Most real estate teams do not begin with a grand plan to automate everything at once.

They start with one headache.

Maybe it is lease abstraction draining analyst hours. Maybe underwriting support is slowing acquisitions. Maybe quarterly audits keep turning into deadline pressure.

They fix that one workflow. And then they realize they are not dealing with just one lion, tiger, or bear.

The same documents keep appearing in different stages of the deal.

The same assumptions get rebuilt in new spreadsheets.

The same bottlenecks show up whether it is underwriting, asset management, or reporting.

That is when automation stops being a quick fix and starts becoming something more like a yellow brick road. Not magic. Just a clearer, more reliable path through the noise.

Here is how teams similar to yours are using Kolena to create that path, move faster, standardize diligence, and avoid surprises hiding in the forest.

Retail, Office, and Industrial: Turning Lease Complexity Into Clarity

For lease-heavy portfolios, value and risk are buried in contract language.

Retail operators are using Kolena to consistently surface high-impact clauses such as options, exclusives, use restrictions, and assignment and sublet rights, so underwriting teams are not relying on memory or inconsistent abstraction formats. Edge cases like go-dark provisions or tenant improvement obligations are flagged early instead of being discovered mid-hold.

Office and industrial investors are normalizing complex rent structures across portfolios. Step rents, CPI escalations, percentage rent, and base-year gross-ups are structured in a way that feeds directly into underwriting models. CAM caps and recovery logic are validated before they become reconciliation disputes.

The result is not just faster abstraction. Kolena results in fewer surprises between acquisition, asset management, and audit teams. Everyone works from the same interpretation of the lease.

Multifamily: Bringing Structure to Volume

Multifamily operators face a different challenge. The issue is not usually a single complicated clause.

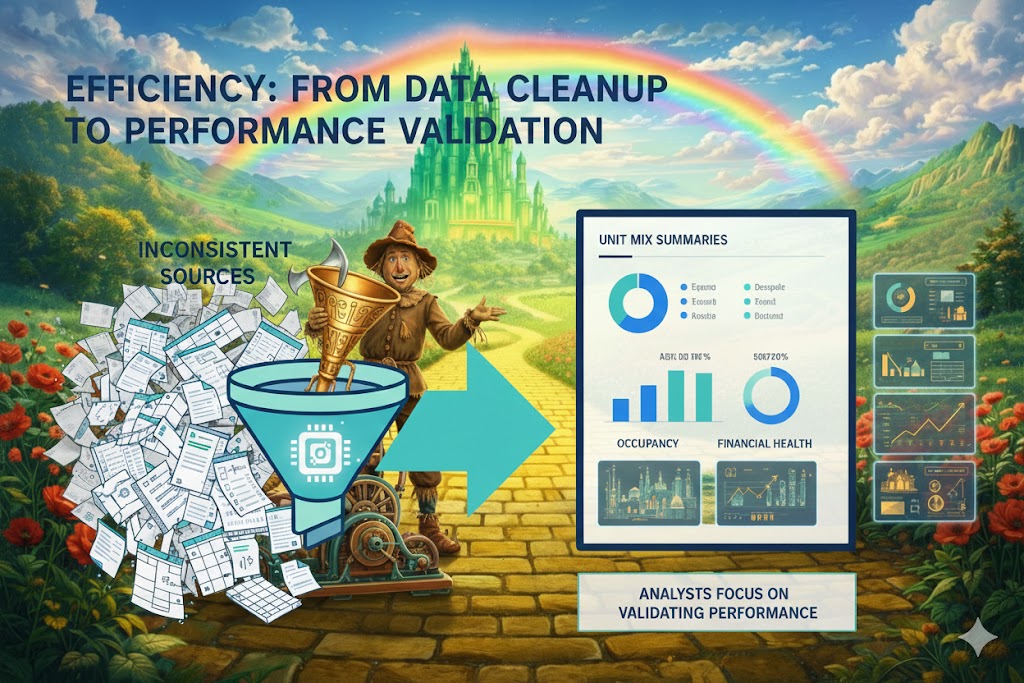

Teams are using Kolena to standardize rent rolls from inconsistent source files, build clean unit mix summaries, and align occupancy, concessions, delinquency, and bad debt assumptions. Instead of spending hours reformatting spreadsheets, analysts can focus on validating performance.

For larger properties, we often see a few common workflows emerge. Multifamily brokers frequently build loan roll-ups and loan sizing models as part of their process. Kolena agents can simplify and automate those steps, structuring the underlying data so debt assumptions are consistent and easier to defend.

The value here shows up in consistency. Standardized inputs lead to better decisions, fewer surprises, and faster deal cycles. Reporting improves because the same structured logic supports both acquisition and ongoing asset management.

Hospitality: Making Performance Analysis Repeatable

Hospitality investors are getting value in a different way.

Because hotels are performance-driven assets, Kolena is being used to structure P&Ls and build out key performance indicators such as ADR, RevPAR, occupancy trends, and seasonality patterns. Management and franchise agreements are reviewed alongside operating results, creating a more complete view of risk.

Sensitivity scenarios tied to rate and occupancy shifts can be modeled consistently across deals. Vendor and service contracts are analyzed within the broader performance context, not as standalone documents.

For these teams, the advantage is to see downside risks sooner. Investment committees receive structured, comparable outputs instead of one-off spreadsheets.

Mixed-Use and Complex Assets: Connecting the Dots

Firms working on mixed-use or special-purpose assets often deal with document fragmentation. Retail leases, multifamily rent rolls, service agreements, operating statements, and lender requirements can all sit within the same deal.

Kolena is helping these teams assemble lender and investor packages directly from underlying documents. Data is cross-validated across leases, rent rolls, and financial statements before being used in loan sizing or DSCR calculations. Narrative investment memos are generated from verified inputs rather than manually stitched summaries.

The value here is operational alignment. There are fewer manual handoffs and more consistent deal narratives. Communication between underwriting, capital markets, and investor relations becomes cleaner and more reliable.

A Pattern Across Asset Classes

Across retail, multifamily, hospitality, and mixed-use portfolios, a common theme emerges.

The initial use case might be narrow, such as lease abstraction, rent roll cleanup, or P&L structuring. Because the same documents feed multiple workflows, companies begin to see broader operational benefits.

Diligence becomes standardized across teams.

Rework between underwriting and asset management decreases.

Assumptions feeding models and reports become more consistent.

Audit readiness improves.

The return is not only time savings. It reduces execution risk and strengthens internal alignment.

Ready to Expand Your Automation?

Every portfolio has its own strategy and asset mix, but the operational friction is often the same. Documents live in different formats. Abstractions vary by analyst. Data gets reworked from one spreadsheet to the next. Surprises surface late.

Firms similar to yours are using Kolena to bring structure to leases, rent rolls, operating statements, and performance reporting across asset classes. If you are already using Kolena for one part of your workflow, there is often more value sitting inside the same documents than you realize. Expansion is not about adding complexity. It is about unlocking the information you already have and applying it consistently across underwriting, asset management, and reporting.

In a market that can feel like lions, tigers, and bears at every turn, structure becomes your yellow brick road. If you want to see how peers in your segment are using it, or explore which agents make sense for your portfolio, book a quick call. We will review your asset mix and map out the next steps with you.