When we talk about property ownership in real estate, the term “fee simple” usually comes up first. It represents the most complete form of ownership, giving the title holder the broadest rights possible. However, not all fee simple estates are absolute. A special category, known as fee simple defeasible, limits ownership rights based on specific conditions or events. If these conditions are violated or occur, ownership can automatically terminate or shift to another party.

For real estate professionals, lenders, and investors, understanding fee simple defeasible is critical—particularly in contexts involving defeasance, lease abstraction, and long-term investment risk. At its core, this estate type ties ownership rights directly to compliance with conditions set by the grantor.

This article is part of a comprehensive series on Defeasance and explores how fee simple defeasible operates, the legal and financial implications, and how modern AI tools can help professionals manage the complexity of conditional ownership.

- What Is Fee Simple Defeasible?

- Types of Fee Simple Defeasible

- Legal Implications of Fee Simple Defeasible

- Fee Simple Defeasible vs. Fee Simple Absolute

- Fee Simple Defeasible in Commercial Real Estate

- Fee Simple Defeasible and Defeasance

- Common Challenges with Fee Simple Defeasible

- Modern Risk Management: AI in Reviewing Deeds and Conditions

- Practical Examples in Finance and Insurance

- How Kolena Helps

- Conclusion

What Is Fee Simple Defeasible?

A fee simple defeasible is a type of freehold estate in which ownership continues only so long as certain conditions are met. If the condition is broken—or, in some cases, if a condition is triggered—the estate may revert back to the original grantor or transfer to a third party named in the deed.

The concept dates back to English common law but remains relevant in modern U.S. real estate. While fee simple absolute grants unconditional ownership, fee simple defeasible introduces limitations and potential termination of rights.

Think of it as ownership with strings attached. You own the property, but only so long as you abide by the agreed terms.

Types of Fee Simple Defeasible

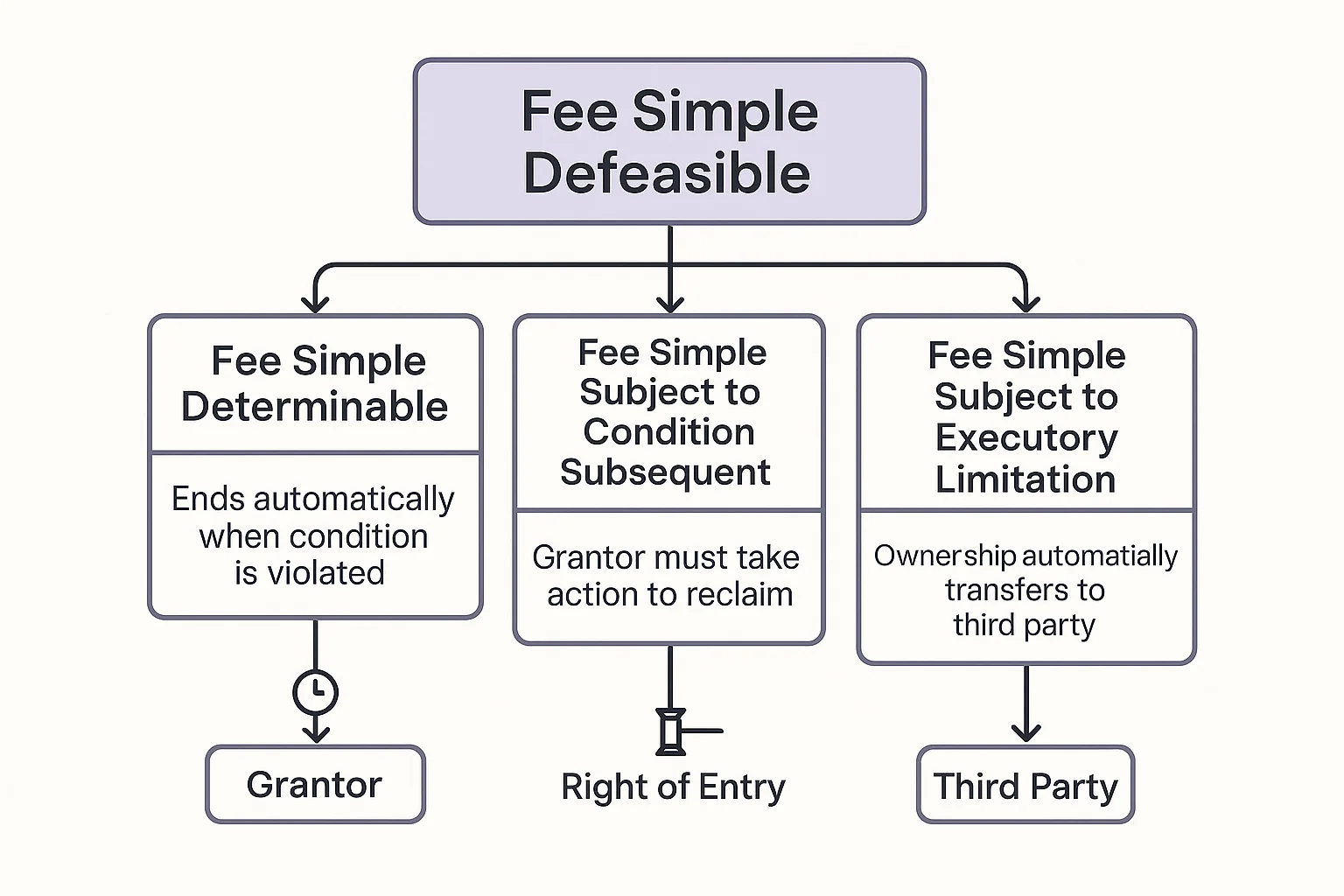

There are three main categories of defeasible estates:

1. Fee Simple Determinable

Ownership lasts “so long as” or “until” a stated condition is met.

