Among the many forms of property ownership in the United States, fee simple absolute stands as the most complete and unrestricted estate in land. It represents the highest form of ownership an individual or entity can hold, conferring full rights to possess, use, sell, or transfer property, subject only to legal restrictions such as zoning laws or taxation. Understanding fee simple absolute is essential for professionals in commercial real estate, finance, and insurance, particularly when navigating complex processes like defeasance, where property interests intersect with loan obligations and ownership rights.

This article is part of a comprehensive series on defeasance.

Historical and Legal Origins

The concept of fee simple absolute originates from English common law, where it evolved as a response to feudal landholding systems. Under feudalism, land was often encumbered with obligations to lords or the crown. Fee simple absolute emerged as a way to create a complete and inheritable interest in land, free from such obligations. Over time, American property law adopted fee simple absolute as the default and most common form of real property ownership.

Defining Characteristics of Fee Simple Absolute

A fee simple absolute estate grants the owner the broadest property rights permitted under law. Its key attributes include:

- Perpetual duration: Ownership does not end after a term of years or upon a specific condition.

- Unlimited alienability: The owner can sell, gift, or transfer the property without restrictions, subject to law.

- Inheritance rights: Property passes to heirs or beneficiaries upon death according to a will or intestacy laws.

- Exclusive control: The owner enjoys rights to use, lease, or improve the land, limited only by legal restrictions such as zoning codes or environmental regulations.

