In this blog, we explore how to leverage AI for Loss Run reports, making the cumbersome process of analyzing insurance documents a breeze. By using Kolena’s AI agent creation platform, you can automate the extraction and analysis of critical data, saving time and enhancing decision-making, without needing to write any code.

Table of Contents

- Introduction to AI for Loss Run

- Understanding Loss Runs

- The Need for Automation in Insurance Reporting

- Creating Your AI Agent with Kolena

- Uploading Sample Documents for Instructions

- Using Natural Language for Data Extraction

- Previewing and Customizing Data Extraction

- Extracting Policy Level Details

- Providing Feedback for Continuous Improvement

- Understanding the Reasoning Behind Extracted Data

- Generating Executive Summaries with the AI

- From Loss Run Document to Complete Report

- Processing New Loss Runs Automatically

- Setting Up Automated Connections for Efficiency

- Creating Dashboards for Data Analysis

- Conclusion: The Future of AI in Insurance

Introduction to AI for Loss Run Reports

AI for Loss Run reporting is transforming how insurance professionals manage and analyze critical data from loss run reports. With Kolena’s AI agent creation platform, you can automate the extraction and interpretation of data from these complex documents. This automation not only saves time but also enhances accuracy in risk assessment and decision-making.

Understanding Loss Runs

Loss runs are essential documents used in insurance underwriting. They provide a comprehensive history of an insured entity’s claims, detailing everything from claim amounts to the status of each case. Understanding these reports is crucial for assessing risk, making informed decisions, and ensuring compliance with underwriting guidelines.

Key Components of Loss Runs

- Claim Number: A unique identifier for each claim.

- Claimant Name: The individual or entity filing the claim.

- Policy Number: The identifier for the insurance policy associated with the claim.

- Claim Status: Indicates whether the claim is open, closed, or pending.

- Dates: Important timelines including the date of loss, date reported, and resolution date.

The Need for Automation in Insurance Reporting

Manual processing of loss run reports is tedious and prone to errors. Insurance professionals often spend hours sifting through lengthy PDF documents, extracting vital data by hand. This process is not only inefficient but can lead to inaccuracies that affect decision-making and risk assessments.

By implementing AI for Loss Run, you can automate this entire process. The AI agent can quickly analyze documents, extracting key information and presenting it in a structured format. This not only accelerates the workflow but also enables teams to focus on higher-value tasks.

