Creating investment memos can be a cumbersome task, but with AI for investment memos, this process becomes seamless and efficient. In this blog, we explore how Kolena’s AI platform automates the creation of investment memos, allowing you to focus on what really matters—making informed decisions.

Introduction to AI Agents and Investment Memos

AI is revolutionizing the way we approach investment memos in real estate, allowing investors to make informed decisions faster than ever. The system we demonstrate here is not just about efficiency; it’s about enhancing the quality of insights derived from complex data.

Investment memos serve as critical documents that summarize the potential of a real estate investment. They encapsulate essential information such as property details, financial projections, and market analyses. With Kolena’s AI for investment memos, generating these documents becomes a streamlined process, enabling users to focus on strategic decision-making rather than tedious paperwork.

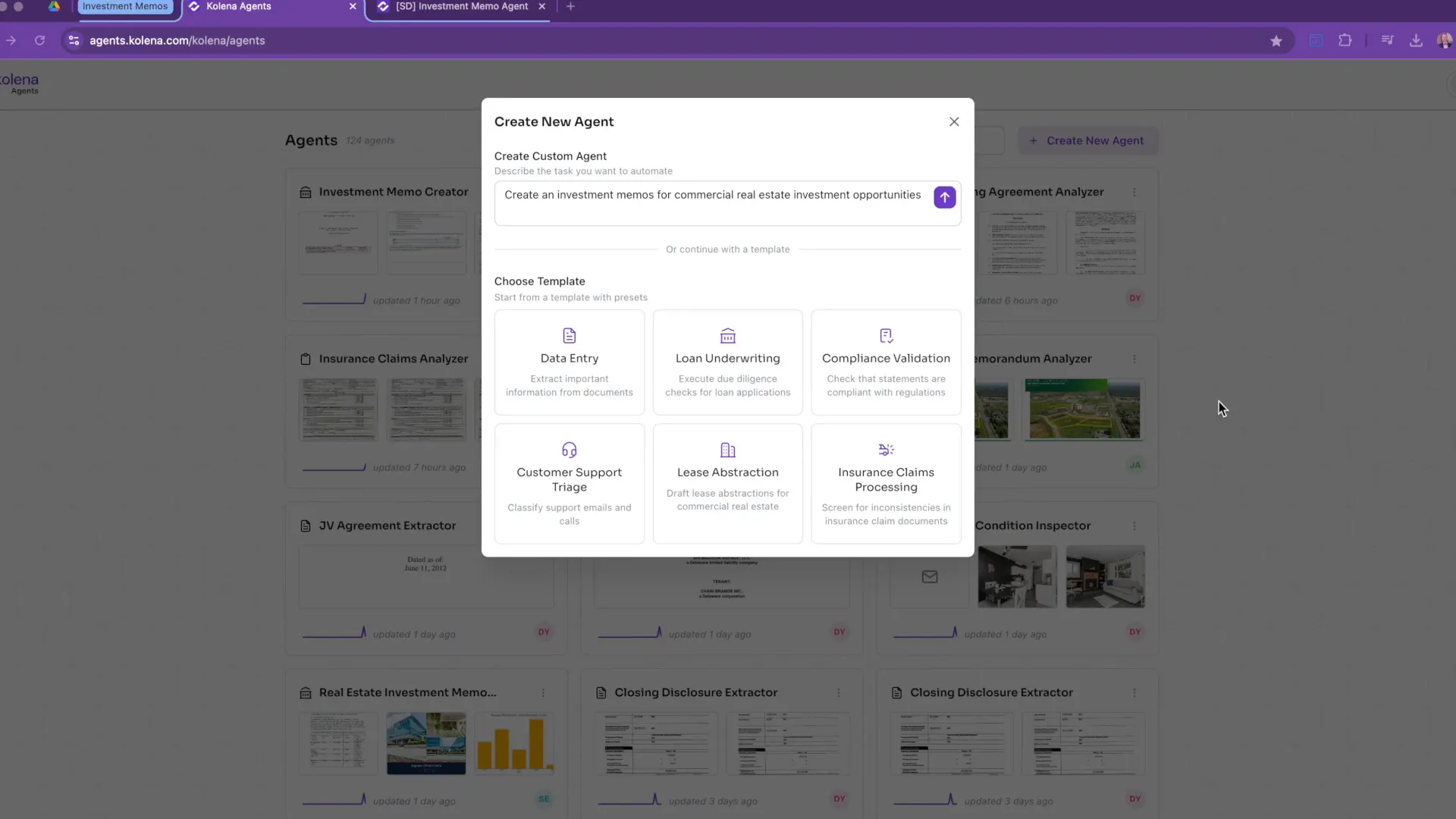

Creating a New AI Agent

Creating a new AI agent in Kolena is a straightforward process. You start by accessing the client agents’ homepage and clicking on “Create New Agent.” This brings up an intuitive interface where you can specify the objectives for the agent.

For instance, if you’re looking to evaluate a commercial real estate opportunity, you can input specific instructions or select from existing templates tailored to various use cases. The AI understands your requirements and enriches them, creating a unique agent tailored to your investment needs.

