In the fast-paced world of real estate investment trusts (REITs), efficiency is key. This blog explores how AI for REIT can revolutionize the creation of investment memos, transforming a time-consuming process into an automated breeze using Kolena’s innovative AI agent platform.

Table of Contents

- Introduction to AI for REIT

- Creating Your First AI Agent

- Uploading Documents for Context

- Understanding Document Types Supported

- Simple Extraction: Finding Investment Names

- Extracting Key Investment Terms

- Feedback Loop for Continuous Improvement

- Performing Complex Calculations

- Customizing Output Formats

- Integrating with Google Drive

- The Future of Automated Memos in REITs

Introduction to AI for REIT

Artificial Intelligence is transforming industries, and real estate investment trusts (REITs) are no exception. With Kolena’s AI agent creation platform, you can streamline the entire process of creating investment memos. This allows you to focus on making strategic decisions rather than getting bogged down in tedious manual tasks.

Imagine automating the extraction of critical investment details from various documents, all while ensuring accuracy and consistency. This is precisely what our AI for REIT enables you to do. By leveraging AI, you can enhance your investment analysis and reporting, ultimately leading to better decision-making.

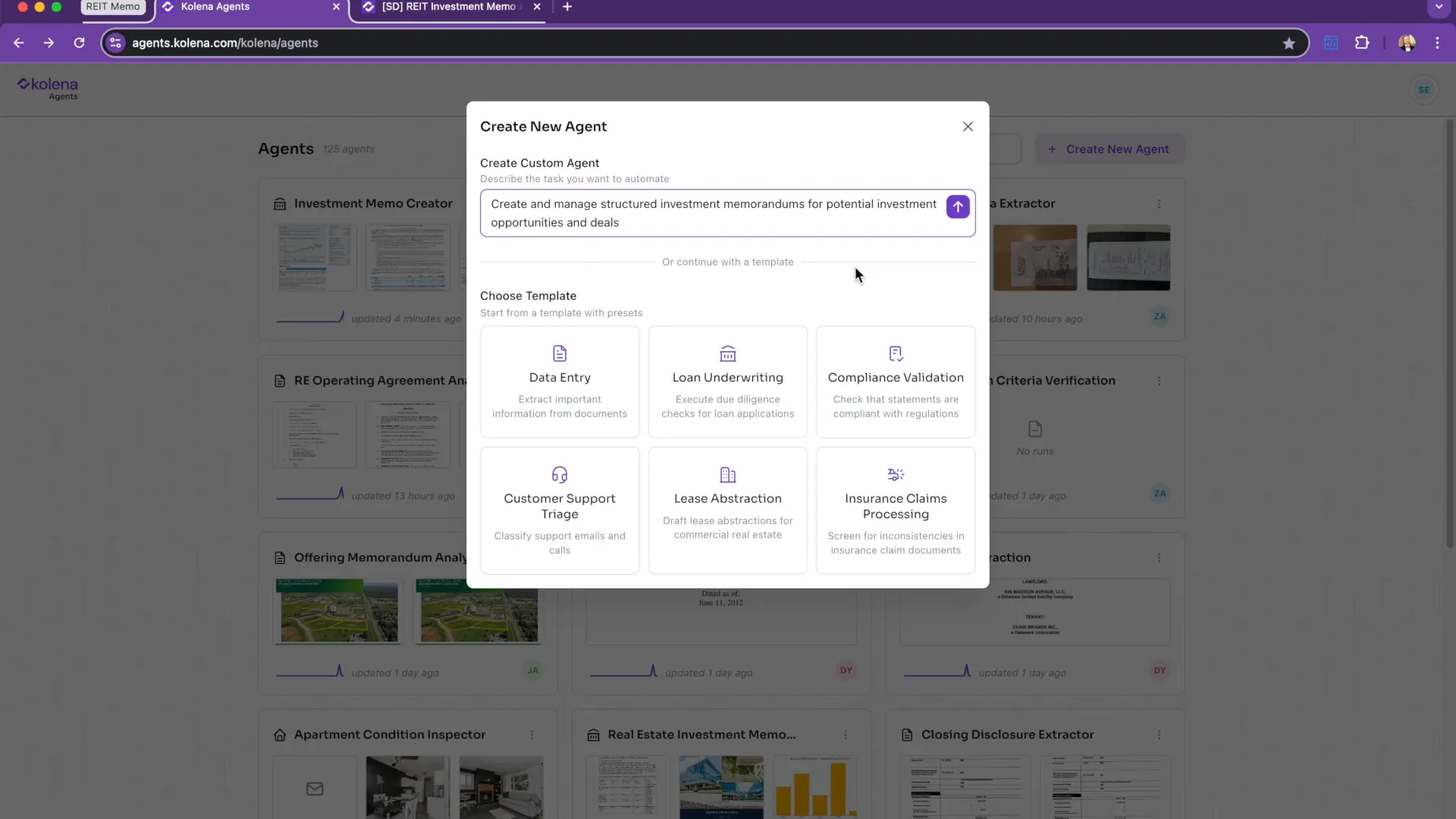

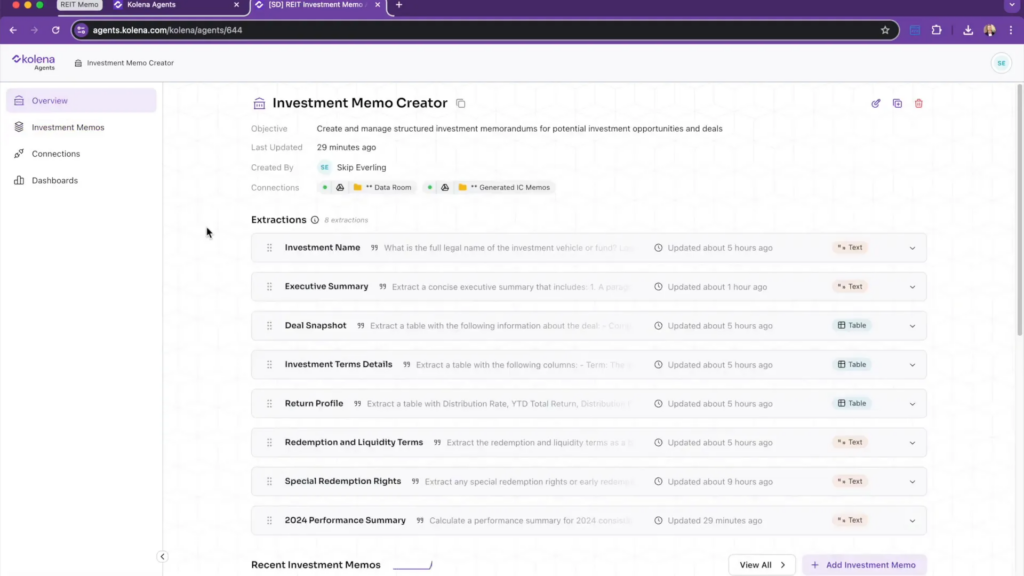

Creating Your First AI Agent

Getting started with Kolena’s AI platform is a breeze. The first step is to create your AI agent. Simply navigate to the homepage and click on “Create a New Agent.” This intuitive interface allows you to define the agent’s purpose in natural language, making it accessible even for those without a technical background.

For instance, you might instruct the agent to manage structured investment memoranda for potential deals, similar to those reviewed by investment committees. This initial setup is crucial as it lays the foundation for all subsequent tasks your agent will perform.

