What Is ACORD 125 (Commercial Insurance Application)?

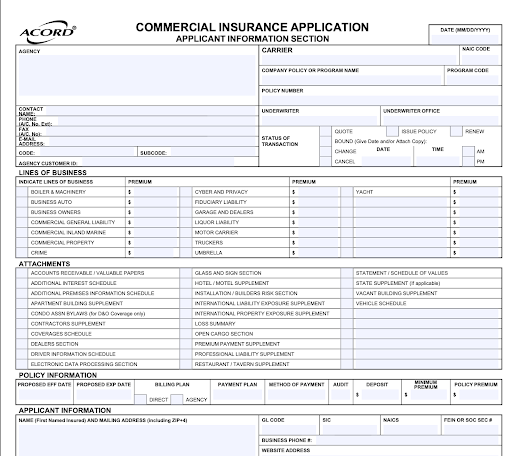

ACORD 125, often called the Commercial Insurance Application, is a standardized form used in the property and casualty (P&C) insurance industry. Created by the Association for Cooperative Operations Research and Development (ACORD), this form acts as a central starting point for gathering essential applicant information, coverage requests, and risk details. It is the document submitted to carriers when businesses seek various types of commercial insurance coverage.

The ACORD 125 form is broadly accepted across insurers in the United States and often forms the backbone of new business and renewal submissions. Its widespread adoption streamlines communication between retail agents, wholesalers, MGAs, and carriers.

Here are the key sections of ACORD 125, described in more detail below:

Applicant and producer information: Captures essential details about the insured business and the agency submitting the application, including legal names, addresses, and contact data.

Policy details: Defines the requested policy period, billing arrangements, and any use of premium finance companies for payment.

Lines of business requested: Identifies the specific types of coverage being sought, such as general liability or commercial auto, and whether the submission is for a package or monoline policy.

Premises and exposure information: Lists all locations to be covered, including physical address, building use, and associated exposures like square footage or number of employees.

Business operations description: Provides a narrative of the applicant’s core activities, services, or products, along with any higher-risk operations that may affect underwriting.

Additional interests: Records entities such as mortgagees, loss payees, and additional insureds who require protection or notification under the policy.

General disclosures: Includes underwriting questions and prior coverage details to help assess eligibility, risk factors, and any red flags from the applicant’s history.

Prior carriers and loss history: Lists historical insurance data and claims over recent years, which are used to evaluate risk performance and quoting accuracy.

Signatures and authorization: Confirms that the application is complete and accurate, with valid signatures for compliance and submission approval.

Automating ACORD 125 with AI

Thanks to recent advancements in insurance technology, it’s now possible to automate the preparation and submission of the ACORD 125 form with AI-driven tools. These systems extract structured data from documents like prior applications, loss runs, and policy schedules, then automatically populate the relevant sections of the form.

AI automation reduces manual entry, speeds up submission workflows, and minimizes errors that can lead to carrier rejections or delays. Automation also enables real-time validation, pre-filling of underwriting questions, and seamless integration with agency management systems, making the submission process faster, more accurate, and easier to scale.

This is part of a series of articles about ACORD forms

- What Is ACORD 125 (Commercial Insurance Application)?

- How ACORD 125 Form Is Used in Commercial P&C Submissions

- Understanding the Key Sections of the ACORD 125 Form

- Automating ACORD 125 Generation With AI

- Best Practices for Producing Clean, Bindable ACORD 125 Submissions

- Automating Insurance Documents with Kolena

How ACORD 125 Form Is Used in Commercial P&C Submissions

The ACORD 125 form serves as the universal intake and submission tool for commercial property and casualty (P&C) insurance. Agents and brokers use it to report client information, exposures, prior coverage, locations, and requested lines of business. In many submissions, ACORD 125 acts as a “cover sheet,” with supplemental forms (like ACORD 126, ACORD 140, or ACORD 131) attached for specific lines of business.

Once completed, the ACORD 125 is transmitted to carriers either electronically or in paper form. Underwriters then use the standardized data to assess eligibility, quote pricing, and decide on binding coverage.