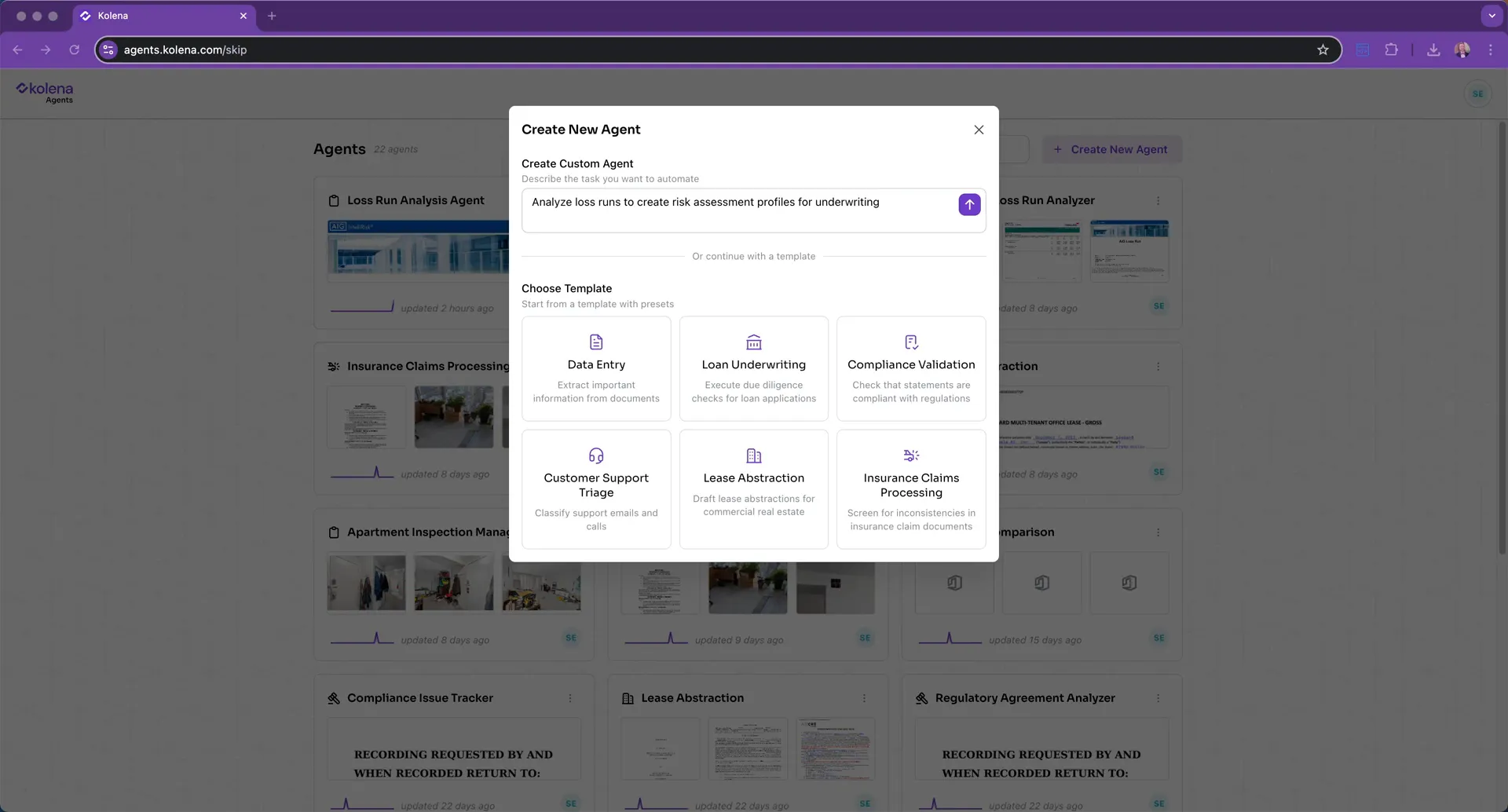

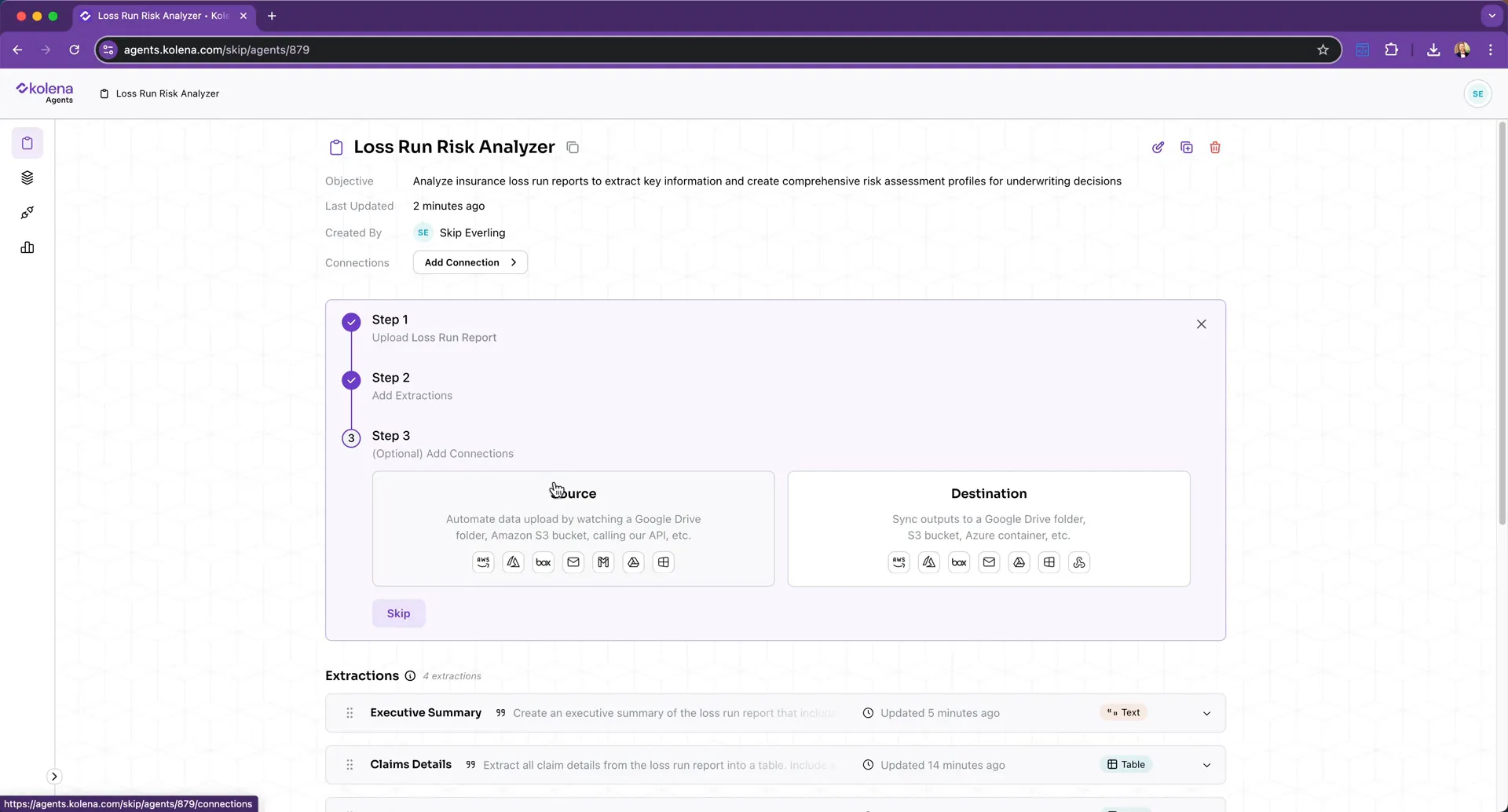

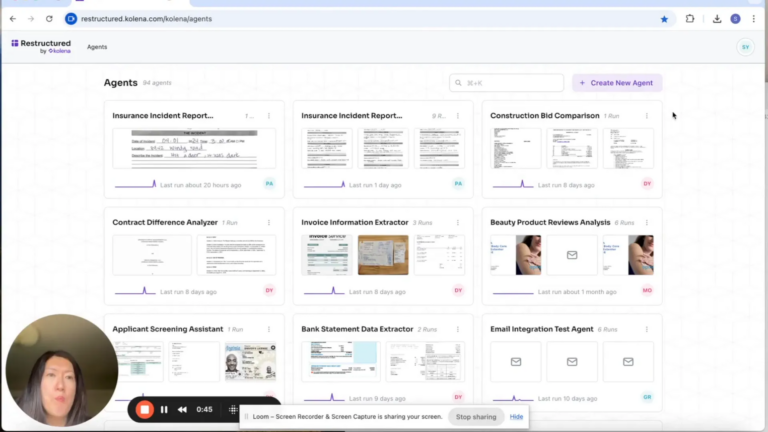

Creating Your AI Agent with Kolena

Building your AI agent with Kolena is straightforward and intuitive. Start by accessing the agent creation platform, where you can define the objectives and functionalities of your agent tailored specifically for loss run reporting.

Defining Your Agent’s Objective

When creating your AI agent, the first step is to define its objective. For loss runs, this could