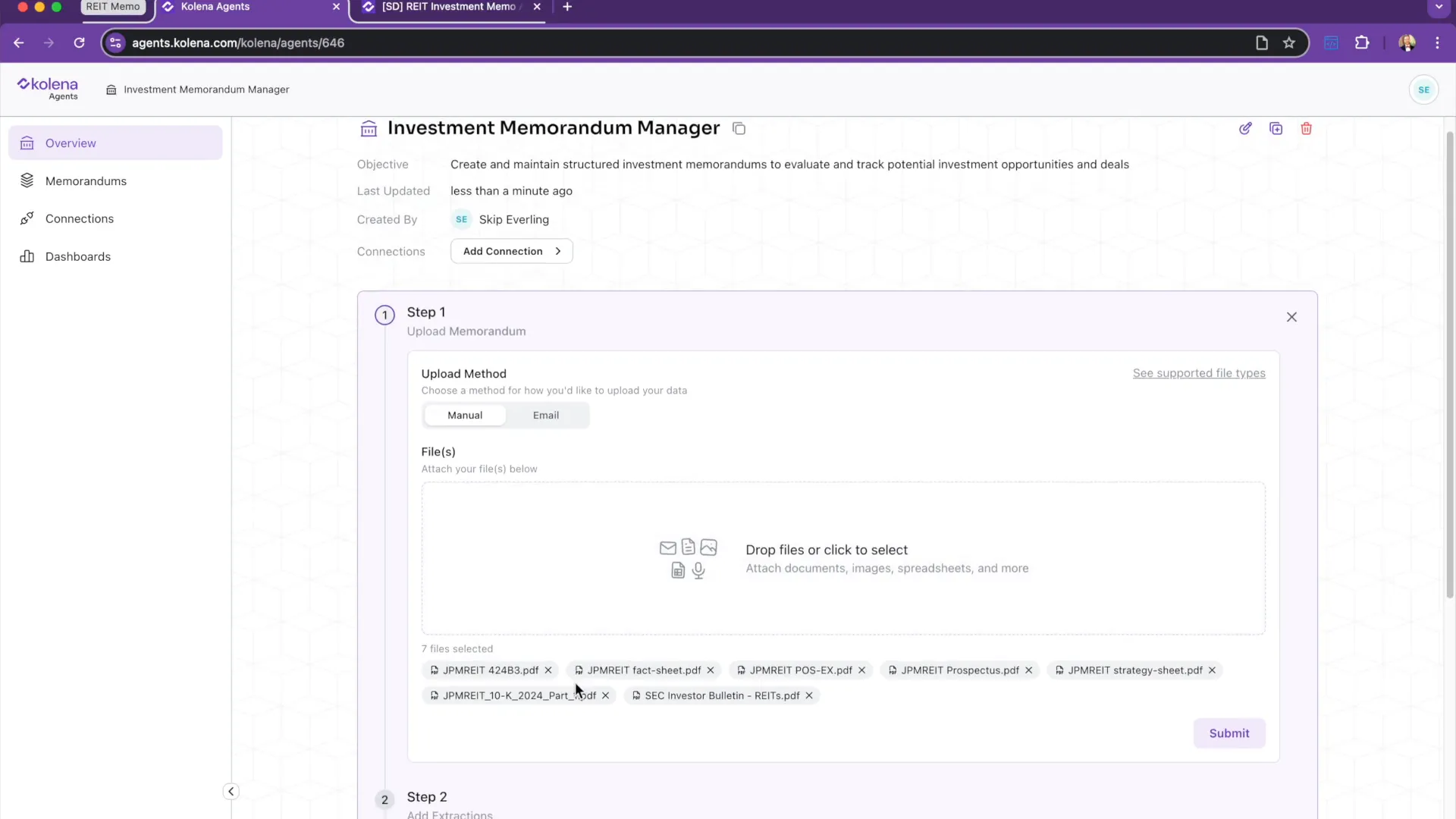

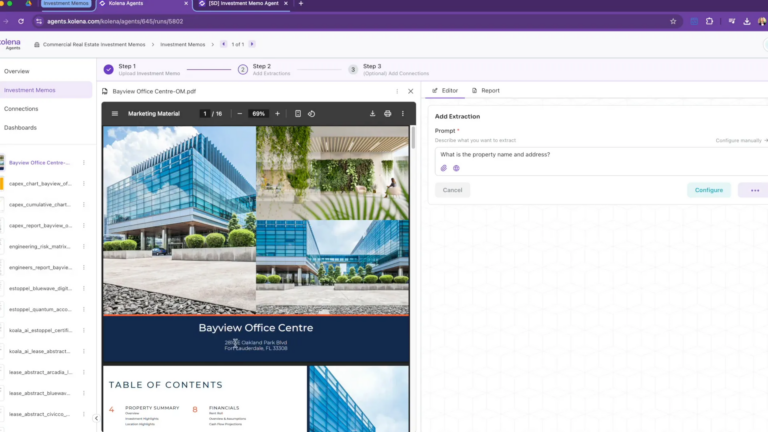

Uploading Documents for Context

Once your agent is created, the next step is to upload relevant documents. This is where the power of AI truly shines. You can upload various file types, including PDFs, spreadsheets, images, and even audio files. For example, when you’re evaluating a JP Morgan real estate income trust opportunity, you can drop in multiple documents that provide the necessary context.

These documents serve as the foundation for your agent to understand the specific information it needs to extract. Each document will be analyzed to ensure the AI can accurately respond to your queries.

Understanding Document Types Supported

Kolena’s platform supports a wide range of document types. This flexibility allows you to work with the formats most relevant to your needs. Common document types include:

- PDFs: Ideal for contracts, reports, and other formal documents.

- Spreadsheets: Useful for financial data and metrics.

- Presentations: Great for summarizing investment opportunities.

- Images: Useful for visual data representation, including scanned documents and handwritten notes.

- Audio Files: Can be transcribed and analyzed for insights.

This variety ensures that you can leverage AI for REIT regardless of the document format you typically encounter.