Understanding the Key Sections of the ACORD 125 Form

1. Applicant Information and Producer Details

This section establishes the legal and administrative identity of both the insured business and the producer submitting the application. It captures the applicant’s exact legal name, mailing address, contact details, and any DBAs to ensure the policy is issued to the correct legal entity. Carriers rely on this data throughout the policy lifecycle, including endorsements, renewals, audits, and claims handling.

The producer portion identifies the agency responsible for the submission, including agency name, contact person, address, and agency code. This information ties the submission to commission records, carrier appointments, and regulatory reporting. Inaccurate or incomplete entries can cause processing delays, billing errors, or misrouted carrier communication.

Tips for filling this section:

Use the exact legal business name as registered with the state.

List all active DBAs that may appear on contracts or invoices.

Confirm addresses and contact details match existing carrier records.

Verify agency codes and producer contact information before submission.

2. Policy Information: Effective Dates, Billing, Premium Finance

This section defines the basic structure of the requested policy, starting with the effective and expiration dates that determine when coverage begins and ends. Underwriters use these dates to confirm continuity of coverage, evaluate eligibility, and align renewals with carrier guidelines. Even minor date errors can create unintended coverage gaps or overlap issues.

Billing instructions are also set here, specifying whether premiums will be billed directly to the insured, through the agency, or via a premium finance company. If premium financing is involved, this section documents the arrangement so carriers understand payment responsibility and timing. These details directly affect policy issuance, invoicing, and cancellation controls.

Tips for filling this section:

Match effective dates to expiring policies whenever possible.

Confirm billing method preferences with the insured in advance.

Clearly indicate premium finance involvement if applicable.

Double-check dates and payment selections for internal consistency.

3. Lines of Business Requested and Package Indicators

This section identifies which commercial coverages the applicant is requesting, such as general liability, property, commercial auto, or umbrella. Selecting the correct lines of business signals to carriers which underwriting teams and supplemental forms are required. Missing or incorrect selections can delay quotes or result in incomplete coverage proposals.

The package indicator clarifies whether the submission is intended as a package policy or as separate monoline placements. This distinction affects rating methodology, form selection, and pricing structure. Clear direction here helps carriers assemble accurate quotes that reflect the intended program design.

Tips for filling this section:

Select every line of coverage being requested, even if quoted elsewhere.

Attach required supplemental ACORD forms for each selected line.

Confirm whether the carrier supports package or monoline placement.

Avoid leaving coverage selections ambiguous or unchecked.

4. Premises and Location Information With Exposures By Site

This section documents all physical locations associated with the risk, including owned, leased, or occupied premises. Each location entry typically includes a full address and a description of how the site is used. Carriers use this information to evaluate geographic exposure, aggregation risk, and coverage applicability.

Beyond addresses, this section captures site-specific exposure data such as square footage, employee counts, building characteristics, or operational hazards. Underwriters review locations individually and collectively to assess total exposure across the account. Incomplete location schedules often trigger follow-up requests or underwriting delays.

Tips for filling this section:

List every location tied to operations, storage, or vehicle garaging.

Use consistent formatting for multi-location schedules.

Include exposure details relevant to the requested coverages.

Verify addresses and ZIP codes for accuracy.

5. Nature of Business and Operations

This section provides a narrative description of what the business actually does on a day-to-day basis. It explains products, services, processes, and operational scope in plain terms that align with underwriting classifications. Carriers rely on this description to determine appetite, assign class codes, and evaluate risk complexity.

The narrative should reflect current operations and disclose any activities that increase exposure, such as subcontracting, hazardous materials, off-site work, or international operations. Incomplete or vague descriptions can result in declinations or post-bind coverage issues if material facts are later uncovered.

Tips for filling this section:

Describe operations as they exist today, not historically.

Include NAICS or SIC codes if known and accurate.

Call out higher-risk activities explicitly.

Avoid generic descriptions that lack operational detail.

6. Additional Interests: Mortgagees, Loss Payees, AIs

This section records third parties that have a financial or contractual interest in the policy. Mortgagees and loss payees are typically tied to property or equipment financing and must be properly listed to protect their interests in the event of a claim. Failure to include them can violate loan agreements or delay claim payments.

Additional Insureds are entities that require coverage under the applicant’s policy due to contractual obligations. Accurate naming and relationship descriptions are necessary so carriers can issue correct endorsements. Incomplete information may result in rejected endorsement requests or coverage disputes.