involve analyzing reports to generate risk assessment profiles. By clearly stating the goal, the AI can optimize its extraction processes.

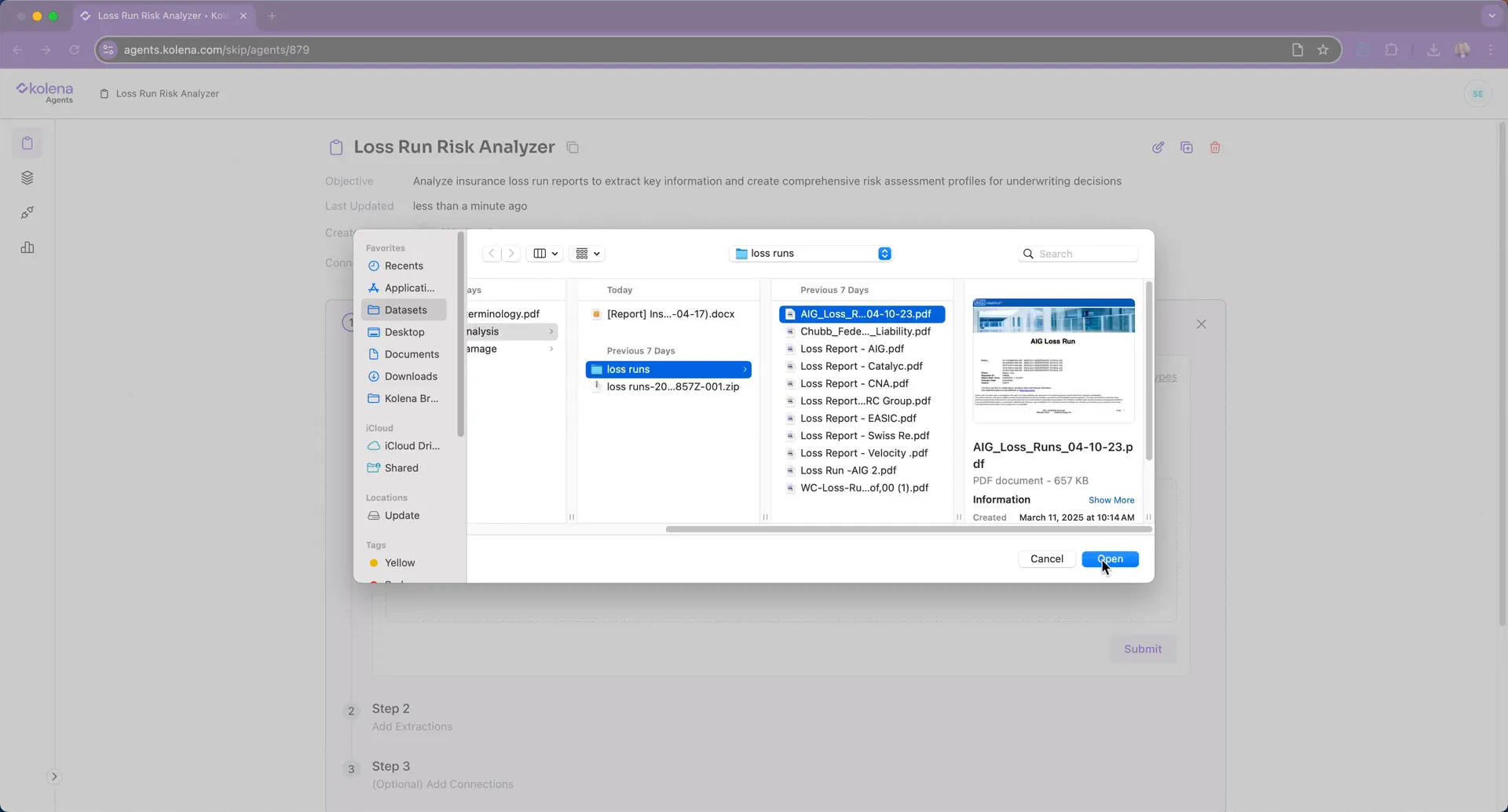

Uploading Sample Documents for Instructions

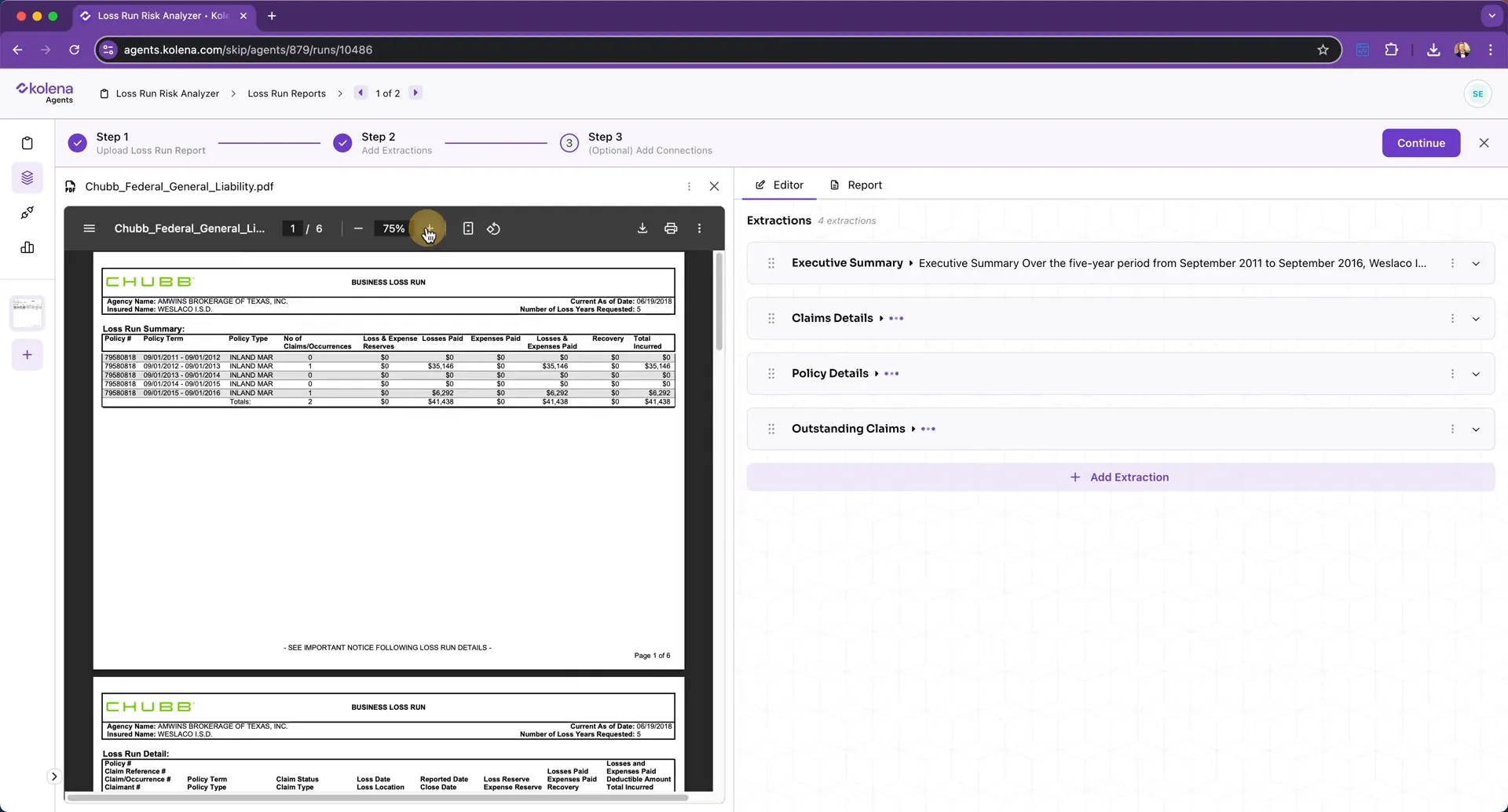

Next, you’ll need to upload a sample loss run document. This document serves as a reference for the AI agent to understand the structure and content it will be working with. By providing an example, the AI can better tailor its extraction instructions.

