What Is Loan Underwriting Software?

Loan underwriting software automates and centralizes the process of evaluating, approving, and managing loans. It handles steps like application intake, credit analysis, risk assessment, and compliance checks. Using pre-defined rules, algorithms, and sometimes artificial intelligence, this software reduces manual review and minimizes errors.

Modern loan underwriting platforms improve speed and accuracy in decision-making. They enable lenders to handle higher volumes of applications efficiently. These systems are configurable for various lending models, from personal loans to mortgages and business loans. The goal is to enhance the borrower and lender experience, ensuring quick and consistent credit decisions.

This is part of a series of articles about loan processing.

What Are the Key Benefits of Using Loan Underwriting Software?

Here are some of the primary benefits of automated loan underwriting solutions:

Faster loan decisions: Automation reduces manual steps, enabling faster evaluation and approval of applications. This shortens the time from application to funding, improving borrower satisfaction.

Improved accuracy: Rule-based engines and integrated data validation reduce human error, ensuring consistent and reliable underwriting decisions.

Scalability: Automated systems handle high volumes of loan applications without requiring proportional increases in staffing or operational overhead.

Regulatory compliance: Built-in compliance checks ensure adherence to evolving laws and regulations, reducing the risk of penalties or legal exposure.

Operational efficiency: Centralized data, streamlined workflows, and automated processes reduce administrative burdens and free up underwriters to focus on exceptions or complex cases.

Enhanced risk management: Advanced analytics and scoring models improve risk detection and borrower profiling, leading to healthier loan portfolios.

Better customer experience: Real-time application status updates, digital document uploads, and instant decisions provide a more transparent and user-friendly experience for borrowers.

Core Functions of Modern Loan Underwriting Platforms

Application Processing

Modern loan underwriting platforms digitize the entire application workflow, from initial submission to final approval or rejection. Borrowers can submit required information and documents online, reducing manual data entry and eliminating redundant paperwork. These systems automatically validate applicant information, flag missing data, and notify stakeholders in real time to accelerate the process.

Beyond basic intake, application processing modules allow lenders to categorize, prioritize, and route loan requests based on custom rules. Integrations with credit bureaus and other data sources provide instant access to supporting information, letting underwriters make rapid, informed decisions.

Automated Credit Scoring and Risk Assessment

Underwriting software uses automated credit scoring engines to quickly evaluate an applicant’s creditworthiness and risk profile. These engines pull data from various sources, such as credit bureaus, income verifiers, and internal databases, to generate a score based on lender-defined models and industry standards. Automation removes much of the subjectivity from risk evaluation, ensuring consistency across decisions.

Risk assessment tools can incorporate analytics or machine learning to identify patterns in applicant behavior and flag potential fraud or default risks earlier in the process. Lenders can tweak or update scoring models as market conditions and business needs shift, giving them greater control while maintaining speed and accuracy.

Document Management

Document management modules digitize the collection, storage, and retrieval of supporting documents needed for loan underwriting. Borrowers and loan officers upload documents, which are automatically matched with loan files and routed for verification or review. Optical character recognition (OCR) and AI-powered validation can read and extract data, reducing manual inspection.

These systems enforce document version control, secure storage, and audit-trail tracking, so lenders always know who accessed or modified records. Centralized and indexed document repositories save time during audits or when reconstructing loan histories, ensuring regulatory compliance and operational resilience.

Compliance

Loan underwriting software embeds regulatory compliance checks throughout the lending process. Automated controls ensure all applications and related decisions adhere to federal, state, and industry-specific regulations. These checks can include anti-money laundering (AML) workflows, know your customer (KYC) requirements, fair lending guidelines, and ongoing rule updates without the need for major manual process revisions.

Audit logs and reporting features make it simple for institutions to demonstrate compliance to regulators and internal auditors. Built-in alerts and approval workflows flag exceptions or high-risk cases, reducing the risk of non-compliance penalties.

Reporting and Analytics

Reporting modules aggregate data from all stages of the loan lifecycle into customizable dashboards and visualizations. Lenders use these tools to monitor application volumes, approval rates, default patterns, and operational bottlenecks. This information supports better portfolio management and allows executives to spot trends or opportunities for process improvement quickly.

Advanced analytics go further, enabling predictive modeling for credit performance, risk segmentation, and performance benchmarking across branches or product lines. These data-driven insights back strategic decisions, resource allocation, and regulatory reporting requirements.