Tips for filling this section:

Use exact legal names for all additional interests.

Confirm required wording from contracts or loan documents.

Specify the relationship between each party and the insured.

Review carrier endorsement requirements before listing AIs.

7. General Information and Prior Coverage Disclosures

This section consists of underwriting questions designed to surface material risk factors. Topics often include prior cancellations, litigation, hazardous operations, bankruptcy, or regulatory issues. Carriers use these responses to assess eligibility and determine whether additional underwriting review is required.

The section also captures prior coverage information, which helps underwriters evaluate coverage continuity and risk management behavior. Inaccurate or misleading responses can result in declinations, coverage restrictions, or policy rescission if discovered later.

Tips for filling this section:

Answer every question directly and truthfully.

Provide explanations for any “yes” responses when possible.

Align prior coverage details with carrier and loss history sections.

Avoid assumptions when unsure; confirm details with the insured.

8. Prior Carriers and Loss History

This section documents the applicant’s insurance history, including previous carriers, policy periods, and types of coverage. Carriers use this information to verify continuous insurance and assess long-term risk stability. Missing or inconsistent history can raise underwriting concerns.

Loss history details claims activity over recent years, including paid amounts and reserves. Underwriters rely heavily on this data for pricing and eligibility decisions. Incomplete loss reporting often leads to quote delays or unfavorable terms.

Tips for filling this section:

Include all carriers for the requested lookback period.

Attach formal loss runs when available.

Disclose both open and closed claims.

Ensure loss data matches carrier documentation.

9. Signatures, Authority, and E-SIGN Compliance

This final section validates the application by confirming that all information is accurate and authorized. Signatures from both the applicant and producer establish accountability and grant permission to submit the information to carriers. Without proper signatures, the application cannot proceed to binding.

Electronic signatures are widely accepted under E-SIGN and state regulations, provided technical and consent requirements are met. Ensuring compliance here protects the enforceability of the application and avoids administrative rejections during submission or audit.

Tips for filling this section:

Confirm signers have authority to act on behalf of the entity.

Ensure dates and signatures are complete and legible.

Follow carrier-specific rules for electronic signatures.

Retain signed copies for compliance and audit records.

Automating ACORD 125 Generation With AI

Traditionally, completing the ACORD 125 form requires manually gathering and entering detailed applicant data, risk profiles, prior carrier information, and loss histories, often across multiple systems and formats. This process is time-consuming and prone to human error.

AI solutions streamline form preparation by:

Extracting relevant data from source documents like loss runs, prior applications, and operational reports.

Populating ACORD 125 with structured, standardized information, automatically identifying key fields and validating inputs. This reduces the need for duplicate data entry and minimizes the risk of missing or inconsistent information.

Generating preliminary risk assessments by analyzing claim history, safety protocols, and underwriting factors. These risk profiles can be used to pre-fill parts of the form or support underwriting decisions early in the submission process.

Perform automated anomaly detection to flag discrepancies or compliance issues before submission, reducing the likelihood of carrier rejections or delays.

By integrating AI into the ACORD 125 workflow, agencies and carriers can accelerate submission preparation, maintain more accurate records, and support audit-ready documentation. The result is a faster, more reliable process that allows underwriters to focus on evaluating risks instead of compiling paperwork.

Automate ACORD 125 forms with Kolena: See it in action!

Best Practices for Producing Clean, Bindable ACORD 125 Submissions

1. Use a Standardized Discovery Script and Intake Form

Starting the insurance submission process with a vetted, standardized discovery script ensures all necessary risk and coverage details are collected efficiently. This script should guide producers through a logical sequence of questions covering exposures, locations, operations, and required endorsements. Pairing the discovery script with a digitally-enabled intake form helps eliminate inconsistent data entry and increases the completeness and accuracy of collected information.

A standardized form structure also helps junior staff or less-experienced producers capture information at a quality level comparable to seasoned professionals. This creates a reliable foundation for populating the ACORD 125 and any necessary supplementals. Digital intake forms can often prevalidate critical fields in real time, adding a layer of error-checking before form generation.

2. Pre-Check Carrier Appetite and Underwriting Guides

Reviewing carrier appetite and eligibility guidelines before submitting a risk is essential. Agents should consult carrier portals, guideline PDFs, or platform prompts to ensure the submitted business fits within their underwriting boundaries. This avoids wasting time on risks that will be automatically declined or require special approvals, aligning agency submissions with current carrier interests.