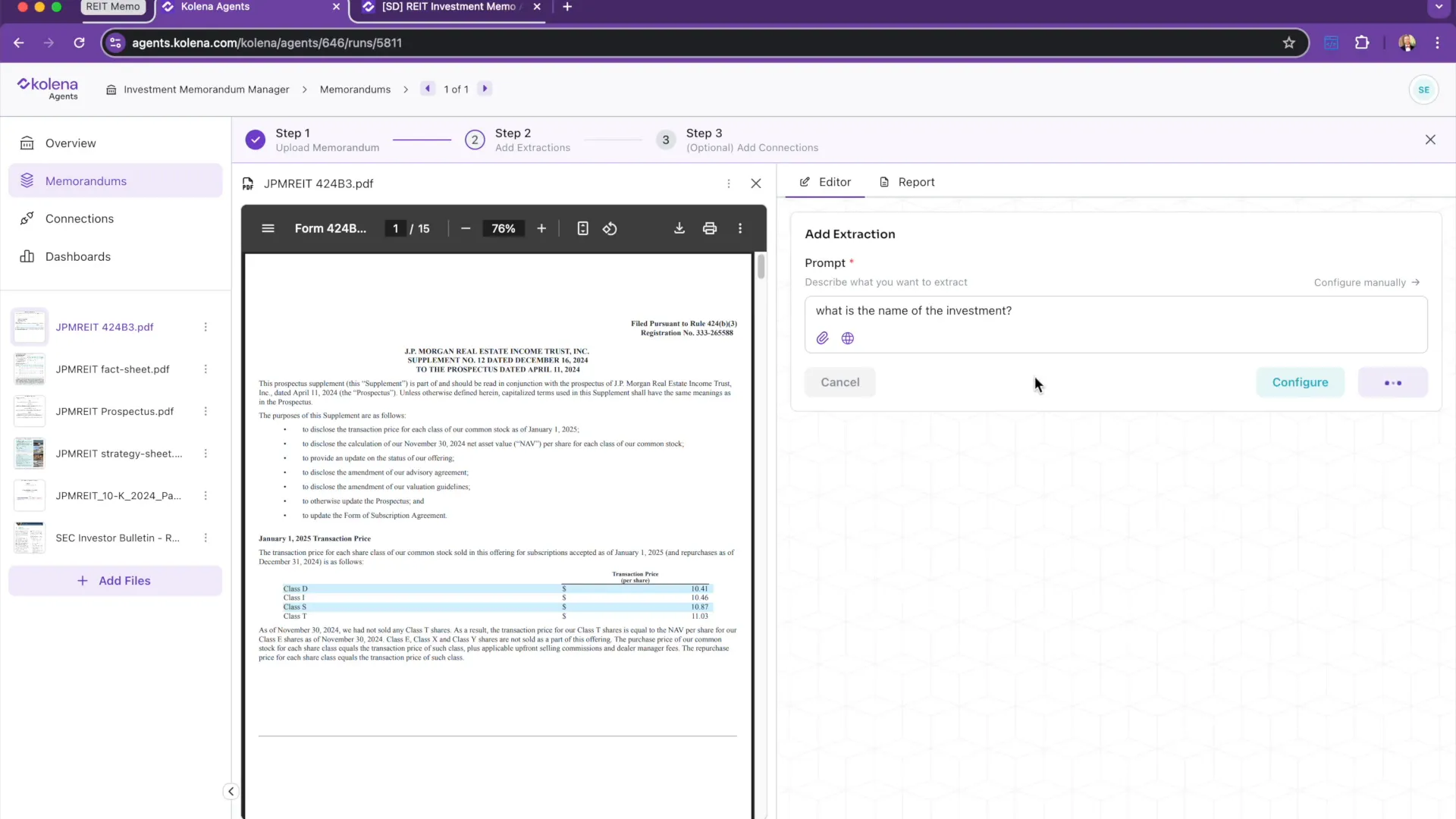

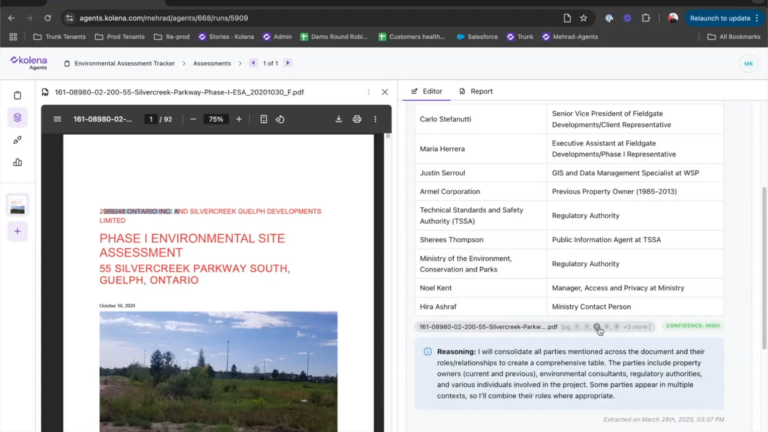

Simple Extraction: Finding Investment Names

One of the first tasks you might want your AI agent to perform is extracting the name of the investment. This is a straightforward yet essential step in creating an investment memo. Simply prompt the agent with a question like, “What is the name of the investment or fund being described in the document?”

The agent intelligently rewrites this prompt to optimize its interaction with the underlying AI model. After processing, it will return the investment name along with citations, allowing you to verify the source of the information. This feature not only saves time but also enhances your confidence in the data being extracted.

