Coming up with a rent roll definition may sound narrow to those outside the real estate industry, but it’s a foundational concept for anyone involved in property management, investment, or lending. At its essence, a rent roll is a carefully structured document, often a spreadsheet or report, listing each tenant in a property alongside critical lease and financial details. This tool offers a precise snapshot of a property’s current income, occupancy levels, and contract structure. In this guide, we’ll unpack the rent roll meaning, explore how rent roll analysis informs smarter decisions, and reveal how AI is revolutionizing rent roll automation.

- What Is a Rent Roll?

- Understanding the Rent Roll Meaning and Its Role

- Why Rent Roll Analysis Matters

- Common Mistakes in Rent Roll Management

- Rent Roll vs. Gross Potential Income

- From Spreadsheets to Specialized Software

- How Automation & AI Are Changing the Game

- Real Gains from Rent Roll Analysis Automation

- An Advanced AI Solution for Rent Roll Automation

- Business-Perspective Advantages of AI in Rent Roll Workflows

- Conclusion

What Is a Rent Roll?

A rent roll functions as the heartbeat of any income-generating real estate asset. By aggregating tenant names, unit identifiers, monthly rents, lease start and end dates, security deposits, square footage, lease types (e.g., gross, triple-net), and any ancillary fees, it provides clarity. Whether evaluating a single-family rental property or a large commercial complex, the rent roll captures the income that is legally enforceable through current leases. As such, it reflects actual rent currently collectable—not hypothetical gross potential income—making it indispensable for stakeholders assessing both present performance and future projections.

Read our related guide on AI Lease Abstraction

Understanding the Rent Roll Meaning and Its Role

When people search “what is rent roll in real estate,” they’re usually looking beyond just tenant lists. They want a tool that reveals revenue stability, occupancy trends, and contractual obligations. A rent roll does just that—it shows which tenants are paying on time, when leases expire, where vacancies might arise, and whether existing tenants are locked into below-market rents or have room for escalations. Sophisticated investors use rent roll data to calculate metrics like gross rent multipliers, capitalization rates, and internal rates of return. Ultimately, the rent roll frames the investment’s income landscape, informing critical buy, hold, or sell decisions.

Why Rent Roll Analysis Matters

Conducting a thorough rent roll analysis goes well beyond reading numbers—it’s about decoding the story behind tenant behavior, lease timing, and revenue patterns. If a rent roll shows several leases expiring within the next six months, an analyst anticipates potential turnover risk or vacancy charges. If rent levels appear below similar units in the market, there’s an opportunity to raise rents. Consistent late payments may suggest tenant credit issues or lax rent collection strategies. Meanwhile, frequent turnover might indicate property or management problems. Rent roll analysis, therefore, empowers real estate professionals to pinpoint risks, identify value creation opportunities, and ensure cash flow aligns with the property’s financial model.

Common Mistakes in Rent Roll Management

Even the best tools fall short when misused. Here are common pitfalls:

Outdated data: If the rent roll isn’t regularly updated, lease expirations or newly signed leases won’t be reflected, causing mismatches during underwriting.

Ignoring concessions: Rent-free periods or tenant incentives must be captured; overlooking them skews revenue forecasts.

Neglecting tenant defaults: The difference between scheduled rent and actual collected rent should be reconciled.

Failing to align documents: A rent roll should match the income stated in bank statements, ledgers, and leases.

Forgetting to include ancillary income: Parking fees, utility charges, or CAM reimbursements can materially impact monthly revenue.

Avoiding these mistakes leads to a reliable data foundation—essential for sound investment decisions.

Rent Roll vs. Gross Potential Income

Many inexperienced investors confuse a high gross potential income (GPI) with real-world performance. GPI represents theoretical revenue if every unit is leased at market rates. The rent roll, on the other hand, reflects the actual rents currently under contract. A building may have high GPI, yet its rent roll could reveal below-market tenants, upcoming expirations, or extended vacancies. Rent roll analysis surfaces these discrepancies, enabling investors to uncover the delta between what’s possible and what’s real—an essential insight for accurate financial modeling and valuation.

From Spreadsheets to Specialized Software

Before fully embracing AI-powered tools, many real estate professionals rely on a hybrid approach: using Excel and other software to automate portions of the rent roll process. This middle ground offers more efficiency than manual entry, yet still lacks the agility and intelligence of end-to-end AI.

Excel-Based Automation

Excel is the longtime staple for rent rolls, favored for its flexibility and low cost. Well-designed templates let users systematically record tenant names, unit identifiers, lease start and end dates, rent amounts, and payment compliance. Many tools harness Excel’s formulas—INDEX/MATCH, boolean logic, data validation—to auto-populate schedules, calculate rent escalations, flag leases nearing expiration, and estimate turnover costs. Users can even incorporate VBA or macros to generate alerts or produce summary reports.

This setup facilitates dynamic rent forecasting and cash flow monitoring. As one recent guide explains, creating a rent schedule in Excel, then linking it to tenant-level escalations via formulas, enables monthly lease modeling across a portfolio—combining rent-roll structure with forecasting capability. However, these spreadsheets often require regular maintenance and are prone to errors as complexity grows.