Workflow Configuration

Modern underwriting solutions offer configurable workflows that adapt to the needs of different lending products, teams, or compliance regimes. Lenders can design custom approval paths, set escalation rules, and use role-based assignments to control task distribution. This flexibility enables faster adaptation to product changes or regulatory shifts without needing to rebuild processes from scratch.

Dynamic workflow engines also allow for continuous improvement. Stakeholders can adjust processes, introduce automation at bottlenecks, and monitor the effects of changes using built-in metrics.

Integration Capabilities

Integration features connect loan underwriting platforms to external and internal systems such as core banking, payment processors, credit bureaus, and document verification services. This connectivity minimizes manual data re-entry and synchronizes real-time information across different departments and software environments. API-based designs are common, allowing straightforward connectivity with both legacy and modern infrastructure.

Such integrations also enable richer decision-making by supplying underwriters with a comprehensive view of each applicant’s financial profile, transaction history, and previous interactions. They lower operational friction and ensure a seamless end-to-end experience for borrowers and lenders alike.

The Role of AI in Loan Underwriting

Artificial intelligence (AI) enhances loan underwriting by bringing greater precision, speed, and adaptability to credit decisioning. AI models can analyze large volumes of structured and unstructured data, from credit histories to employment trends, to improve risk evaluation beyond what traditional rule-based systems can achieve.

Machine learning algorithms detect complex patterns in borrower behavior, enabling more accurate default predictions and fraud detection. Unlike static models, AI systems can self-improve over time as new data becomes available, refining their scoring and risk assessment capabilities with each iteration.

Generative AI models help extract insights from unstructured documents such as tax returns, bank statements, or employment letters. This allows underwriters to gain a fuller picture of borrower qualifications without manual review.

AI also supports adaptive decision workflows. For example, low-risk applications might be auto-approved within seconds, while borderline cases are routed for manual review with AI-generated risk explanations. This layered approach balances efficiency with oversight.

Notable Loan Underwriting Software

1. Kolena

Kolena is not a traditional underwriting platform—it is an AI agent creation framework with out-of-the-box pre-built agents for loan underwriting that can be customized to every organizations specific policies. It lets lenders build custom underwriting agents using natural language instructions.

Key features include:

Create an underwriting agent simply by describing its purpose

Upload sample loan packages to train extraction tasks

Automate calculations like annual income across varying pay frequencies

Detect document inconsistencies

Connect to email or cloud storage for automated intake

Produce fully reasoned, citation-backed outputs

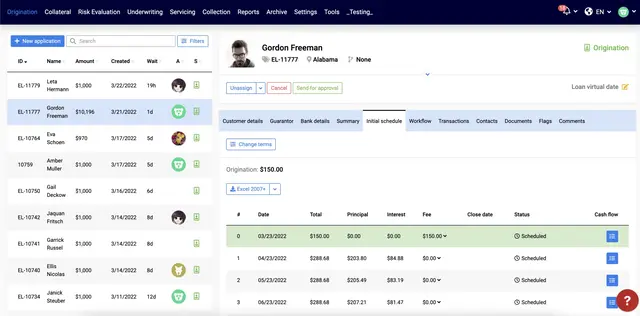

2. TurnKey Lender

TurnKey Lender automates credit decisioning while minimizing risk and operational overhead. The platform integrates intelligent data-driven scoring, fraud detection, and real-time verification to enable instant, reliable loan approvals.

Key features include:

AI-powered decision engine: Automates credit decisions using machine learning, credit bureau data, and 200+ fraud detection rules

Real-time verification: Supports ID checks, bank account verification, and bank statement scoring

Instant loan decisioning: Loan applications are evaluated and approved in under one second

Customizable workflows: Fully adjustable application flows, dictionaries, and decision rules to match lender needs

Digital borrower portal: Intuitive interface for borrowers to apply and receive decisions quickly

Source: TurnKey Lender

3. nCino Credit Analysis Suite

nCino’s Credit Analysis Suite is embedded directly into the loan origination workflow, automating key aspects of credit analysis. It helps underwriters evaluate borrower financials, assess risk, and generate credit memos with minimal manual effort.