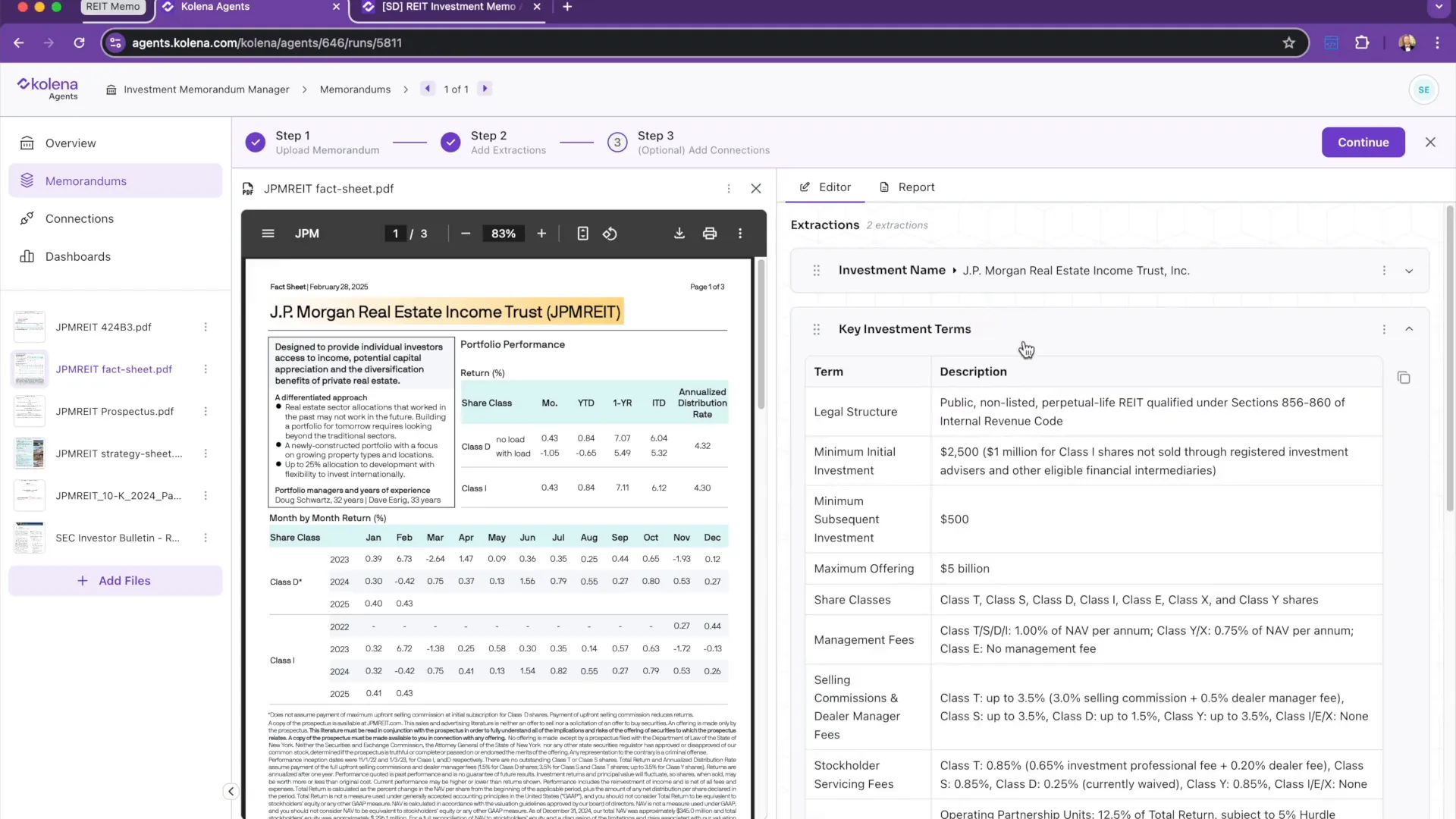

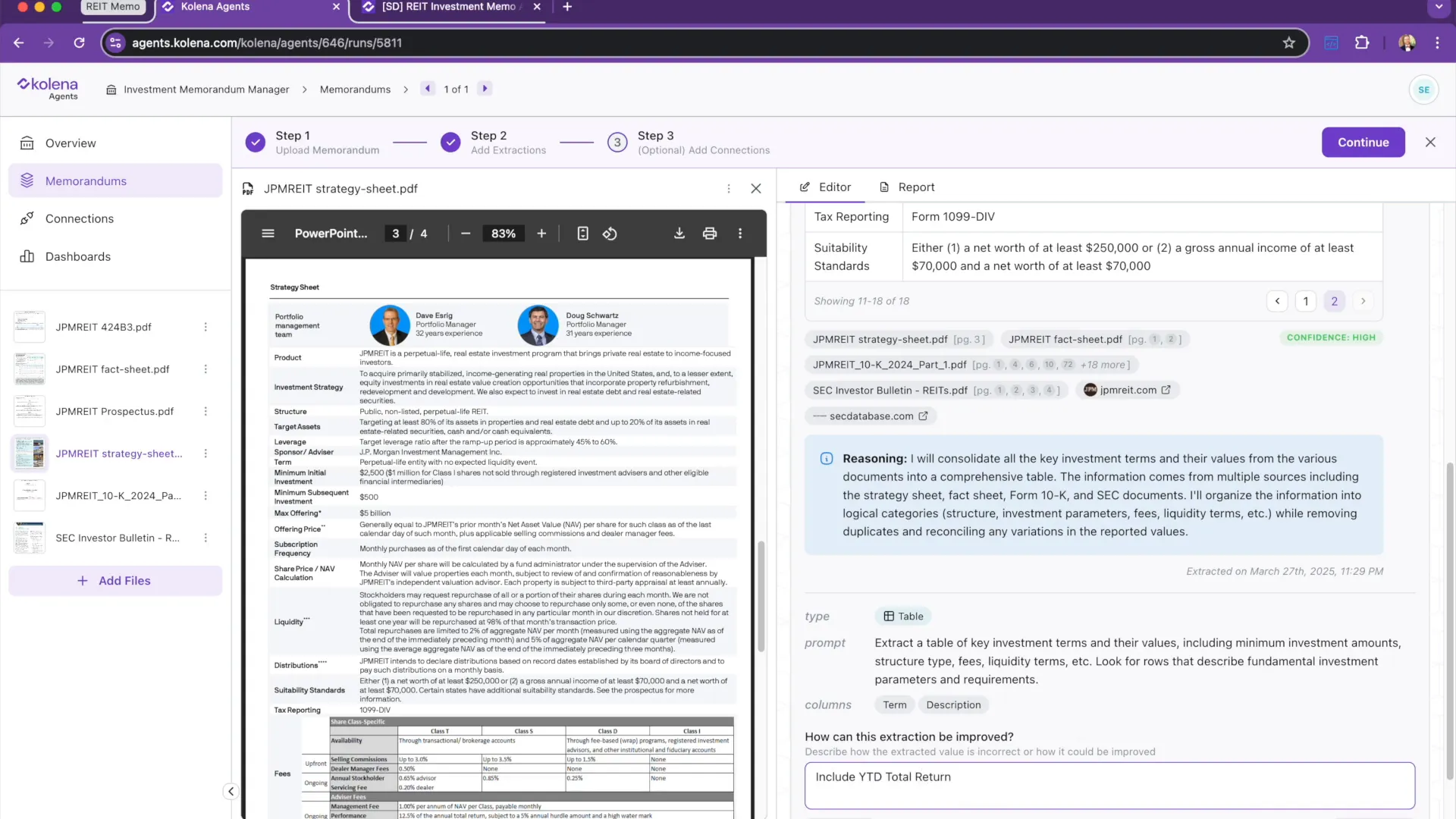

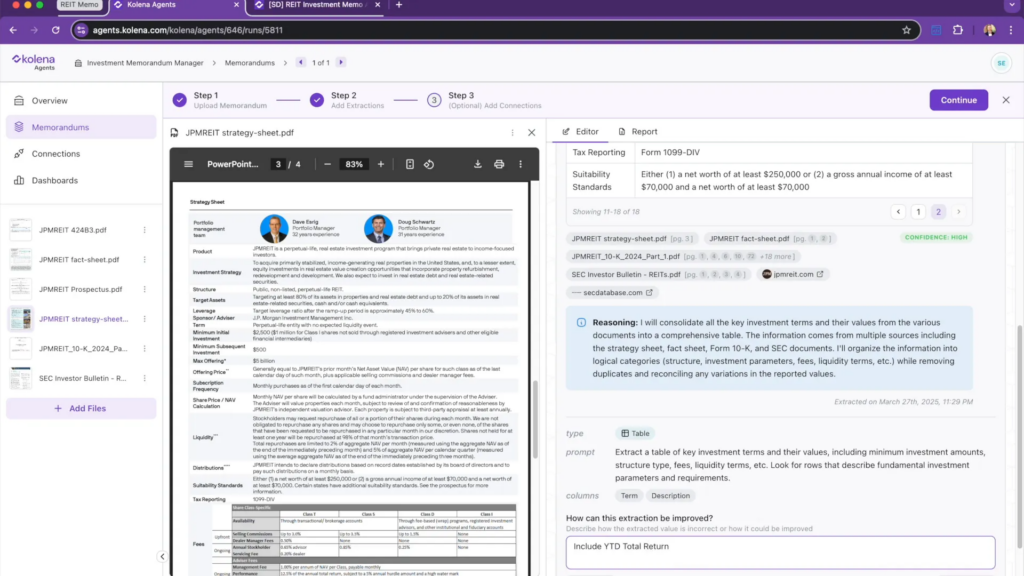

Extracting Key Investment Terms

Beyond just names, you can instruct your agent to extract a table of key investment terms. This includes vital information such as minimum investment amounts, structure types, fees, and liquidity terms. With a simple command, your agent will understand the context and requirements, providing you with a structured summary of critical investment details.

This extraction process is highly customizable, allowing you to specify exactly what you want to include. For instance, if you need to know the legal structure or fee structure for a particular investment, the AI can retrieve this information efficiently, complete with citations for each data point.