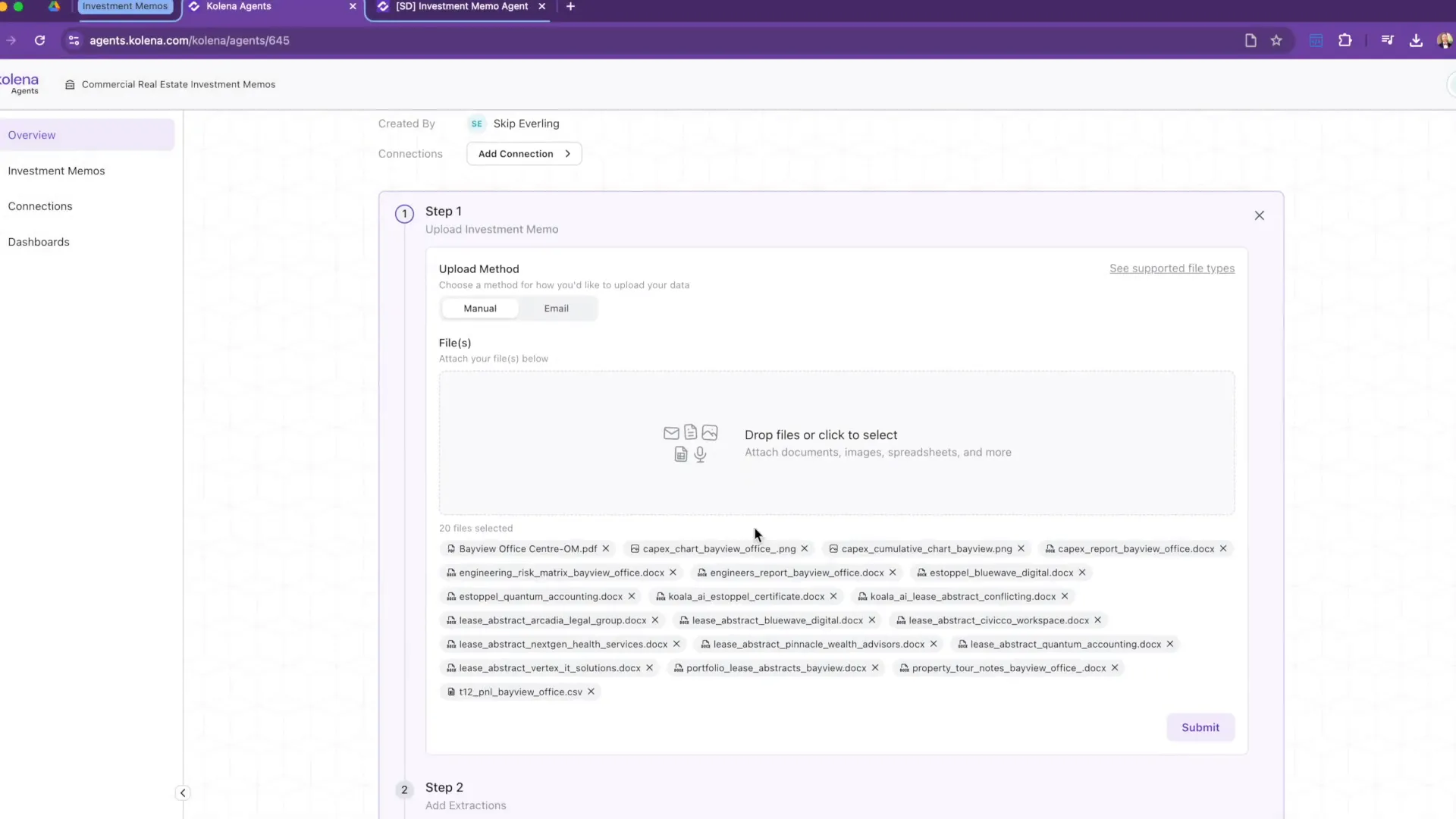

Uploading Source Documents

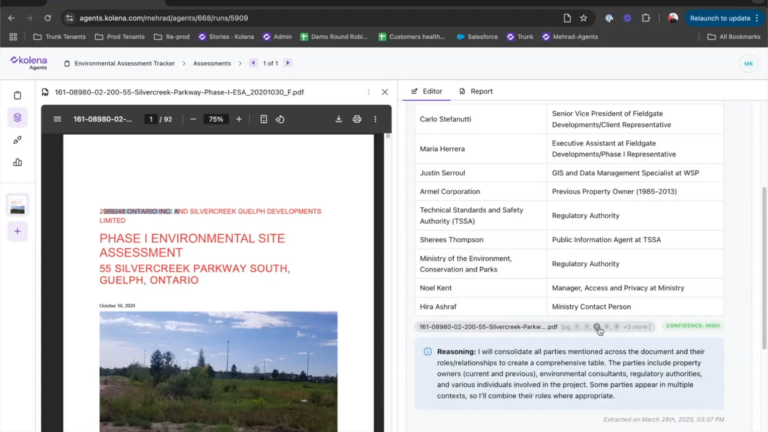

Once your AI agent is created, the next step is to upload source documents. Kolena supports a wide range of file types, including presentations, spreadsheets, images, and even audio files. This flexibility allows you to gather all relevant information in one place.

For example, you can drag and drop multiple documents, such as offering memoranda, lease abstracts, and financial spreadsheets, directly into the platform. This initial upload sets the groundwork for your agent, establishing a template that it will use for future analyses.

