For seasoned professionals in commercial real estate (CRE), the investment memo is not merely a report—it is a strategic instrument. Beyond presenting the facts of a deal, the best memos synthesize complex underwriting assumptions, market intelligence, and operational insights into a persuasive narrative that accelerates decision-making. Mastering the art of the investment memo means elevating it from a compliance document to a competitive advantage.

This article is part of a comprehensive series on AI in real estate investing.

- Why the Investment Memo is the Cornerstone of Advanced CRE Decision-Making

- Core Narrative Elements of a High-Impact Memo

- Offering Memorandums vs. Investment Memos

- Underwriting as a Narrative, Not Just a Model

- Best Practices for Professional Presentation

- Visuals and Enhancements Beyond Text

- How AI and Automation Are Redefining the Memo

- Where Kolena Fits in Advanced CRE Workflows

- Conclusion

Why the Investment Memo is the Cornerstone of Advanced CRE Decision-Making

The investment memo sits at the intersection of analysis, persuasion, and governance. For capital allocators, it is often the first—and sometimes only—document they review before deciding to commit millions of dollars to an acquisition. While offering memorandums provide a broker’s marketing angle, and underwriting models crunch numbers in spreadsheets, the memo connects these elements, weaving data and strategy into a coherent story.

At advanced firms, the quality of the investment memo directly correlates with deal velocity, stakeholder alignment, and long-term performance. A mediocre memo introduces ambiguity and slows approvals. A great one crystallizes conviction, reveals risks candidly, and establishes trust with investment committees and partners.

Core Narrative Elements of a High-Impact Memo

The most effective investment memos move far beyond lists of facts or tables of metrics. They combine clear structure with persuasive, evidence-based storytelling. Several key elements define world-class memos.

Executive Framing

The memo begins not with numbers, but with context. Advanced practitioners know that committees are not just asking, “What are the returns?” but “Why this deal, in this market, at this moment?” The introduction should set the stage: identifying macroeconomic conditions, sector-specific dynamics, and firm-level strategy that make the deal compelling. This establishes the relevance of the opportunity before delving into details.

Property and Market Storytelling

Instead of presenting static descriptions of square footage and amenities, strong memos position the property within a broader narrative. A logistics warehouse might be contextualized as a critical node in regional supply chain infrastructure, backed by absorption trends and e-commerce growth data. An office acquisition may be explained in terms of flight-to-quality demand, tenant migration, and local incentives. In advanced memos, the property is not an isolated asset—it is a solution to market demand.

Tenant and Lease Dynamics

The rent roll is essential, but sophisticated memos interpret it. They highlight tenant dependencies, lease rollover cliffs, and embedded opportunities such as mark-to-market rent potential or expansion clauses. Advanced memos go further by analyzing tenant credit not just as a binary risk, but as part of a portfolio exposure strategy. They also discuss how AI-driven lease abstraction tools, like Kolena’s, surface hidden risks or unusual provisions that might otherwise be missed.

Underwriting in Context

Underwriting assumptions are the backbone of any memo, but advanced readers expect more than just numbers. The best memos explain not just what the assumptions are, but why they are defensible. For example, a rent growth forecast is linked to third-party market research, construction pipeline data, and comparable transactions. Exit cap rates are benchmarked against both historical trading ranges and current capital flows. In other words, the memo provides a rationale for each input, supported by data.

Valuation Triangulation

Advanced memos don’t rely on a single valuation method. They triangulate between the capitalization rate, discounted cash flow, and comparable sales, and then explain discrepancies. If the pro forma value is significantly above market comps, the memo must argue why execution of the business plan justifies the premium. This analytical discipline reassures sophisticated committees that optimism has not displaced objectivity.

Risk as a Strategic Lens

Perhaps the greatest differentiator of advanced memos is how they treat risk. Novice memos often bury risks in a token section near the end. Experienced teams elevate risk to a central theme, addressing it with candor. They do not just list risks—they assess probability, potential impact, and mitigation strategies. For example, instead of writing “leasing risk,” an advanced memo might discuss that 40% of the rent roll expires in year three, that this coincides with a wave of new supply, and that mitigation will include early renewals and targeted tenant incentives. By framing risk as manageable rather than avoided, the memo builds credibility.