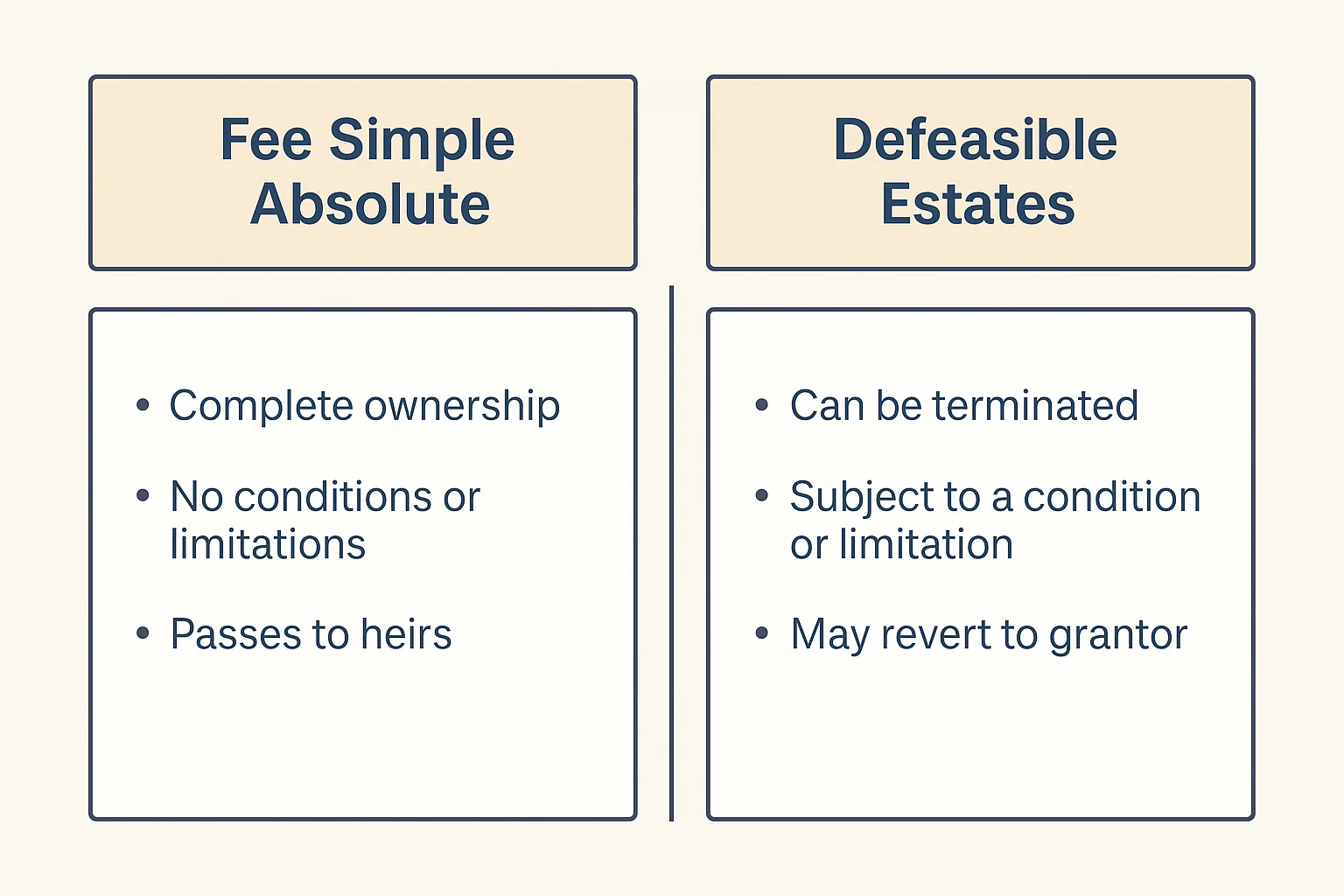

Fee Simple Absolute vs. Defeasible Estates

To understand the significance of fee simple absolute, it is useful to contrast it with defeasible estates, which are ownership interests subject to conditions or limitations. For example:

- Fee simple determinable: Ownership automatically reverts to the grantor if a condition is violated (e.g., land used only for educational purposes).

- Fee simple subject to condition subsequent: The grantor has the right to reclaim ownership if a condition is breached, but must take action to do so.

In these cases, ownership is not absolute, but contingent. By contrast, fee simple absolute is free from such restrictions, making it the most secure and predictable form of ownership. This distinction becomes highly relevant in defeasance transactions, where lenders and borrowers must carefully account for ownership rights and limitations.

Implications in Commercial Real Estate

In commercial real estate (CRE), most properties are held in fee simple absolute. This form of ownership provides investors and lenders with confidence that the property is not subject to hidden reversionary interests or conditions that could disrupt business operations. For developers, fee simple absolute allows maximum flexibility in how land can be used, redeveloped, or leveraged for financing.

In practice, fee simple absolute ownership underpins many CRE transactions, including acquisitions, refinancing, and securitization. Because it represents the most marketable and transferable interest, lenders often require borrowers to hold fee simple absolute title as a condition for financing.

Fee Simple Absolute in Lending and Defeasance

In structured finance, particularly in commercial mortgage-backed securities (CMBS), defeasance is a process by which a borrower substitutes collateral (often government securities) for the real property securing a loan. For this process to work smoothly, the underlying property is typically held in fee simple absolute. This ensures that no competing claims or conditions can interfere with the lender’s security interest or the investor’s rights in the loan.

The predictability of fee simple absolute also reduces risk for lenders. Since there are no conditional limitations on ownership, lenders can more easily assess property value and enforce their interests in the event of default. This security is vital in large-scale transactions, where billions of dollars may hinge on clear, uncontested property rights.

Limitations and Misconceptions

While fee simple absolute provides the broadest ownership rights, it is not without limitations. Owners remain subject to:

- Government powers: Eminent domain, taxation, zoning, and environmental regulations can all restrict or impact use of property.

- Private restrictions: Deed covenants, easements, or homeowners’ association rules may limit property rights.

- Market forces: Even absolute ownership does not insulate property value from broader economic conditions or market downturns.

A common misconception is that fee simple absolute conveys “unlimited” rights in an absolute sense. In reality, ownership exists within the framework of public law and private agreements.

The Role of Technology in Managing Property Interests

As real estate and finance professionals manage increasingly complex portfolios, AI-driven tools like Kolena’s automation platform are transforming how ownership interests—including fee simple absolute—are documented, analyzed, and leveraged. By using AI to automate lease abstraction, contract analysis, and compliance monitoring, Kolena helps organizations ensure accuracy and efficiency in managing property rights. This is especially valuable in contexts like defeasance, where precise understanding of ownership and contractual terms is essential.

Kolena’s platform allows professionals to:

- Extract critical data from deeds, leases, and loan agreements.

- Validate ownership structures for financing transactions.

- Automate due diligence across large property portfolios.

By streamlining these processes, Kolena enhances the reliability of property records, reduces legal risk, and supports more efficient transactions.

Try Kolena’s free AI tools:

- AI-powered lease abstraction

- AI-powered rent roll

- AI-powered investment memo generation

- AI-powered offering memorandum analysis

Conclusion

Fee simple absolute remains the foundation of property ownership in the United States, offering the most complete bundle of rights available under law. Its security, flexibility, and predictability make it the preferred form of ownership in commercial real estate and a critical component in lending structures such as defeasance. While subject to legal and market limitations, fee simple absolute provides the stability necessary for investors, lenders, and developers to transact with confidence. With the help of AI solutions like Kolena, professionals can more effectively navigate the complexities of modern real estate, ensuring that property ownership remains a reliable cornerstone of financial and operational success.