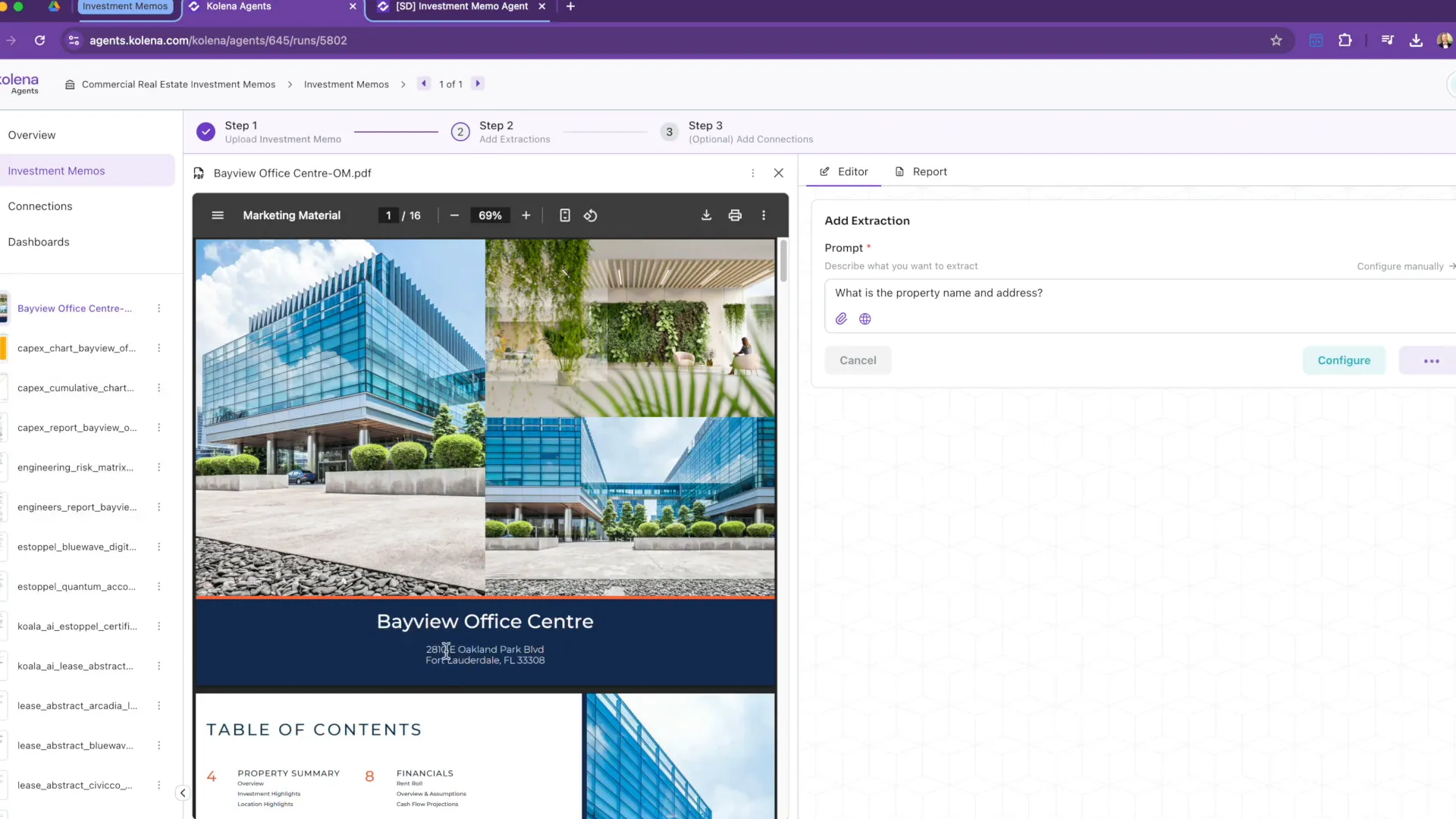

Understanding the Offering Memorandum

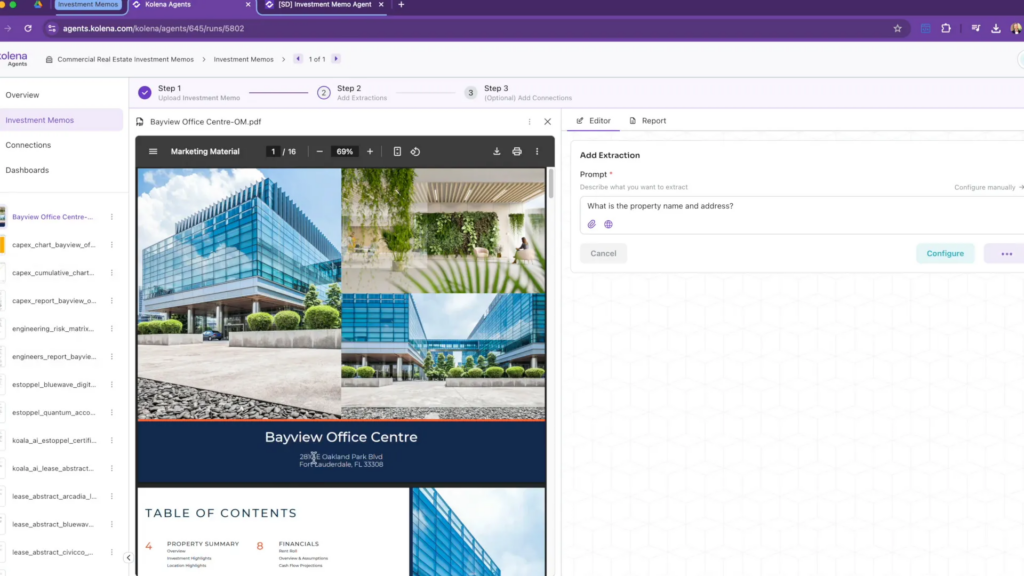

The offering memorandum is a crucial document in real estate transactions. It typically contains comprehensive details about the property, including a property summary, financial information, and demographic data. Kolena’s AI can analyze this document and extract key insights, making it easier to assess the investment’s potential.