Business Plan Integration

The narrative culminates in the business plan. Rather than generic statements about “value-add opportunities,” top-tier memos outline detailed strategies. For a multifamily acquisition, this might mean unit-by-unit renovation programs with cost-per-unit benchmarks, anticipated rent lifts, and evidence from comparable projects. For industrial, it might involve specific capital upgrades that unlock ESG certifications attractive to modern tenants. In advanced memos, the business plan is not an add-on but the bridge between underwriting and market storytelling.

Offering Memorandums vs. Investment Memos

While offering memorandums and investment memos may appear similar, their audiences and purposes differ. The OM is designed to market, often highlighting upside and minimizing challenges. The investment memo, in contrast, is written for internal stakeholders who must justify capital allocation. The most sophisticated teams use AI-powered tools to extract structured data from OMs, which are then rigorously tested and contextualized in the memo. This dual use ensures that no critical detail is overlooked while maintaining an independent perspective.

Underwriting as a Narrative, Not Just a Model

Advanced investment memos treat underwriting as a story. A spreadsheet may show projected cash flows, but the memo explains why those flows are plausible. It describes why the assumed rent growth aligns with submarket absorption, why tenant retention is achievable, and why exit pricing is realistic. By turning underwriting into a narrative, the memo guides readers through the logic of the numbers, making it far more persuasive than raw figures alone.