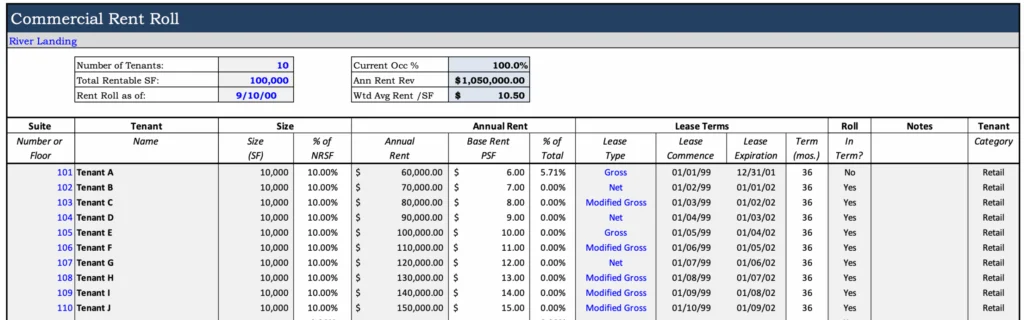

Image source: Property Metrics

Free and Downloadable Templates

For users looking for convenience, various free rent roll templates like those from Ownwell, Baselane, or Someka provide pre-built structures with common fields and calculation logic. These templates often include monthly tracking tabs, vacancy summaries, and payment monitoring built atop Excel or Google Sheets. They streamline initial setup and entries, making rent roll creation accessible even to small landlords.

Lear more from our guide on rent roll templates.

Standalone and Add-In Software

As portfolios scale, landlords and asset managers frequently upgrade from Excel to specialized tools or Excel-integrated software. Companies like Stessa automate rent and expense tracking across multiple properties, offering customizable reports and financial dashboards. Enterprise platforms like PRODA take it further, with Excel add-ins that can ingest rent roll data from PDFs, property management systems, or spreadsheets, standardize the output, perform error checks, and streamline analysis. Many property management systems like Buildium, AppFolio, and MRI include similar modules for automatic rent roll generation and tracking.

Learn more from our guide on rent roll software.

How Automation & AI Are Changing the Game

Manual rent roll compilation is laborious. It requires sorting lease documents, extracting data, cross-checking with ledgers, and entering fields by hand. This traditional approach is slow, error-prone, and virtually impossible to scale across portfolios.

With AI-driven rent roll automation, platforms can now read lease PDFs, scanned or handwritten documents, emails, and spreadsheets to extract key data—tenant names, lease dates, rent amounts, deposits, square footage, and payment status—without human input. Machine learning algorithms standardize formats, handle inconsistencies, validate extracted data against expected patterns, and flag anomalies in real time such as missing escalations or delayed payments.

AI doesn’t just accelerate data entry—it enables rapid analysis. Imagine instantly identifying units coming up for renewal, measuring rent increases relative to market, or uncovering high delinquency rates—all without scouring individual files. As a result, teams make faster decisions, close deals more effectively, and maintain tighter operational control.

See our step-by-step tutorial on AI rent roll automation

Real Gains from Rent Roll Analysis Automation

Organizations deploying AI-powered rent roll tools report substantial benefits:

Speed: Processes that took hours now resolve in minutes.

Accuracy: Automation eliminates manual-entry errors and delivers over 95% data precision.

Cost Reduction: Firms often cut processing overhead by 50–70%.

Scalability: Whether handling 10 units or 1,000, systems perform consistently.

Insightful Analytics: Real-time dashboards show rent rent collection patterns, turnover rates, expirations, and below-market leases—all enabling proactive portfolio strategies.

Better Financing Outcomes: Lenders value accurate, AI-validated rent rolls—streamlining underwriting and improving refinancing terms.

Automation isn’t just efficiency; it offers strategic visibility and competitive advantage.

An Advanced AI Solution for Rent Roll Automation

Kolena stands at the forefront of this transformation. Its AI-driven rent roll tool seamlessly extracts and validates rent roll data, regardless of document format—whether digital PDFs, Word leases, scanned images, or even handwriting. With Kolena, users simply upload property documents and let the system do the heavy lifting.

Kolena’s platform identifies essential fields automatically: tenant names, lease timelines, rent amounts, square footage, deposit balances, and any add-on fees. The system applies customizable validation rules to flag discrepancies—whether misaligned rent escalations, missing lease dates, or inconsistent deposit entries. Within moments, users receive structured output in spreadsheet-ready formats, API feeds, or dashboard views for deeper analysis.

The result? A rent roll that It eliminates tedious manual effort, reduces error risk, speeds up due diligence, and gives users the confidence that their financial models rest on solid, AI-verified foundations.

Business-Perspective Advantages of AI in Rent Roll Workflows

From a strategic standpoint, integrating AI into rent roll operations positions firms to:

Operate efficiently: Free up staffing resources for value-generating activities like tenant relations, marketing, and negotiation.

Maintain data integrity: With automated validation and alerts, inconsistencies are caught early—before they impact decisions.

Enhance risk management: Early warnings of delinquency, clustered lease expirations, or high vacancy risk help teams act proactively.

Grow smarter: Firms can expand into new markets or asset classes without proportional increases in admin overhead.

Win financing leverage: Reliable, AI-backed rent rolls result in smoother loan approvals and better terms from lenders.

Stay competitive: Fast, accurate data gives a strategic edge in negotiations, acquisitions, and portfolio optimization.

AI-powered rent roll processes are not just operational tools—they become strategic assets.

Conclusion

A rent roll may appear simple—a sheet of tenants and rents—but when used intelligently, it becomes a strategic asset. It reveals cash flow trends, risk exposures, and value creation potential at a granular level. However, traditional manual processing falls short across speed, accuracy, and scalability.

This is where AI-driven rent roll automation, as delivered by Kolena, changes the game. By extracting, validating, and structuring lease and revenue data with unerring reliability, Kolena empowers professionals with real-time insights, operational efficiency, and competitive advantage.

Whether you’re an investor underwriting a new acquisition, a property manager aiming to reduce vacancies, or a lender seeking accurate documentation, understanding rent roll definition, mastering rent roll analysis, and adopting AI tools gives you the edge.