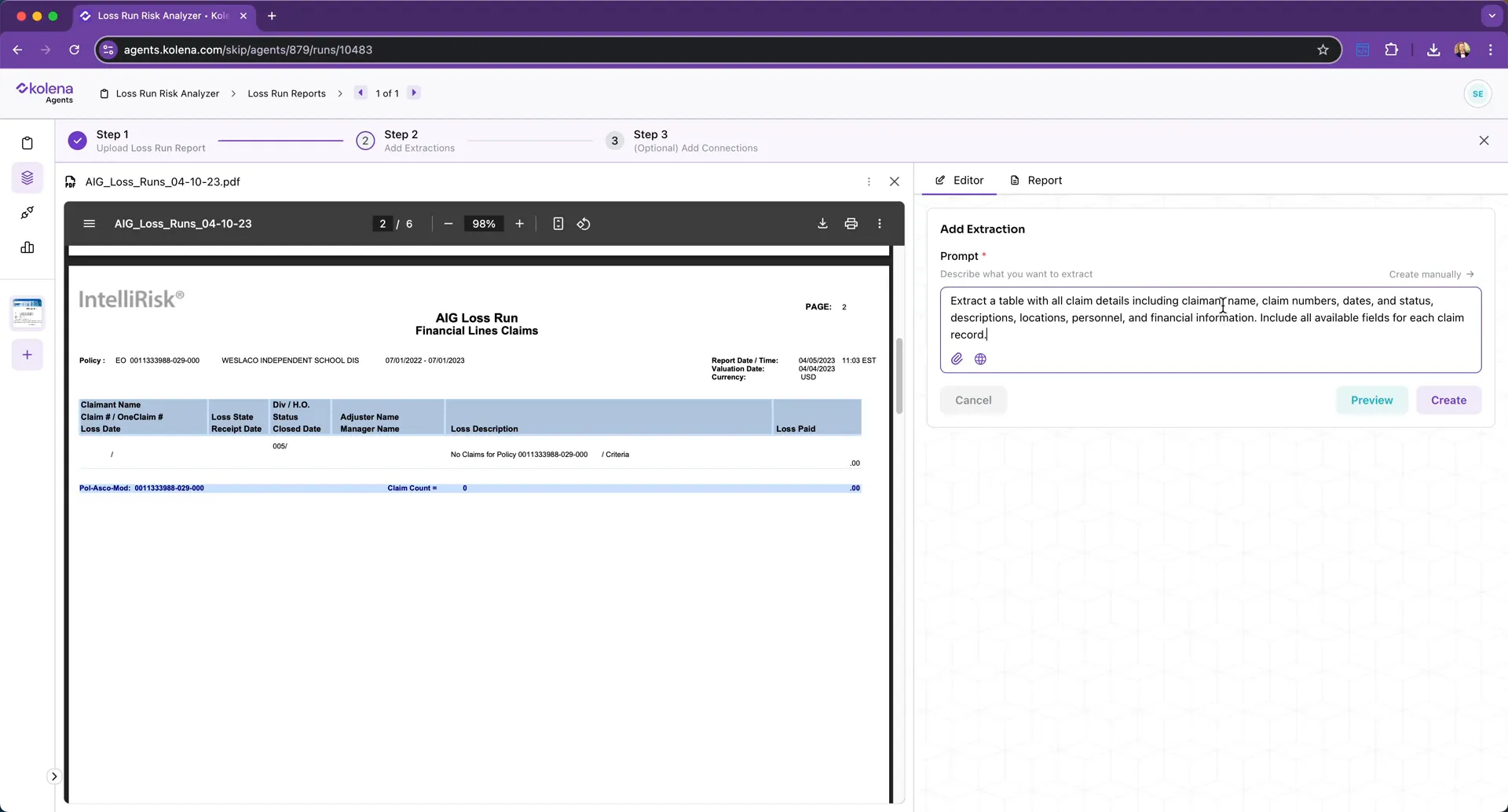

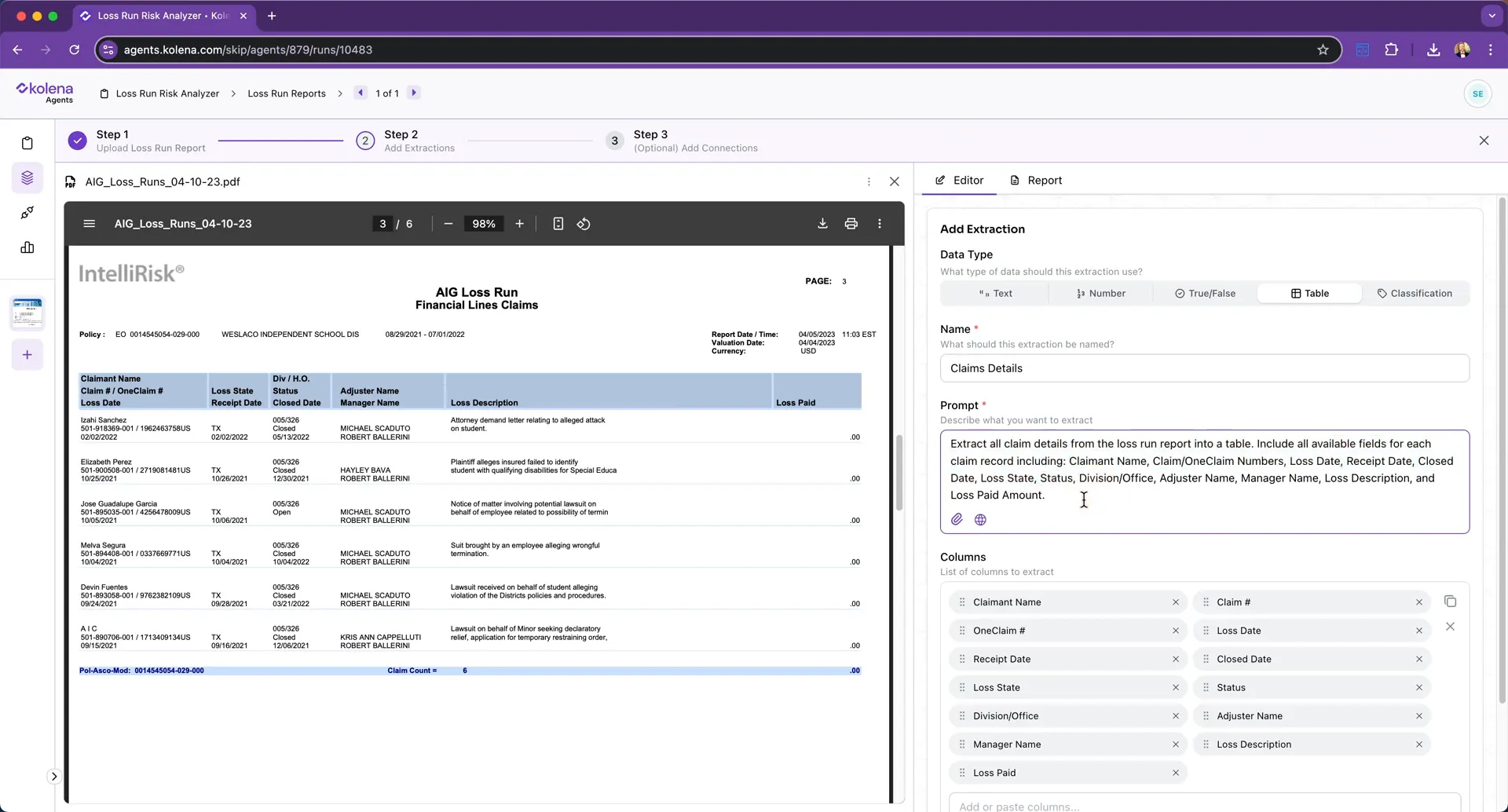

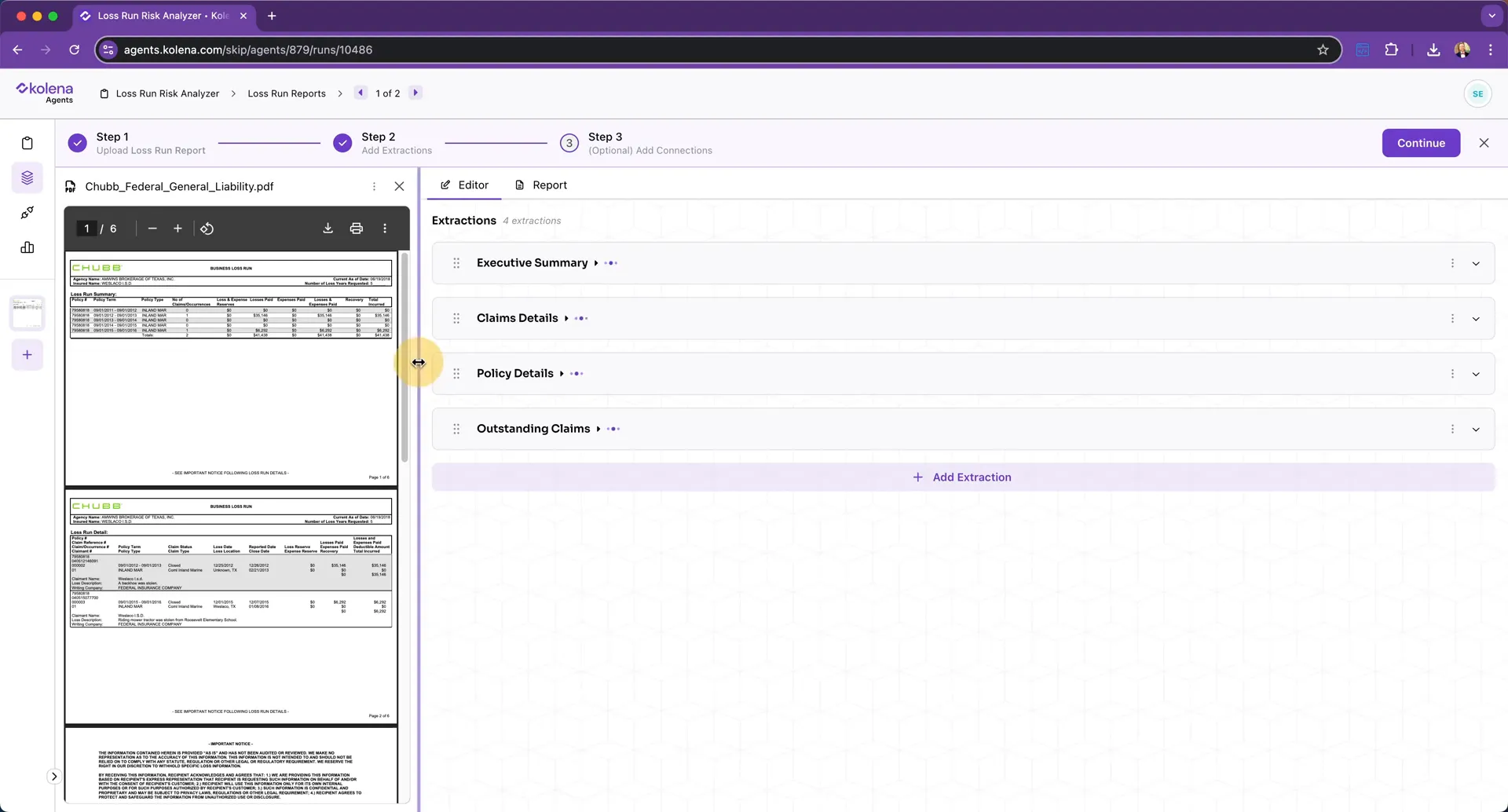

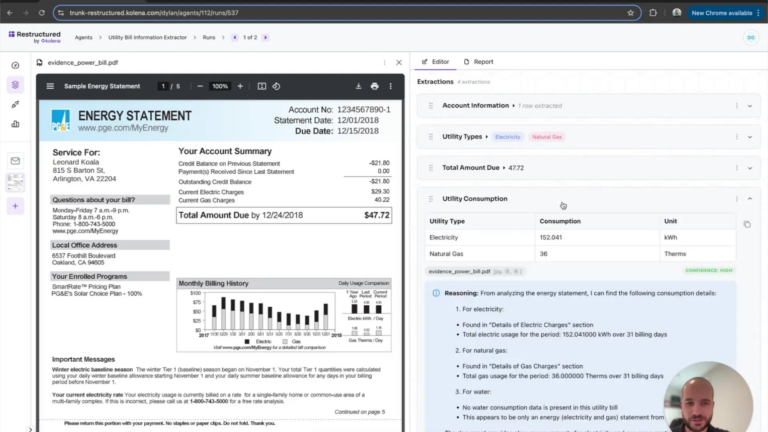

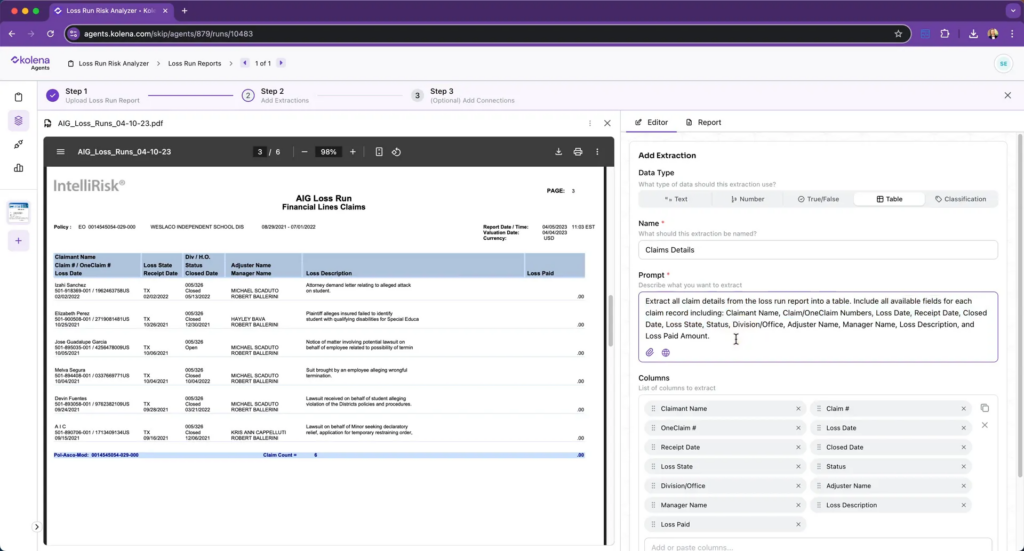

Using Natural Language for Data Extraction

One of the standout features of Kolena’s platform is its natural language interface. You can instruct the AI agent using simple language to extract specific information from the loss run. For instance, you might ask it to pull details for each claim, including claimant names and claim numbers.

Previewing and Customizing Data Extraction

Once you’ve defined what data to extract, you can preview the AI’s proposed extraction. Kolena’s system will automatically enrich your initial instructions, ensuring that the AI is set to pull the most relevant information based on the document’s context.