For instance, the offering memorandum for the fictional Bayview office center in Fort Lauderdale contains multi-page information critical for evaluating the property. By processing this document, Kolena can help you identify essential metrics like occupancy rates, financial projections, and risk assessments.

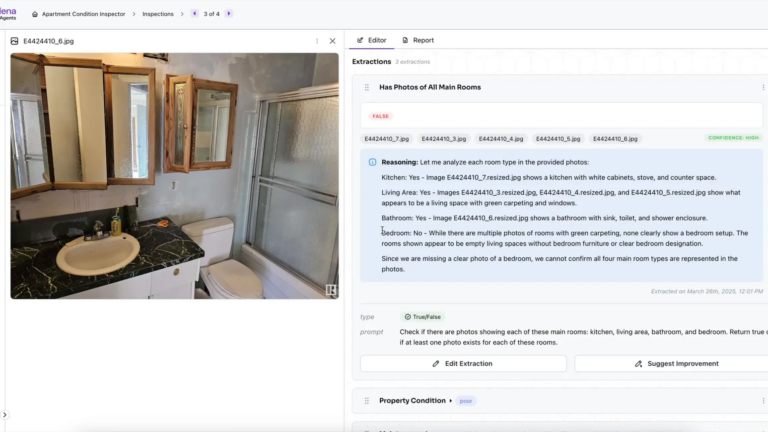

Basic Extraction of Property Information

One of the standout features of Kolena is its ability to perform basic extractions of property information with minimal input. You simply instruct the AI in natural language to retrieve specific data points, such as the property name and address. The AI intelligently rewrites your request to optimize the extraction process, ensuring accurate results.

For example, when querying for the Bayview office center’s information, Kolena will pull the correct name and address from the offering memorandum. This process not only saves time but also enhances the accuracy of the data collected, which is vital for effective investment decision-making.