Best Practices for Professional Presentation

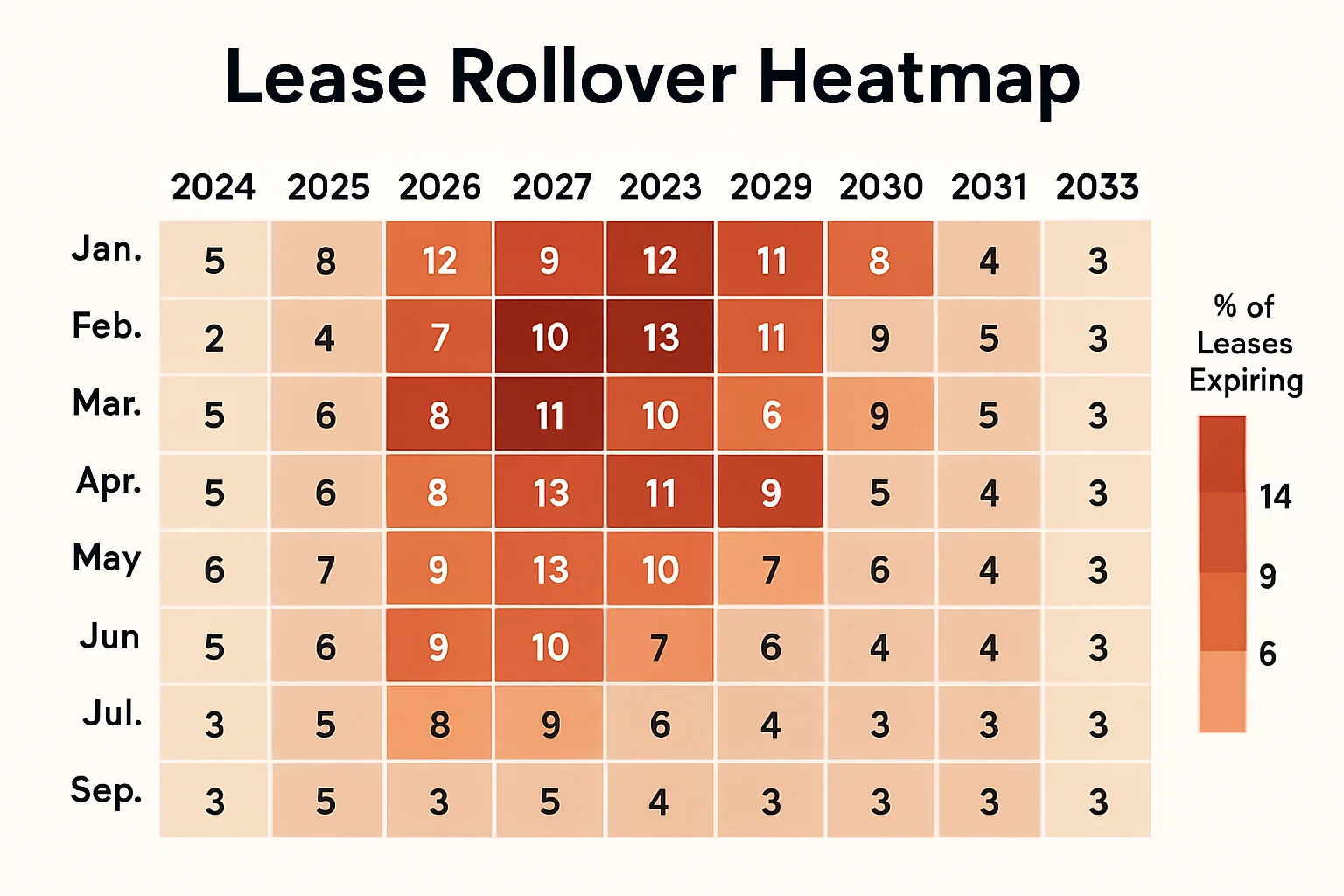

For experienced audiences, presentation matters as much as content. Dense tables or lengthy bullet lists can obscure insights. Instead, the best memos use clear subheadings, well-designed visuals, and narrative flow. Professional presentation techniques include embedding heatmaps of tenant rollover, using annotated maps to show proximity to demand drivers, or including sensitivity tornado charts to highlight key assumptions. The visual language communicates just as much as the text.

Visuals and Enhancements Beyond Text

For advanced memos, visuals are not decorative—they are analytical tools. Suggested enhancements include:

- A heatmap showing lease rollover concentration by year

- A scenario-based sensitivity chart for IRR under different exit cap rates

- Annotated submarket maps highlighting supply pipelines

- Side-by-side valuation comparisons (DCF vs. cap rate vs. comps)

- AI-driven lease summary dashboards for appendix integration

Embedding these visuals in the memo enriches comprehension and accelerates decision-making.

How AI and Automation Are Redefining the Memo

Artificial intelligence is not replacing analysts, but it is transforming how memos are produced. Kolena’s platform, for example, can ingest leases, offering memorandums, and rent rolls, and then output structured data. It can draft memo sections automatically, highlight unusual lease clauses, and flag inconsistencies across documents. This automation accelerates the process without sacrificing depth, enabling teams to focus on analysis rather than clerical work. Advanced professionals recognize that scaling investment activity requires technology that ensures consistency and accuracy across dozens of deals.

Where Kolena Fits in Advanced CRE Workflows

Kolena supports the creation of institutional-grade investment memos by providing:

- Automated extraction of lease and rent roll data

- Integration into underwriting models

- AI-generated narrative drafts that analysts can refine

- Quality control through consistency checks and risk detection

This allows investment teams to produce memos that are not only accurate but also faster to prepare, freeing senior professionals to focus on strategy, market positioning, and investor communication.

Try Kolena’s free AI tools for:

- Lease abstraction

- Rent roll

- Investment memo generation

- Offering memorandum analysis

- Pay application review

Learn more about Kolena’s AI for Real Estate.

Conclusion

For advanced professionals, the investment memo is not just a document but a discipline. It is the tool through which strategy, underwriting, and market insight are fused into a persuasive argument for capital allocation. Mastering the memo means mastering the art of synthesis: transforming raw data into strategic conviction. As artificial intelligence tools reshape workflows, firms that integrate AI-driven efficiency with human judgment will be positioned to produce the best memos—ones that are not only accurate and thorough, but also compelling and decisive.