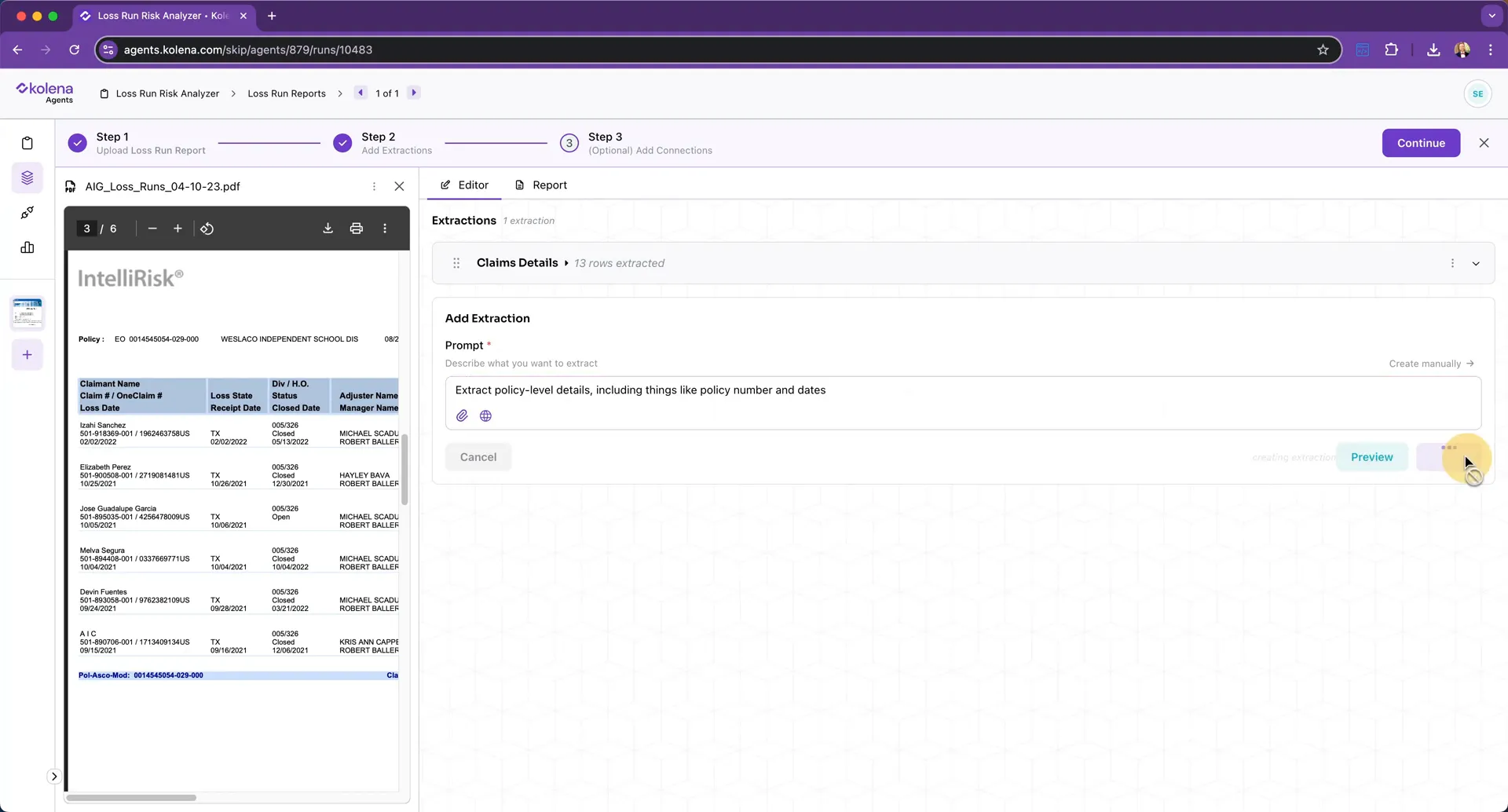

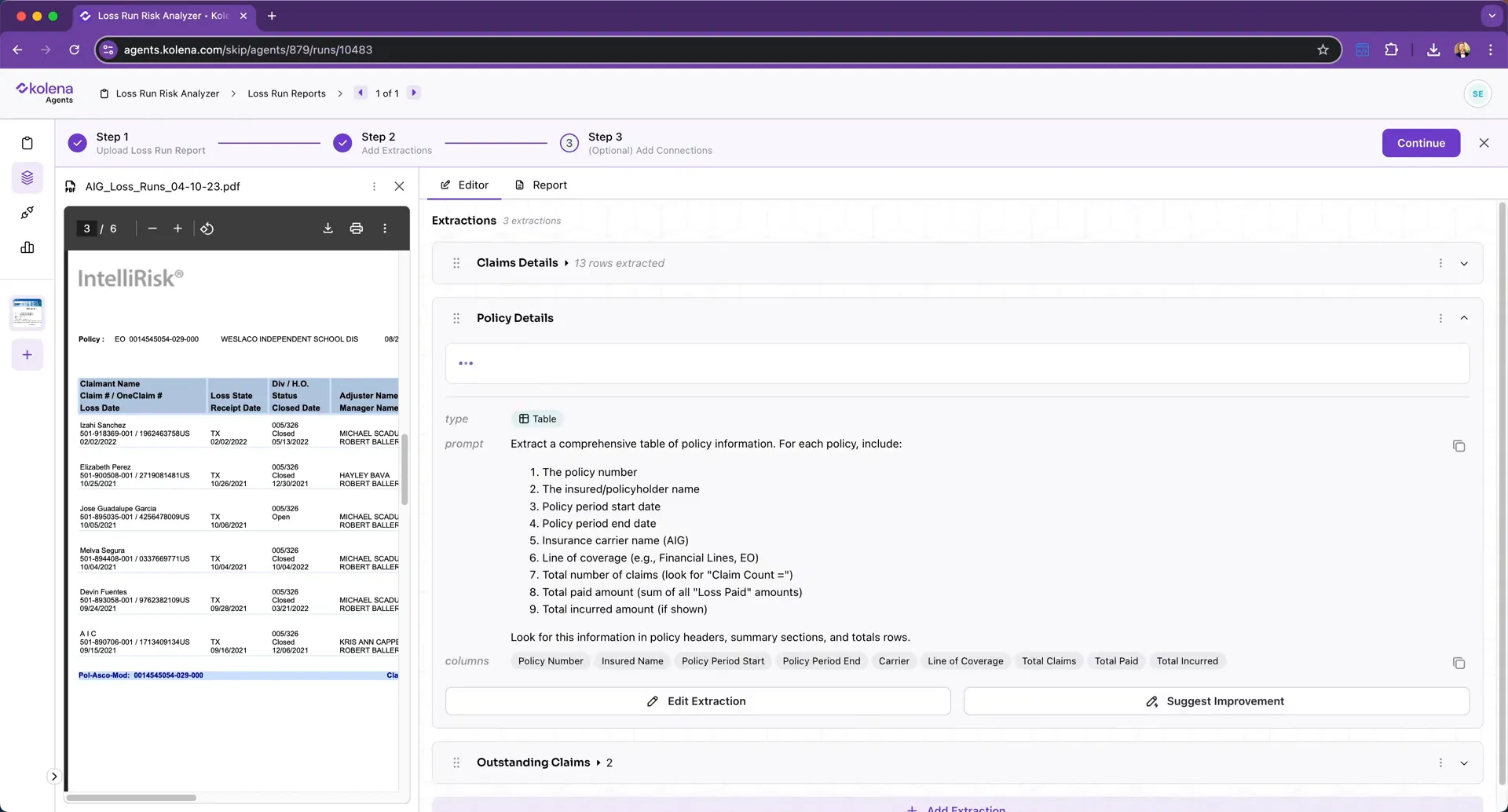

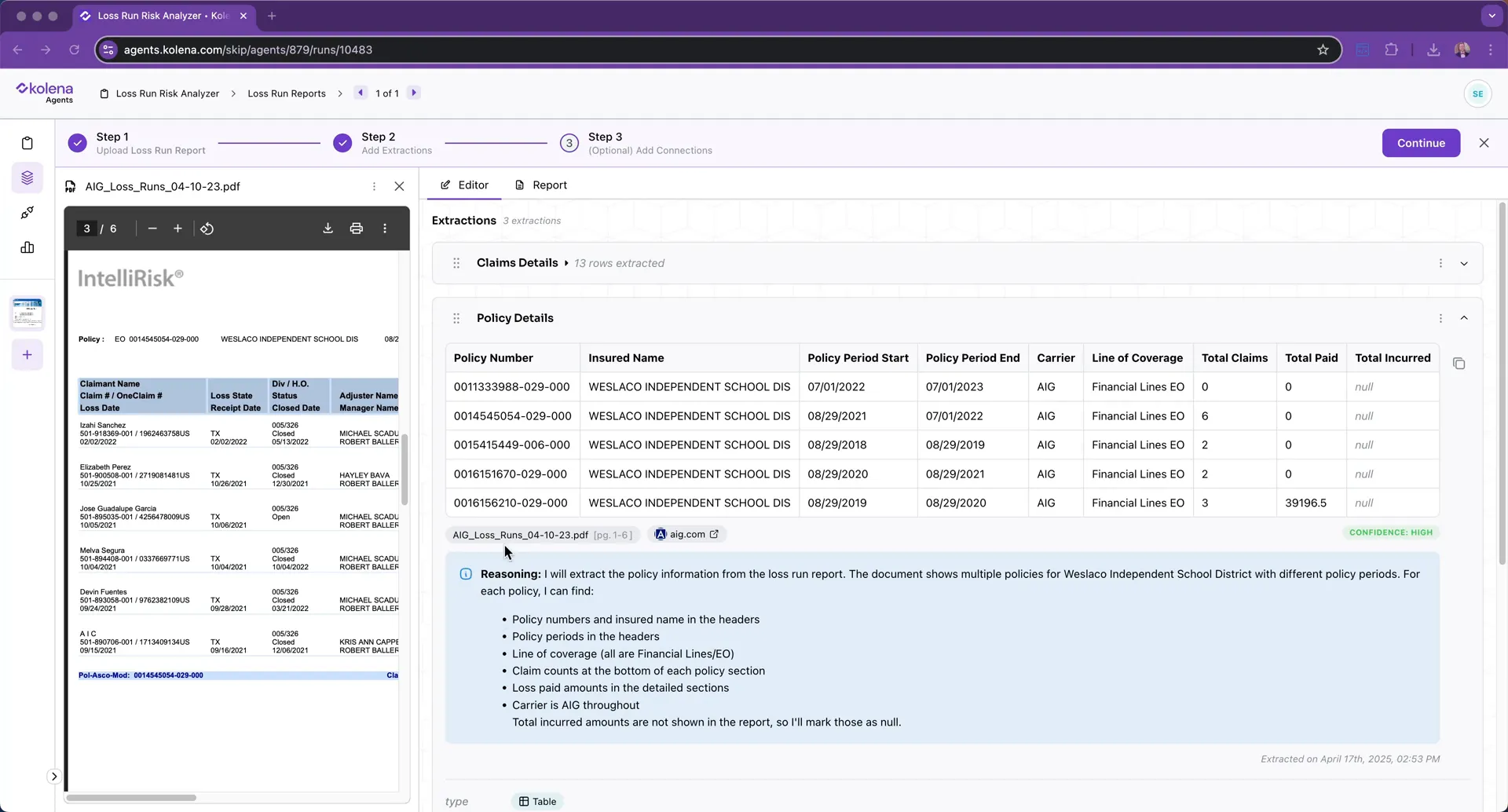

Extracting Policy Level Details

In addition to claim-specific details, extracting policy level information is crucial. This includes data points like the policy number, the insured’s name, and the coverage period. By instructing the AI to gather this information, you ensure a comprehensive overview of the risk profile associated with each policy.