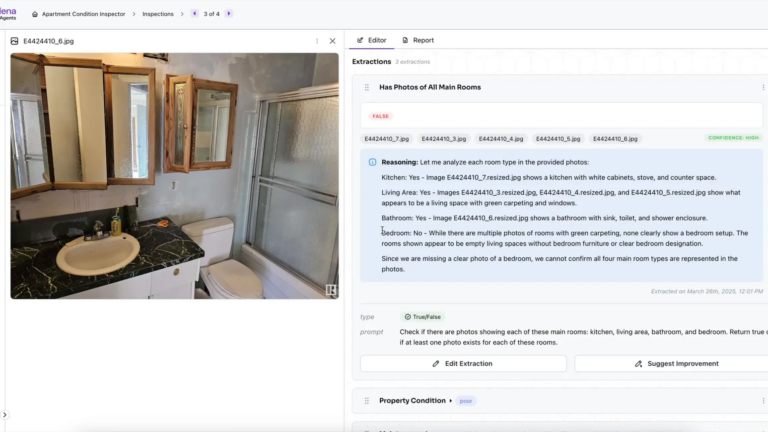

Feedback Loop for Continuous Improvement

One of the standout features of Kolena’s AI platform is its ability to learn and adapt through a feedback loop. After your agent has extracted data, you can provide suggestions for improvement. This is as simple as stating what additional information you want to include.

For instance, if you initially generated a report without the year-to-date total return, you can instruct the agent to incorporate that data. The agent will rewrite its internal instructions, ensuring that it understands your needs for future extractions. This iterative process allows for continuous enhancement of the output quality.

