Ready ACORD 140 Submission

1. Use Persistent Location and Building IDs Across Renewals

Consistent use of persistent location and building identifiers across policy renewals is essential for maintaining clean records and facilitating accurate risk evaluation. Assigning unique IDs to each building and location, rather than re-numbering or re-labeling with every submission, avoids confusion for both carriers and internal teams. This practice streamlines the renewal process and helps track coverage, loss experience, and any risk changes over time.

Failing to use persistent identifiers can lead to mismatched or duplicated entries in carrier systems, increasing the risk of errors during claims or endorsements. Adoption of standardized ID logic, potentially based on third-party address verification or property management systems, supports audit readiness and allows for seamless integration of the ACORD 140 with other risk management workflows.

2. Tie Limits to a Defendable Valuation Methodology and Include Support

Limits entered on the ACORD 140 should always be based on a robust, defendable valuation methodology, such as a formal appraisal, replacement cost estimator, or recent construction invoices. Attaching supporting documents, like appraisal reports or replacement cost calculations, provides transparency and substantiation for the limits requested, which underwriters require in order to grant coinsurance waivers or agreed value endorsements.

Demonstrating how each limit was determined mitigates potential disputes at audit or loss time. For risks with unusual exposures or recently renovated buildings, supply detailed footnotes or explanations alongside third-party documentation to show due diligence in the valuation process. This approach increases underwriter trust and enables more efficient policy issuance with fewer follow-up requests.

3. Pre-Validate Occupancy, Protection, and CAT Data Against Trusted Sources

To expedite underwriting review and reduce errors, applicants should pre-validate building occupancy, fire/police protection features, and catastrophe (CAT) data, including flood and wind zones, against trusted sources. Using municipal records, GIS data, or vendor reports helps ensure accuracy and credibility. This is particularly valuable for multi-location risks where missing or inconsistent data can slow down submission processing.

Pre-validation also streamlines the quote process by preventing underwriter data challenges and improving eligibility screening. Any discrepancies between data sources and the information on the ACORD 140 should be addressed and documented prior to submission, increasing the overall quality and reliability of the application. This level of diligence reflects positively on agents and brokers in carrier relationships.

4. Attach an SOV With Data Lineage, Footnotes, and Version Control

A best practice is to attach a schedule of values (SOV) alongside the ACORD 140, ensuring all building, location, and value data are fully detailed and traceable. The SOV should include data lineage, identifying the source, such as appraisals, engineering reports, or prior submissions, and footnotes to explain outliers or recent changes. Incorporating version control further enhances transparency and supports iterative policy management.

Maintaining a robust SOV reduces the chance for data mismatch across policies or during loss adjustment. Underwriters increasingly expect detailed SOVs to confirm the integrity of coverage limits and exposure details. By proactively providing context and supporting documentation, applicants foster a smoother underwriting process and minimize correction cycles.

5. Document Risk Improvements With Dated Photos and Invoices

Risk improvements, such as upgraded roofs, sprinkler system installations, or new security measures, should be fully documented with dated photographs and relevant invoices or warranties. Submitting this evidence with the ACORD 140 substantiates any positive changes and provides underwriters with credible, time-stamped proof of mitigation activities that warrant better rates or expanded coverage.

Keeping organized records of improvement documentation is not just useful at application time, it simplifies renewals and future audits as well. Photos should be clearly labeled with dates and captions, and invoices should reference project details. Providing organized, credible documentation strengthens the submission, demonstrates risk management commitment, and can be decisive in negotiating favorable terms.

Try our AI-powered insurance workflow tool

Automating Insurance Documents with Kolena AI

Automating Insurance Documents with Kolena

Kolena enables insurance teams to automate both the creation and review of ACORD 140 forms using AI, reducing manual effort while improving consistency across property submissions. Instead of manually re-keying property data, Kolena can extract structured information from the same source documents already used in the underwriting process—such as schedules of values (SOVs), property inspection reports, COPE surveys, appraisals, loss runs, prior ACORD forms (such as ACORD 125), and engineering reports—and use that data to accurately populate ACORD 140 fields at the location and building level.

Beyond form generation, Kolena can also analyze completed ACORD 140 forms as part of the underwriting workflow. The AI reviews the application holistically, validating that COPE details, values, limits, deductibles, and coverage selections are internally consistent and aligned with supporting documentation. For example, it can flag buildings with reported values that do not match the SOV, identify missing COPE elements required for property risk scoring, or surface discrepancies between stated construction type and inspection findings. These issues are often caught late in underwriting and drive unnecessary back-and-forth between brokers and carriers.

Kolena’s document intelligence also supports scalable property risk assessment. From ACORD 140 submissions, the platform can extract and structure key exposure drivers—such as construction class, occupancy risk, protection features, CAT exposure indicators, and valuation assumptions—and surface them as standardized risk signals for underwriters. It can summarize complex property portfolios into underwriter-ready views, highlight high-risk locations, and flag unusual coverage requests or deductible structures that may require additional review. This allows underwriting teams to focus on evaluating risk, not validating data.

By automating both ACORD 140 data intake and application analysis, Kolena helps brokers submit cleaner property applications and enables carriers and MGAs to scale underwriting operations without sacrificing quality. ACORD 140 forms shift from being static, error-prone documents to structured, analyzable inputs—supporting faster turnaround times, fewer follow-ups, and more consistent property underwriting decisions powered by AI.