If the condition is violated, the estate automatically reverts to the grantor.

Example: A deed states, “This land is conveyed to the city for use as a park, so long as it remains a park.” If the city builds a shopping mall on the land, ownership immediately reverts to the grantor.

2. Fee Simple Subject to Condition Subsequent

Ownership is granted with a condition, but unlike determinable estates, the grantor must take action to reclaim the property if the condition is violated.

Example: “To the local nonprofit, on condition that alcohol is never sold on the premises.” If alcohol is sold, the grantor has the right to re-enter and reclaim the property, but ownership does not terminate automatically.

3. Fee Simple Subject to Executory Limitation

Ownership automatically transfers to a third party—not back to the grantor—if the condition is broken.

Example: “To Jane, but if the property is ever used for commercial farming, then to Tom.”

Each type reflects subtle but important differences in how ownership ends and who gains the property afterward.

Legal Implications of Fee Simple Defeasible

The presence of conditions introduces several legal complexities:

Title Clarity: Deeds with restrictions must be carefully worded to avoid disputes.

Reverter Rights: Whether reversion occurs automatically or requires legal action matters significantly.

Marketability: Conditional estates may be harder to sell, as buyers may hesitate to acquire property with ownership risks.

Enforceability: Courts may strike down conditions that violate public policy or constitutional protections (for example, discriminatory restrictions).

Attorneys, lenders, and investors often need to assess the enforceability and likelihood of forfeiture before finalizing transactions involving defeasible estates.

Fee Simple Defeasible vs. Fee Simple Absolute

The difference between fee simple absolute and defeasible boils down to security of ownership:

Fee Simple Absolute: The owner has unrestricted rights—use, sell, transfer, and pass to heirs—without conditions.

Fee Simple Defeasible: The owner’s rights are conditional and can be cut short by violating a deed restriction.

This distinction directly affects investment risk, valuation, and financing. Lenders in particular will scrutinize whether ownership rights could be disrupted by future events.

Fee Simple Defeasible in Commercial Real Estate

In commercial real estate, fee simple defeasible ownership structures often appear in:

Land donations: Universities, cities, or nonprofits may receive land donations with restrictions such as “must be used for educational purposes.”

Religious or cultural sites: Land may revert to the grantor if used for non-religious purposes.

Environmental restrictions: Properties may require preservation of wetlands or natural habitats.

Long-term leasehold conversions: Developers sometimes encounter defeasible estates when assembling land parcels with older deed restrictions.

Each of these contexts intersects with defeasance—the process of releasing property from encumbrances or restrictions during refinancing or sale.

Fee Simple Defeasible and Defeasance

While defeasance typically refers to releasing debt obligations, the broader principle applies: eliminating or neutralizing restrictive clauses to make ownership cleaner.

In defeasible estates:

Investors may need to negotiate releases from grantors.

Title insurers must evaluate conditional clauses before underwriting.

Lenders may require confirmation that no active reversion risk threatens collateral.

By connecting fee simple defeasible to defeasance, we see a shared objective: ensuring ownership is free of conditions that jeopardize value or transferability.

Common Challenges with Fee Simple Defeasible

Ambiguity in Deed Language

Many older deeds contain vague wording such as “for educational purposes” without defining boundaries. Courts often step in to interpret intent, which introduces uncertainty.

Trigger Events

Determining whether a condition has been violated can be contentious. For example, does hosting a fundraising gala with alcohol violate a “no alcohol sales” clause?

Third-Party Rights

In executory limitations, the named third party gains powerful future rights. These can complicate negotiations if the property is being sold or refinanced.

Valuation Impacts

Properties with defeasible conditions may appraise lower due to the risk of reversion. Lenders may demand higher interest rates or refuse financing altogether.

Modern Risk Management: AI in Reviewing Deeds and Conditions

With the explosion of document-intensive workflows in real estate, AI is increasingly used to review deeds, titles, and lease agreements for restrictive clauses.

Platforms like Kolena enable professionals to:

Automatically extract restrictive clauses from deeds.

Flag conditions that could trigger fee simple defeasible scenarios.

Cross-check restrictions against lender requirements.

Generate clear summaries for underwriting or due diligence.

This reduces human error and accelerates decision-making—critical when timeframes are tight in acquisitions or refinancing.

Practical Examples in Finance and Insurance

Finance: A lender evaluating collateral must determine if reverter rights compromise security. AI tools can streamline this by surfacing deed restrictions early in the underwriting process.

Insurance: Title insurers can better assess coverage risk when AI-powered abstraction clarifies whether ownership could terminate under certain conditions.

These applications highlight why understanding fee simple defeasible is not just academic—it directly affects profitability and risk in real estate transactions.

How Kolena Helps

At Kolena, we specialize in using AI to simplify document-heavy real estate workflows. Our technology helps professionals:

Automate the detection of conditional ownership clauses.

Abstract and summarize deed restrictions into actionable insights.

Support compliance and risk analysis for lenders, insurers, and investors.

Ensure faster, more accurate decision-making during transactions.

By applying AI to the problem of fee simple defeasible estates, Kolena enables real estate and finance professionals to work with clarity, speed, and confidence.

Conclusion

Fee simple defeasible estates remind us that not all property ownership is absolute. By tying ownership to conditions, these estates create unique risks—and opportunities—for investors, lenders, and real estate professionals. Understanding the different types (determinable, subject to condition subsequent, and subject to executory limitation) is essential for assessing long-term ownership security.

As defeasance strategies and AI technologies evolve, professionals now have better tools than ever to manage conditional ownership risks. Fee simple defeasible may be complex, but with the right insights and technology, it becomes manageable—and even strategically advantageous.