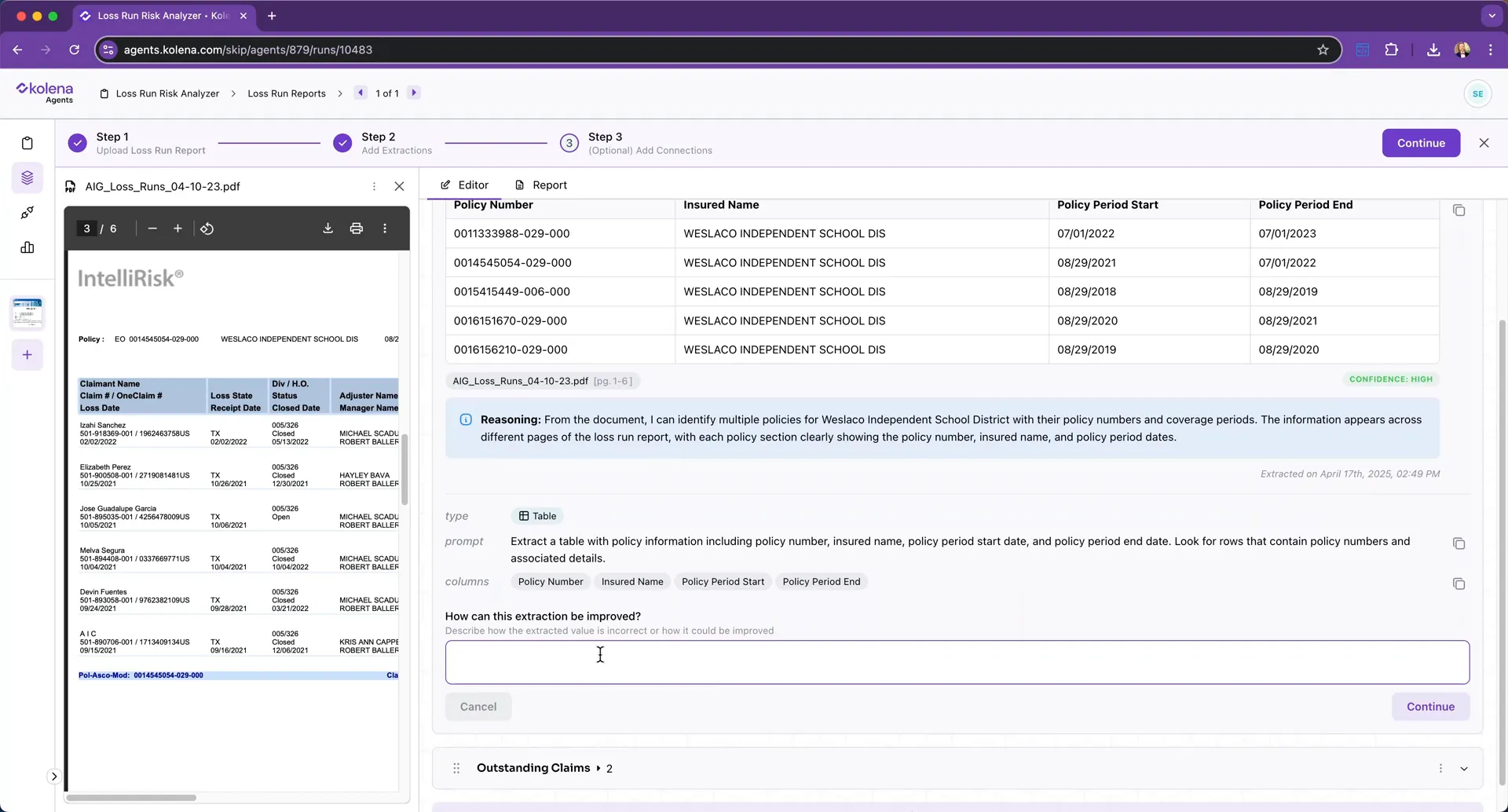

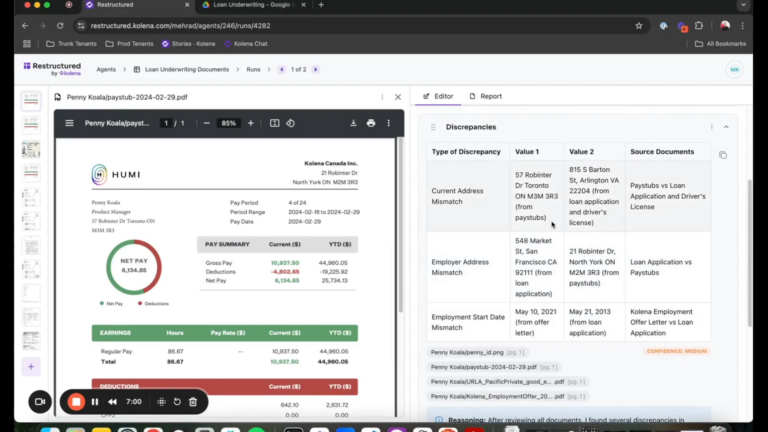

Providing Feedback for Continuous Improvement

One of the standout features of Kolena’s AI agent is its ability to learn and adapt through user feedback. After the initial extraction, you can provide natural language feedback to the AI, enhancing its performance. This feature allows you to specify additional fields or adjust existing ones, ensuring that the information extracted aligns with your requirements.

How Feedback Works

When you click on the ‘suggest improvement’ button, you can communicate directly with the AI. For example, if you want to include more detailed information, simply state your needs. The AI rewrites its extraction instructions based on your input, leading to more accurate results in future extractions.

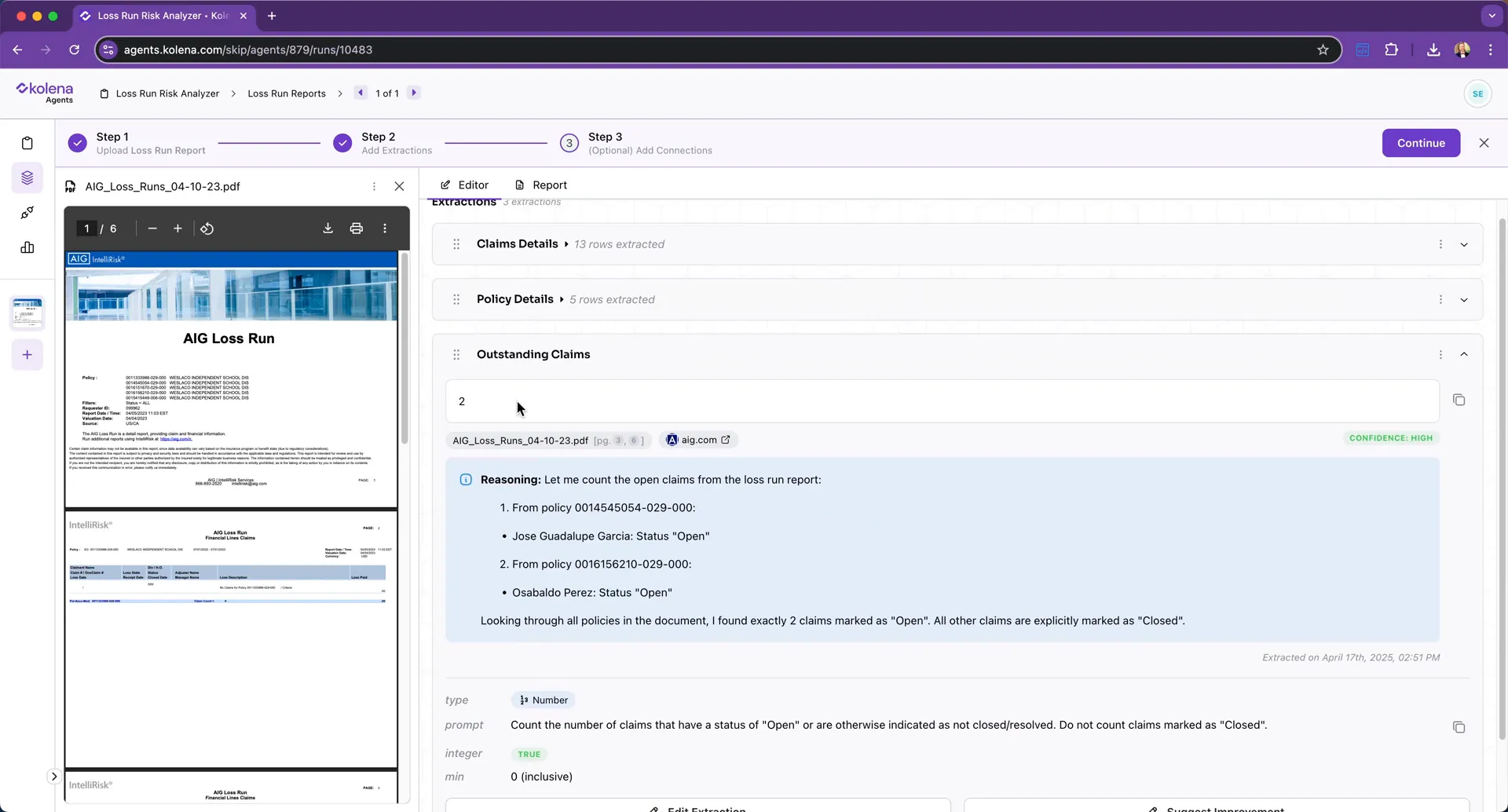

Understanding the Reasoning Behind Extracted Data

Trust is essential when dealing with extracted data, especially in sectors like insurance where accuracy is critical. The AI agent provides a reasoning field for each extracted element, explaining how it arrived at that information. This transparency fosters confidence in the data you receive.

How Reasoning Enhances Trust

With each piece of extracted data, you can see the source and methodology behind it. This means you can verify that the AI is not only pulling data correctly but also applying the right logic to do so. Whether it’s identifying outstanding claims or summarizing policy details, this feature adds a layer of accountability.