Key features include:

Automated financial spreading: Quickly analyze borrower financials and identify trends using centralized, consistent data inputs

Streamlined credit memo creation: Automatically generate memos using current platform data in templates customized to each institution

Advanced risk assessment tools: Evaluate credit quality using user-defined risk ratings, debt analysis, and risk-grade calculations

Cash flow forecasting: Underwriters can project future cash flows for C&I and CRE loans to support sound lending decisions

Debt and collateral management: Import and analyze borrower debt obligations, track collateral, lien positions, and market rates

4. MeridianLink Mortgage Software

MeridianLink Mortgage is a loan origination system built for mortgage lending. It automates every phase of the mortgage process, from application to closing, through rules-based automation, integrated compliance tools, and partner connectivity.

Key features include:

End-to-end process: Supports a paperless lending process from application through approval

Workflow automation: Speeds up processing and increases consistency using customizable, rules-based task automation

PriceMyLoan (PML): Combines underwriting, product pricing, margin management, and fee calculations in one native tool

Compliance automation: Maintains regulatory accuracy with built-in checks and seamless updates to keep workflows compliant

Open API architecture: Connects with hundreds of fintech and vendor partners for maximum flexibility and scalability

5. Oscilar

Oscilar is a B2B credit underwriting platform that enables financial institutions to make faster, more accurate credit decisions while minimizing manual effort. Built for risk and onboarding teams, it uses machine learning and natural language workflows to automate complex underwriting logic, boost approval rates, and reduce false positives.

Key features include:

AI-driven workflow builder: Create and modify credit decision workflows using natural language, with automatic generation of logic and conditions

Database & API integrations: Connect internal data sources and 80+ third-party providers for a unified view of applicants

One-click testing & validation: Run historical backtests and A/B tests on underwriting models to assess impact before deployment

Real-time analytics: Track approval rates, defaults, and custom KPIs with a built-in analytics suite for ongoing performance monitoring

Customizable risk models: Use ML models to predict bank balances, assess spend power, and analyze transaction behavior