A pre-check ensures supporting data and documentation meet carrier expectations for that class of business, from required coverages to risk characteristics and supplemental questions. It also helps agents flag required attachments or disclosures up front, so the ACORD 125 package is “submission ready” the first time, reducing declines and rework from incomplete or misaligned risks.

3. Maintain Industry-Specific Operations Narrative Templates

Using templated operations narratives tailored to specific industries creates clarity and saves time for both agents and underwriters. These templates should include required details such as main business activities, locations, years in operation, safety protocols, and any unusual exposures. An effective narrative template addresses the typical information sought by carriers for that industry segment, aligning facts with underwriting terminology and decision criteria.

Keeping these templates updated means the agency can quickly respond to changes in client operations or carrier requirements, ensuring each submission matches both client reality and carrier appetite. Well-crafted narratives facilitate faster underwriting and reduce question cycles, as carriers receive comprehensive information on the initial submission. This leads to quicker quotes and increased agency credibility.

4. Attach Photos, Diagrams, and COPE Details for Property Risks

For risks involving physical property, including photos and site diagrams alongside COPE (Construction, Occupancy, Protection, Exposure) details is essential. Visual documentation conveys critical context about building quality, security measures, and adjacent hazards, enabling underwriters to quickly spot red flags or underwriting merits. COPE information—such as type of construction, occupancy percentage, fire protection systems, and exposures to wind, flood, or adjacent properties—can make or break insurability decisions.

Agencies should adopt standard procedures for requesting current site photos, floor plans, or aerial images and ensuring they’re attached with each property submission. Proper documentation not only expedites underwriting reviews but also supports favorable terms by giving a complete risk profile. Missing visual or COPE data often triggers follow-up requests, delaying the quoting process.

5. Automate Data Sync to Avoid Re-Keying and Drift

Automation tools that sync risk, applicant, and policy data between agency systems and the ACORD 125 form eliminate manual re-keying, which is a common source of errors. This integration ensures that changes in CRM, rating, or servicing platforms are reflected instantly on the application, maintaining up-to-date and accurate submissions. Real-time data sync also helps enforce version control, reducing the risk of outdated information floating between systems or teams.

By minimizing manual touchpoints, automated data sync accelerates the submission cycle and creates reliable, auditable application histories. Agencies that invest in these tools can handle greater submission volumes, maintain compliance, and deliver better client service without risking information drift. This is especially critical when dealing with mid-term changes or frequent endorsements, where accuracy and speed are both at a premium.

Try our AI-powered loss run analysis tool

Automating Insurance Documents with Kolena

Kolena enables insurance teams to automate both the creation and review of ACORD 125 forms using AI, reducing manual effort while improving consistency and underwriting readiness. Instead of re-keying data across systems, Kolena can extract structured information from the same source documents already used during submissions—such as prior ACORD applications, loss runs, schedules of values, COIs, financial statements, and operational questionnaires—and use that data to populate the ACORD 125 accurately.

Beyond form generation, Kolena can also analyze a completed ACORD 125 application to surface insights that are typically caught late in the underwriting process. The AI can review the application holistically, checking for missing fields, internal inconsistencies, or mismatches between the ACORD 125 and supporting documents. For example, it can flag discrepancies between stated operations and loss history, identify locations listed without corresponding exposure data, or highlight prior carrier gaps that may trigger underwriting follow-ups.

Kolena’s document intelligence goes further by producing structured summaries and risk signals from ACORD 125 submissions. It can automatically extract key exposure drivers, summarize operations narratives in underwriter-friendly language, and identify potential red flags such as high-risk operations, adverse loss trends, or unusual coverage requests. These insights help brokers submit cleaner applications and allow underwriters to focus on evaluating risk rather than validating paperwork.

By automating both ACORD 125 data intake and application analysis, Kolena supports faster submissions, fewer back-and-forth requests, and more scalable underwriting workflows. Agencies, MGAs, and carriers can standardize how ACORD 125 forms are prepared and reviewed—turning a traditionally manual, error-prone process into a repeatable, audit-ready workflow powered by AI.