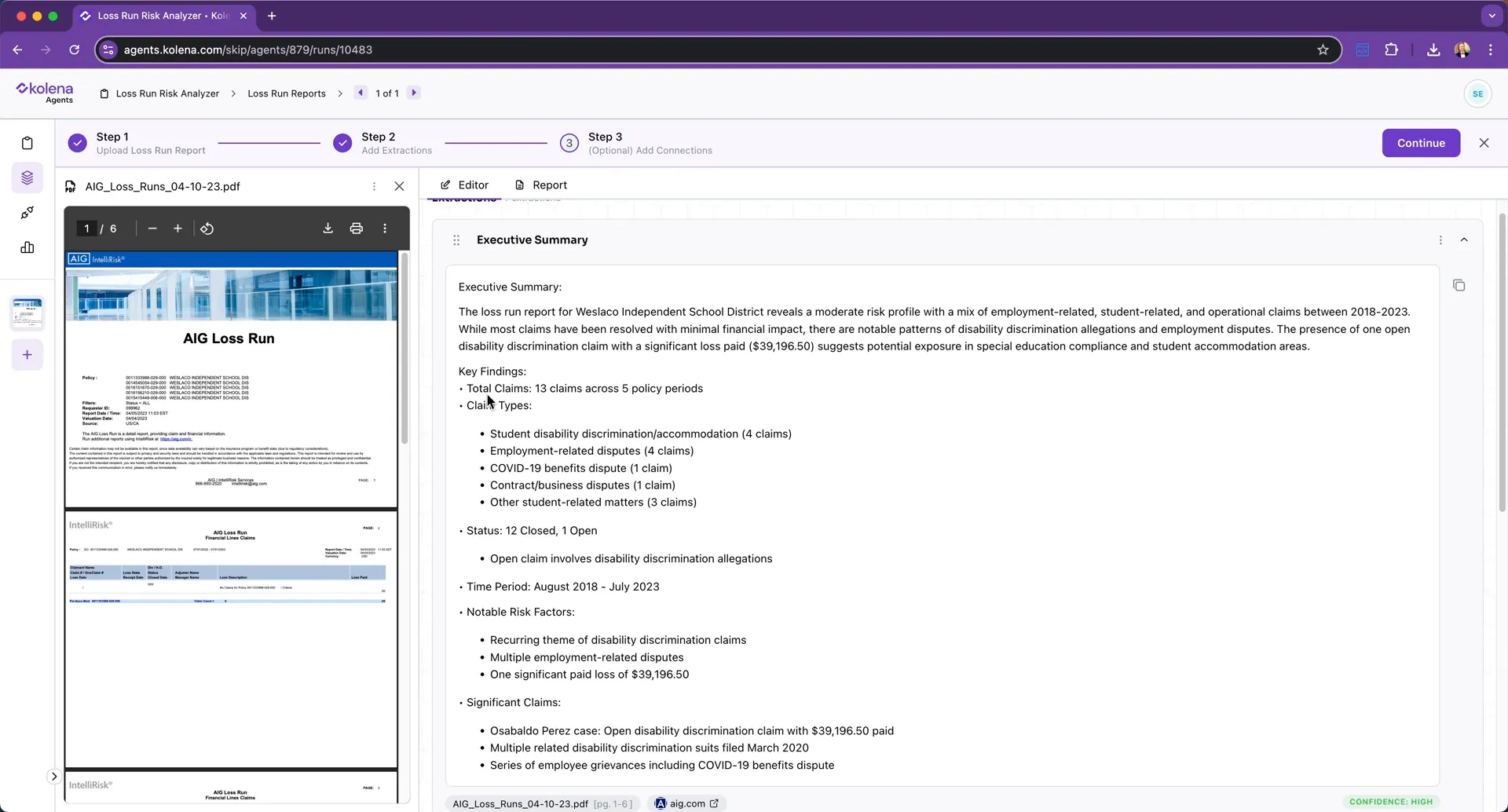

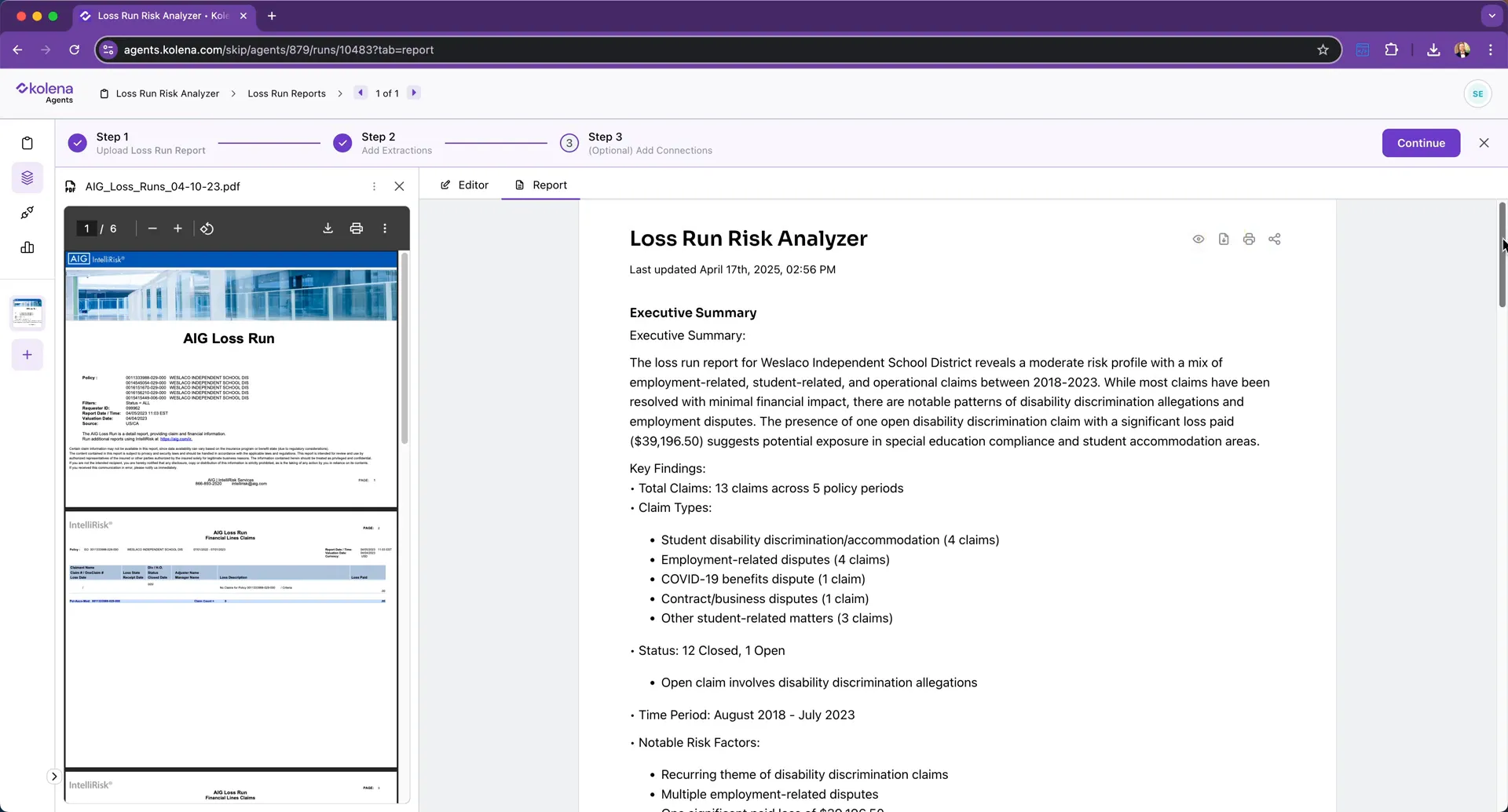

Generating Executive Summaries with the AI

Beyond simple data extraction, the AI can also generate comprehensive executive summaries. This functionality is particularly useful for stakeholders who need a quick overview without delving into the minutiae of the loss run reports.

Creating a Narrative Report

When you request an executive summary, the AI compiles key findings and insights into a narrative format. This includes bullet points highlighting crucial data, enabling decision-makers to assess risks quickly and efficiently. The summary serves as a valuable tool for presentations or internal reviews.

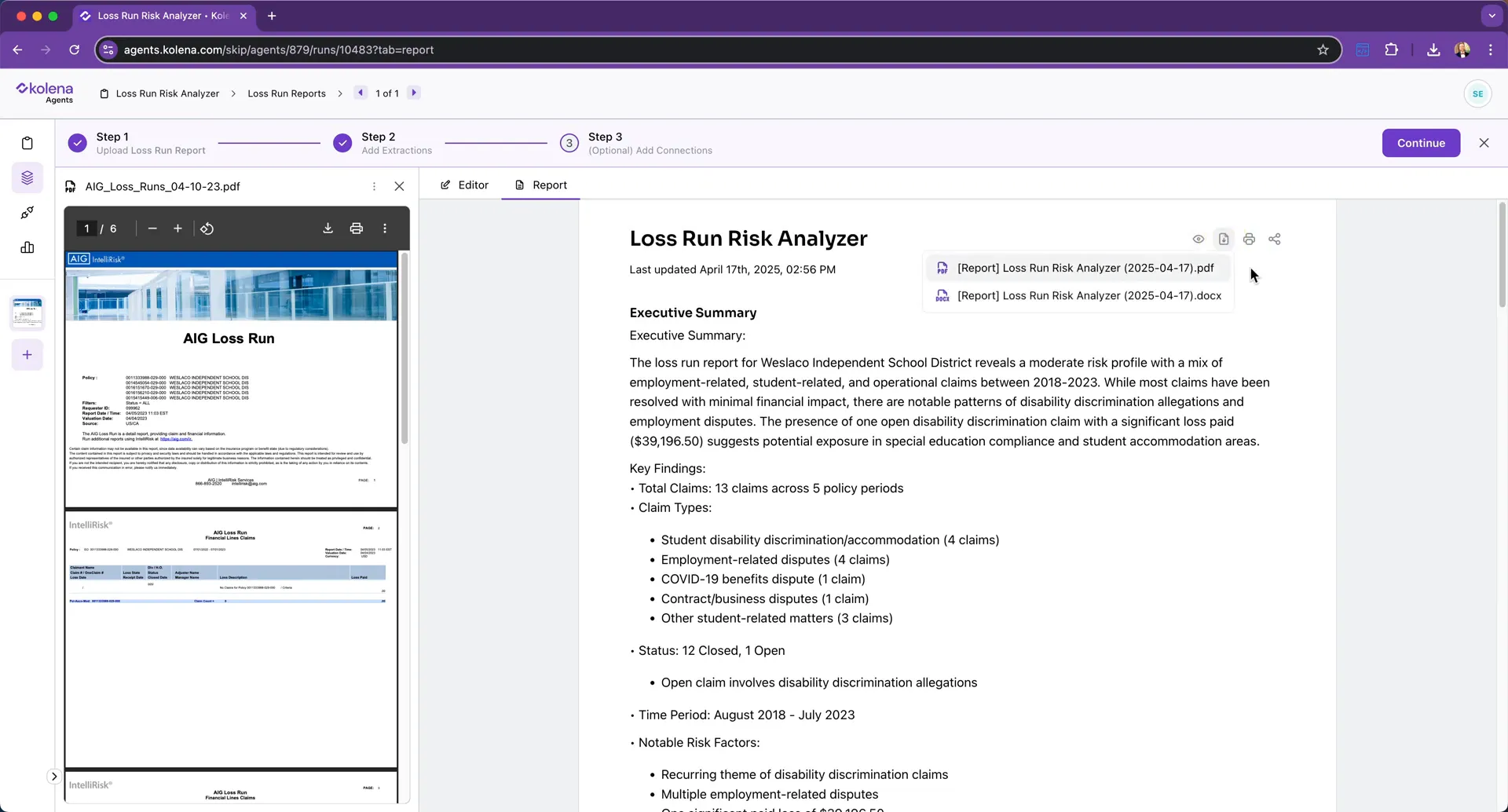

From Loss Run Document to Complete Report

The transformation from a raw loss run document to a polished report is seamless with Kolena’s AI agent. After executing the necessary extractions and analyses, the AI compiles everything into a report document that can be downloaded or printed.