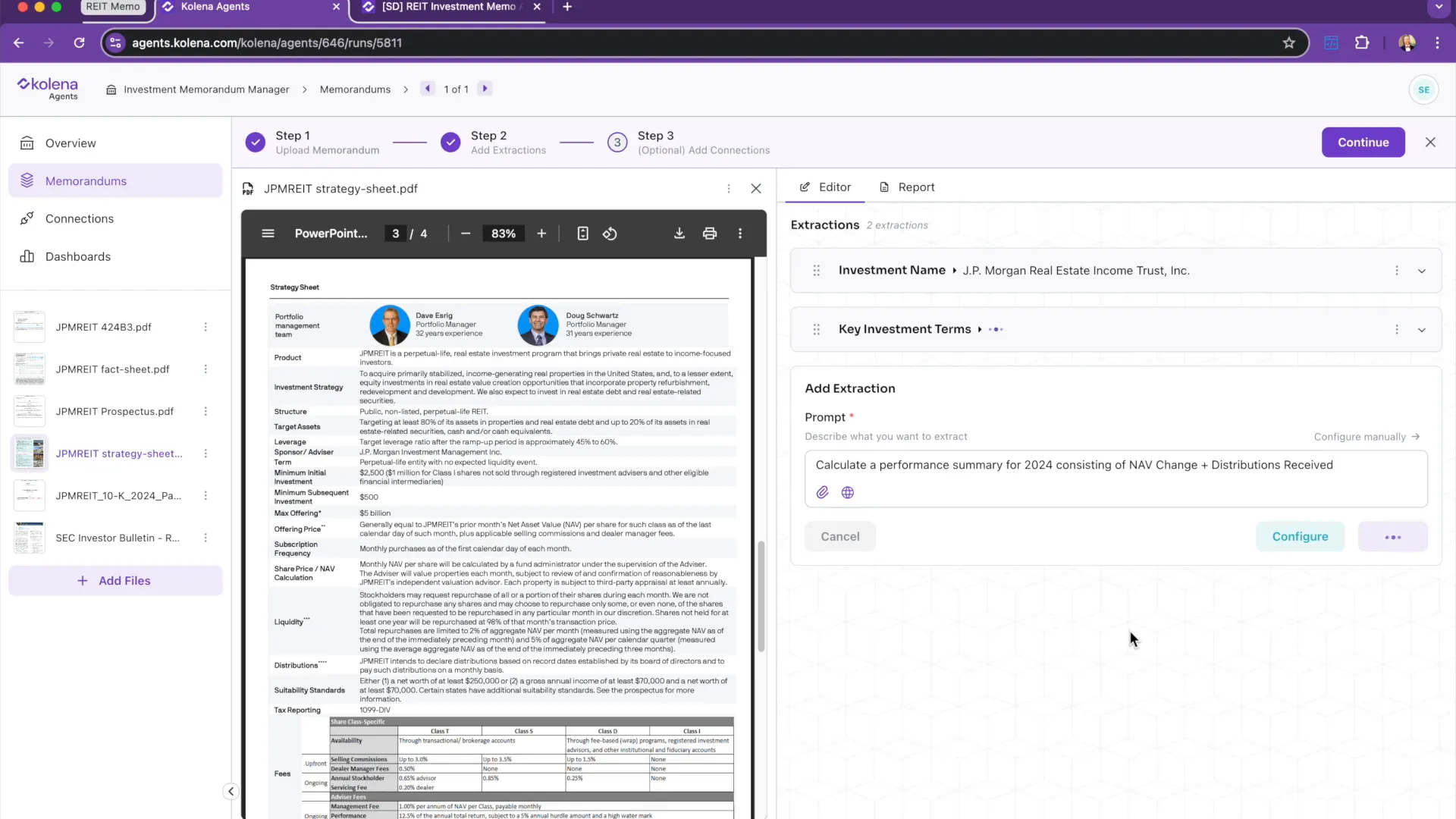

Performing Complex Calculations

Beyond simple data extraction, Kolena’s AI agents can perform complex calculations using the data extracted from documents. For example, if you need to calculate a performance summary for a specific year, you can easily instruct your agent to do so.

Let’s say you want to compute the net asset value change plus distributions received for 2024. The agent intelligently rewrites your prompt to