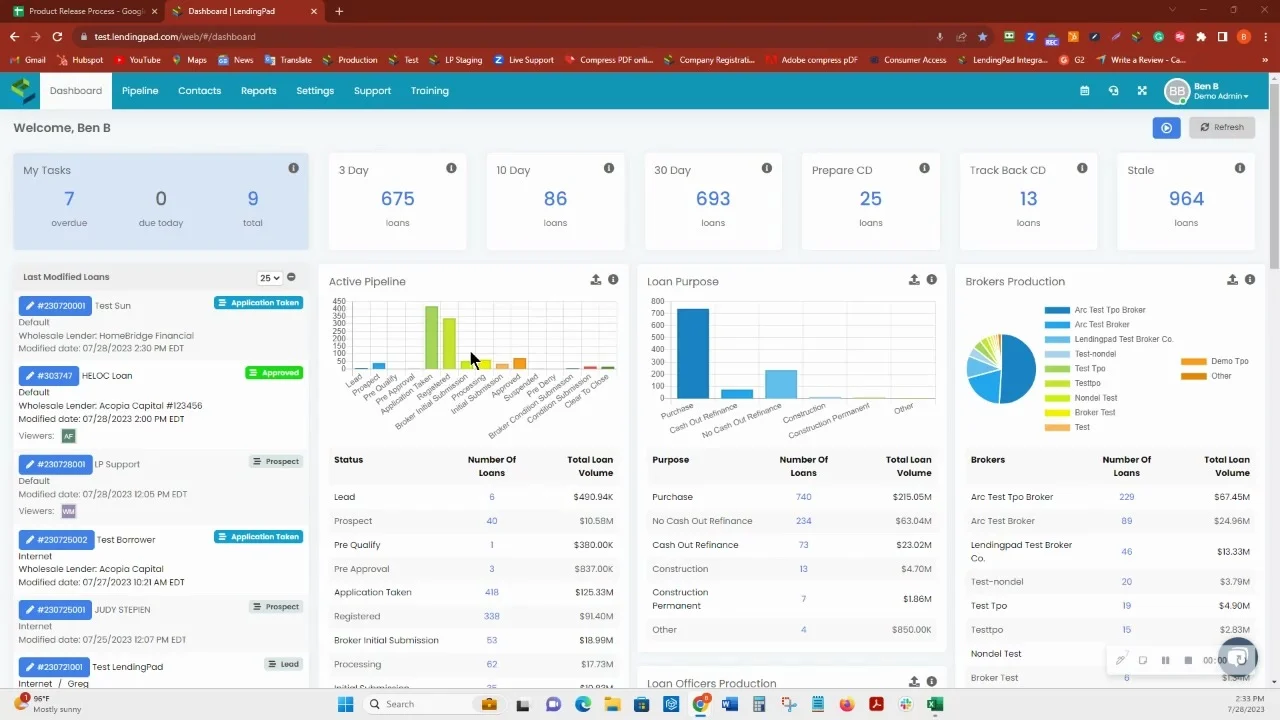

6. LendingPad

LendingPad is a cloud-based loan origination system with deep customization for financial institutions. It combines automation, real-time pipeline visibility, and multi-user processing to streamline operations across retail, wholesale, and correspondent channels.

Key features include:

Lending data API: Supports real-time, synchronous data exchange across systems for seamless connectivity and automation

Custom pricing & eligibility engine: Tailor pricing logic and eligibility rules to fit institutional lending criteria and investor requirements

Automated underwriting: Integrated underwriting tools speed up decision-making and reduce manual effort in the approval process

Real-time pipeline monitoring: Multi-channel visibility across all loans with live updates to support faster response and issue resolution

Multi-user, simultaneous processing: Enables teams to collaborate on loan files in parallel without conflict or delays

Source: LendingPad

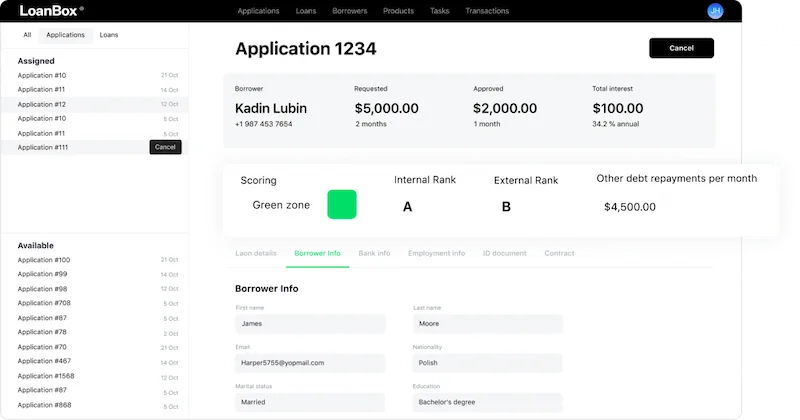

7. HES Fintech LoanBox

HES LoanBox is a modular, white-label lending platform designed to streamline the entire lending lifecycle, from application and underwriting to servicing and repayment. It enables lenders to launch fully branded digital lending solutions quickly, improve operational efficiency, and enhance borrower experience across devices.

Key features include:

White-label lending platform: Customize your digital loan interface with branding, terms, and calculators to attract and engage borrowers

Mobile lending app: Offer customers full loan visibility and application capabilities via iOS and Android apps

Digital loan origination: Enable borrowers to apply online, upload documents, and track approvals through a secure client portal

Automated underwriting: Expedite credit decisions with scoring and verification processes supported by KYC and biometric tools

Real-time application tracking: Clients can monitor application status, receive decisions, and view full application history

Source: Hesfintech HES LoanBox

8. Earnix Underwrite-It

Earnix Underwrite-It is an underwriting solution that combines rules-based decisioning, machine learning, simulation, and analytics. It allows business users to create, test, and deploy underwriting rules without heavy IT involvement.

Key features include:

Unified rules management: Centralized platform for creating and maintaining underwriting rules, with no-code/low-code UI for business users

Automated decisioning: Enables straight-through processing by fully automating underwriting workflows

Machine learning integration: Combines traditional rules with ML models to improve accuracy and decision quality

Advanced simulation tools: Simulate the impact of rule and pricing changes on portfolios before deployment

A/B rules testing: Compare different underwriting strategies to evaluate performance and select the best approach.

Conclusion

Loan underwriting software centralizes application intake, risk assessment, document management, and compliance checks into one system. With automation, analytics, and AI, it reduces manual work and improves decision consistency. Integrations and reporting tools give lenders a clearer view of borrower data and portfolio performance, helping them manage underwriting more efficiently as requirements and volumes grow.