Efficient Reporting Process

This report includes all extracted fields, reasoning information, and even citations, ensuring that you have a comprehensive overview of the data. The speed and accuracy of this process mean you can focus on strategic tasks rather than getting bogged down in data entry or manual analysis.

Processing New Loss Runs Automatically

One of the most significant advantages of using an AI agent is the ability to automate the processing of new loss runs. Once the initial setup is complete, you can upload additional loss run documents without repeating the extraction instructions.

Streamlining Future Workflows

Each new document is processed using the pre-established extraction parameters, saving you time and ensuring consistency across reports. This automation allows you to scale your operations effectively, handling multiple documents simultaneously without losing accuracy.

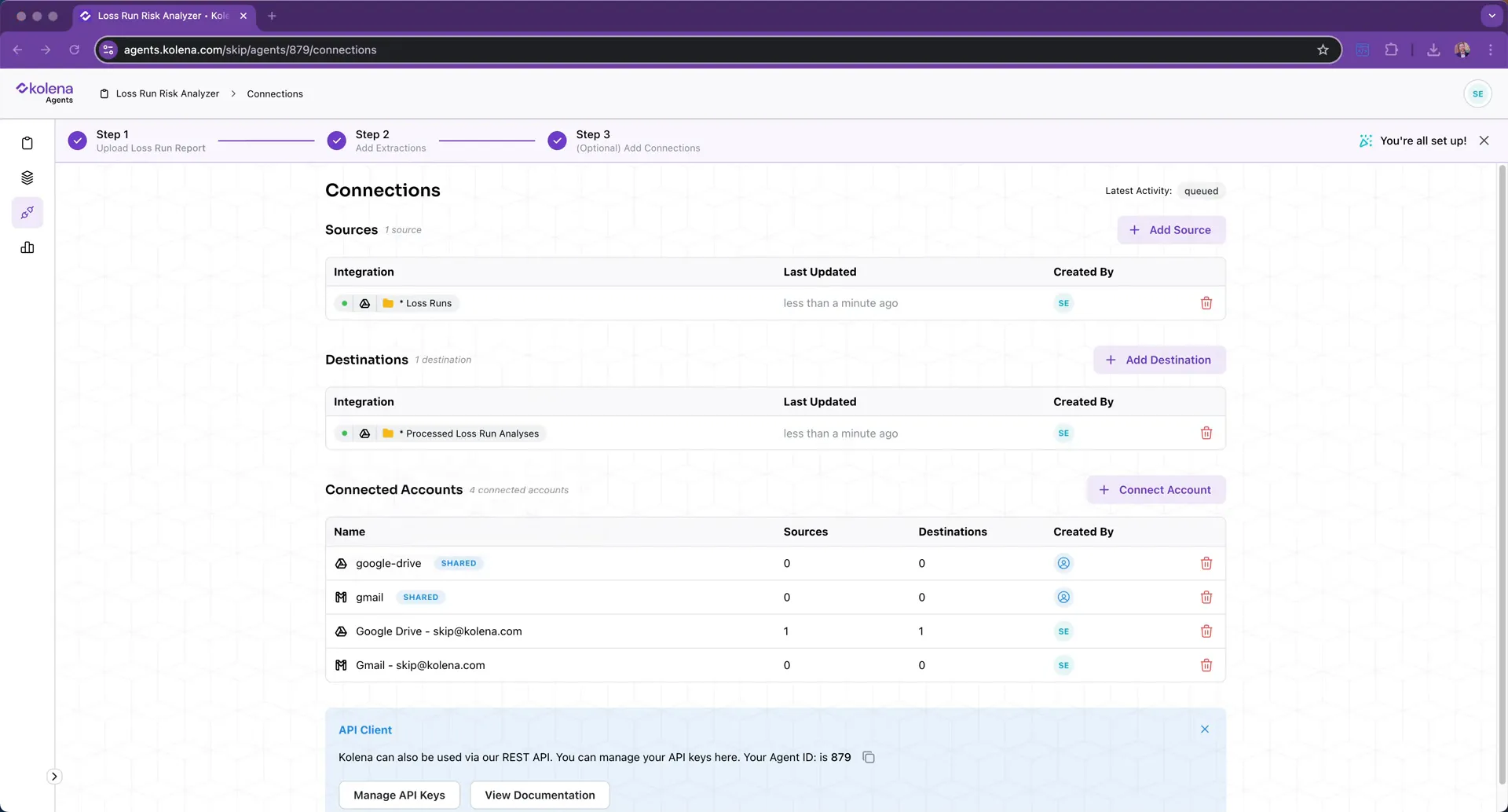

Setting Up Automated Connections for Efficiency

Automation doesn’t stop at processing documents. You can set up connections to various data sources, ensuring that as new loss runs arrive—whether via email, cloud storage, or other platforms—they are automatically processed by the AI agent.

Integrating with Your Existing Systems

This capability enables organizations to maintain a steady workflow without manual intervention. For instance, if you upload a hundred loss runs into a designated folder, the AI can generate reports for all of them in a fraction of the time it would take manually.

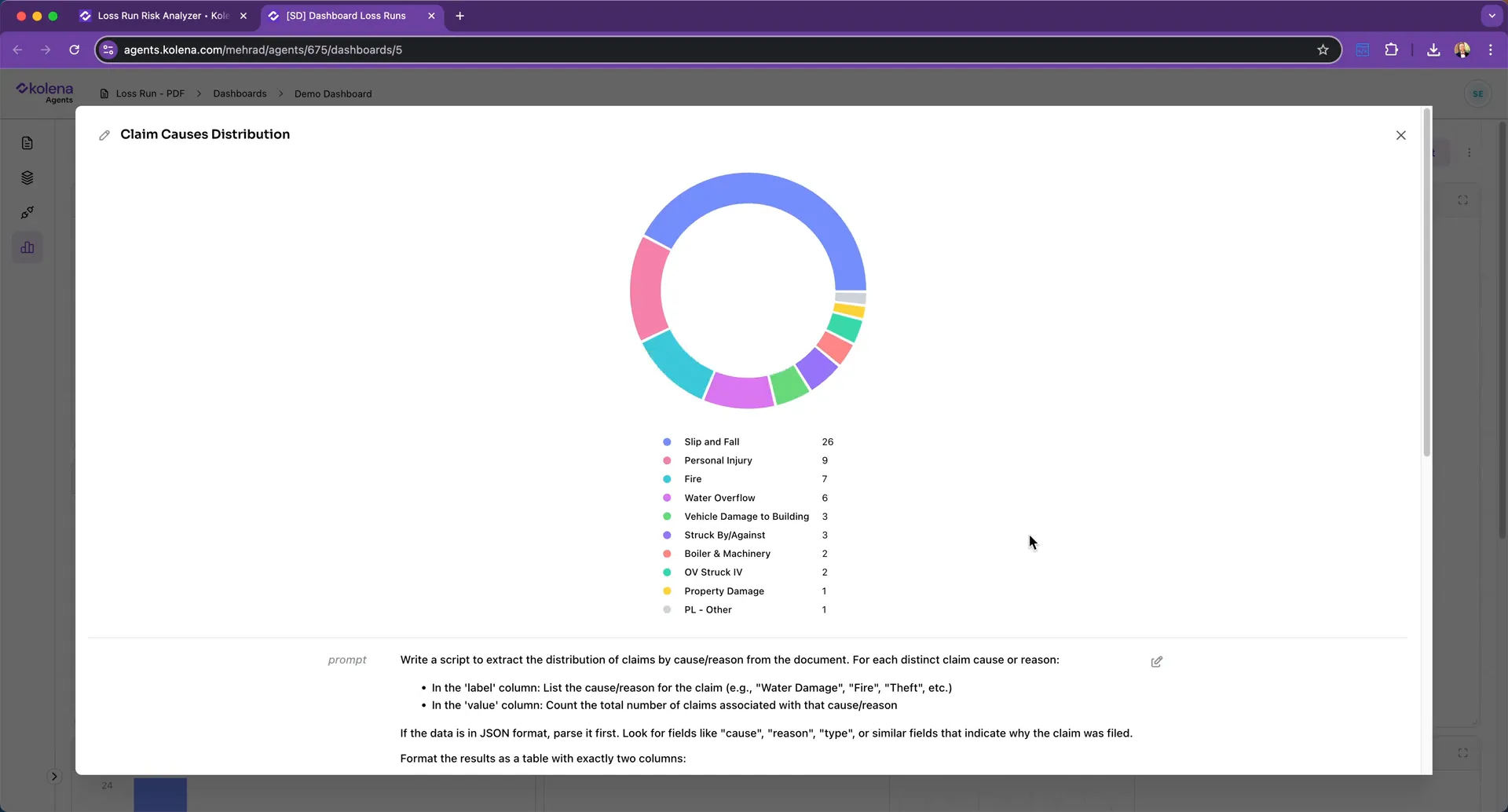

Creating Dashboards for Data Analysis

Another powerful feature of Kolena’s AI platform is the ability to create dashboards that visualize your data. These dashboards can help you analyze trends, identify risks, and present findings in a clear, graphical format.

Visualizing Key Metrics

Kolena automatically generates the necessary code to create charts and graphs, making it easy for users to interpret complex data without needing technical expertise. This visual representation aids in decision-making and strategic planning.

Conclusion: The Future of AI in Insurance

Incorporating AI for Loss Run not only streamlines the extraction and analysis of crucial data but also enhances accuracy and efficiency. As the insurance industry continues to evolve, leveraging AI technologies like Kolena’s platform will be essential for staying competitive.

By automating repetitive tasks and facilitating data-driven decision-making, organizations can focus on higher-value work. The future is bright for those who embrace these innovations.