understand the calculation required. This feature not only saves time but also ensures that your financial analyses are accurate and reliable.

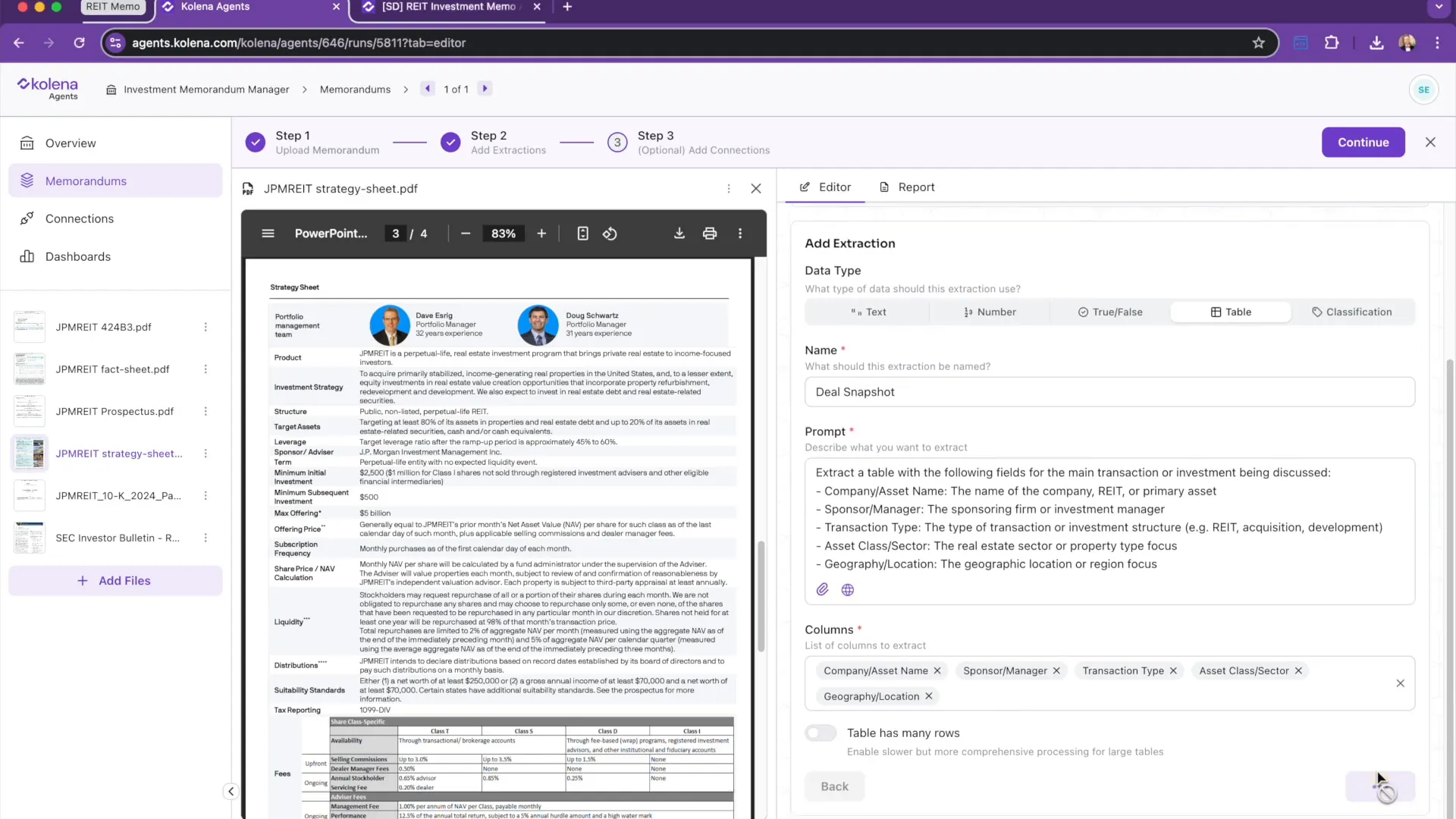

Customizing Output Formats

The flexibility of Kolena’s platform extends to output formats as well. You can tailor the final reports to meet your specific needs. If you have a preferred structure for your investment memos, simply attach an example file or copy-paste the desired format.

For instance, if you want a deal snapshot table with specific columns, provide that as guidance to your agent. It will understand your instructions and generate the report accordingly. This level of customization ensures that the outputs align perfectly with your expectations and requirements.

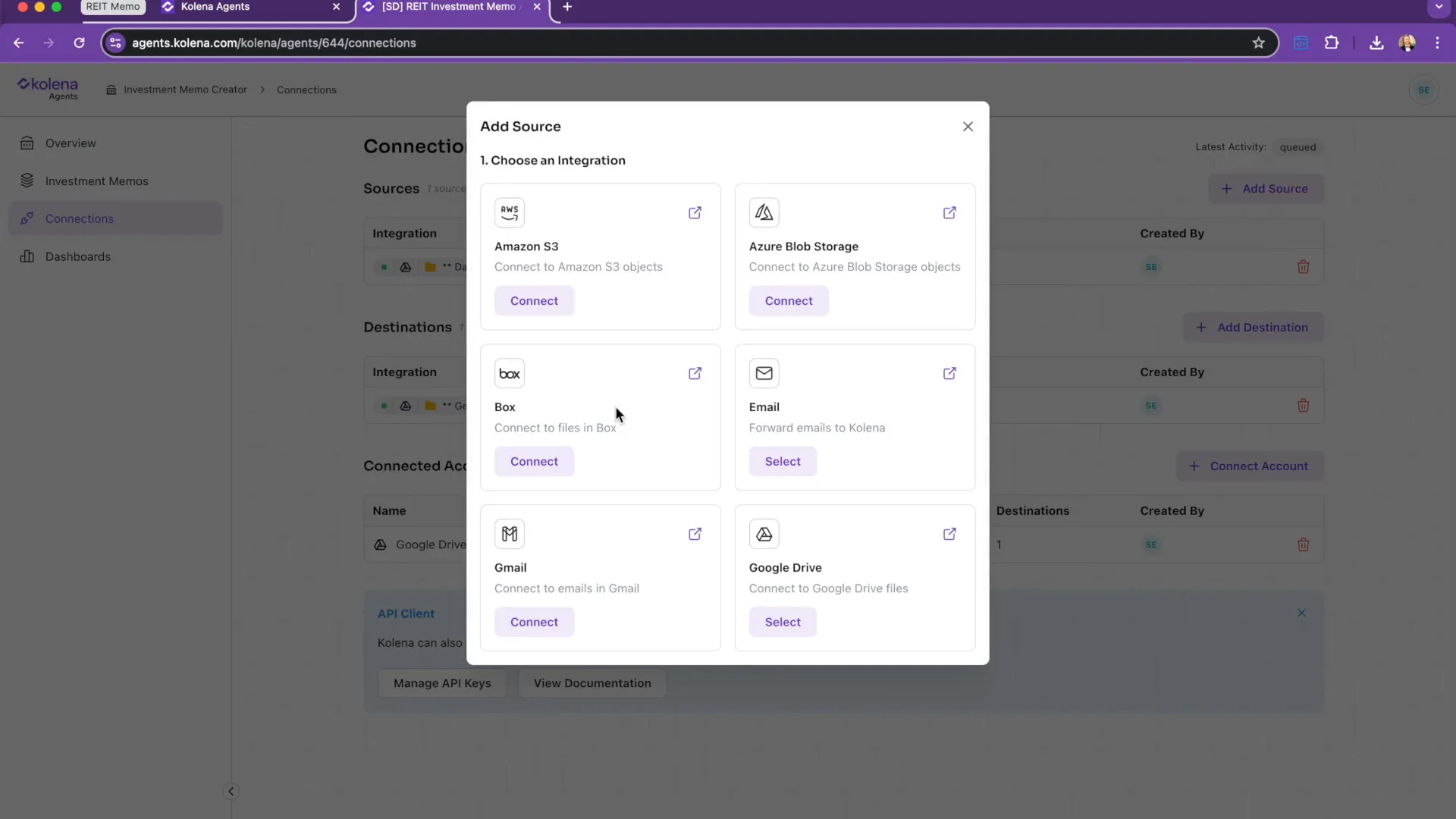

Integrating with Google Drive

Seamless integration with Google Drive is another powerful feature of Kolena’s platform. By connecting your AI agent to a Google Drive folder, you can automate the processing of new documents effortlessly. Whenever you upload new files, the agent will automatically run the same extraction processes.

This integration not only streamlines your workflow but also enhances collaboration. Your team can easily access updated investment memos without the need for manual intervention. It’s a game-changer for efficiency in managing investment opportunities.

The Future of Automated Memos in REITs

The future of investment memos in the realm of REITs is bright with the advancements in AI technology. As platforms like Kolena continue to evolve, we can expect even more sophisticated features that will further automate and enhance the investment memo creation process.

Imagine a world where your AI agent not only generates memos but also provides predictive analytics based on historical data trends. This could lead to more informed investment decisions and strategies that are agile and data-driven. The possibilities are limitless, and embracing these technologies will be crucial for staying competitive in the real estate investment landscape.