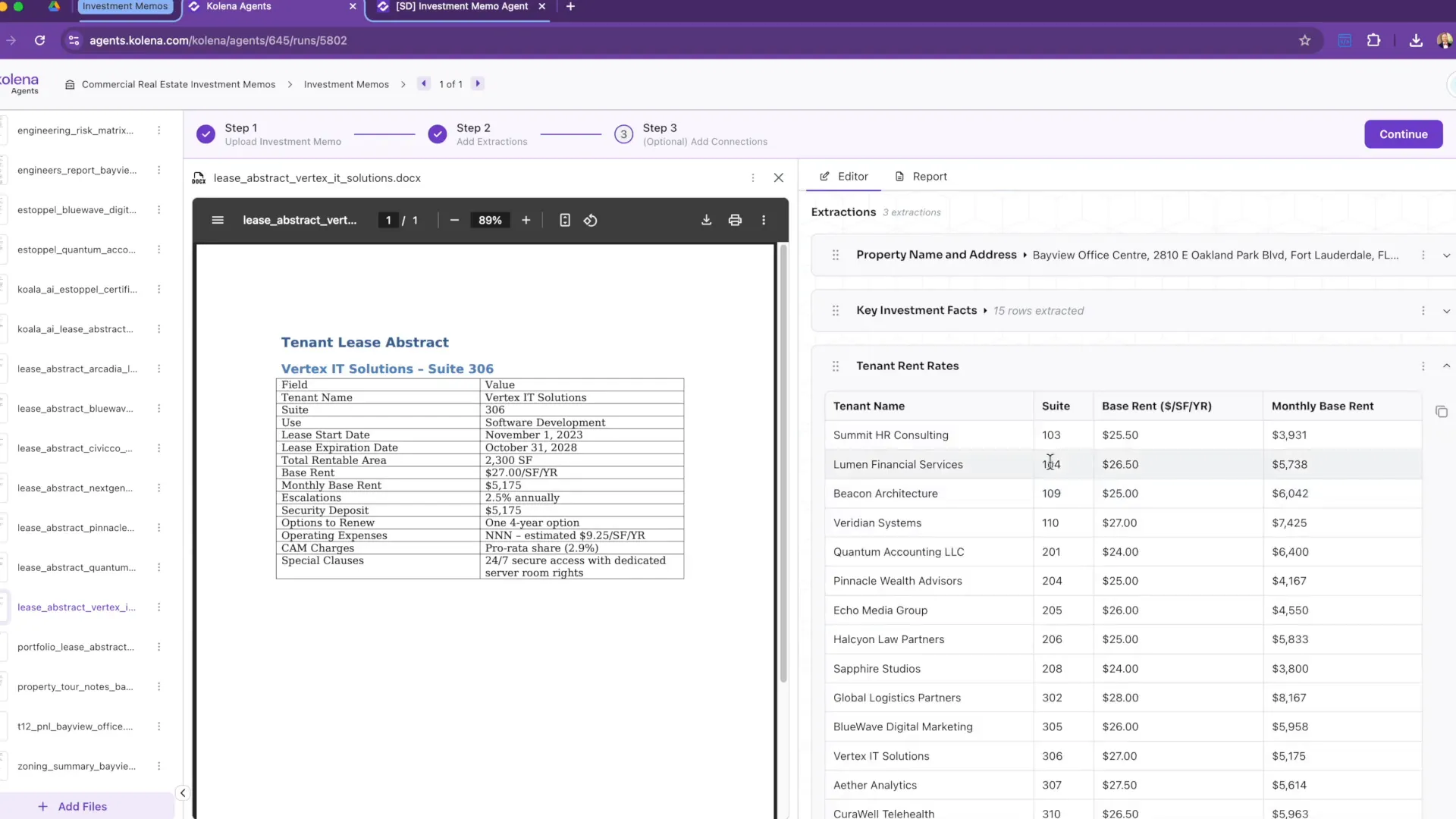

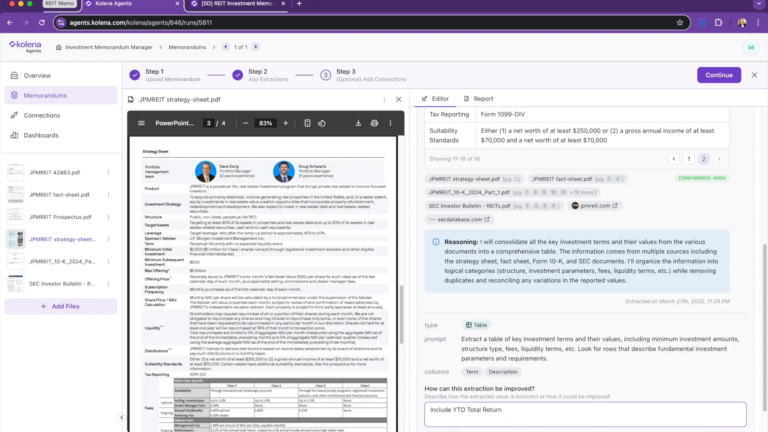

Key Facts Extraction for Investment Opportunities

One of the primary functions of Kolena’s AI for investment memos is the extraction of key facts from the documents uploaded. This feature allows investors to quickly gather essential data that informs their decision-making process. By simply instructing the AI in natural language, users can obtain vital metrics such as property name, location, building size, and occupancy rates.

For example, when tasked with extracting key facts for the Bayview office center, the AI generates a comprehensive table summarizing crucial information. This includes details like tenant mix and building features, all tailored to fit the context of an investment memo. The flexibility to customize these extractions ensures that you receive the most pertinent information for your specific needs.

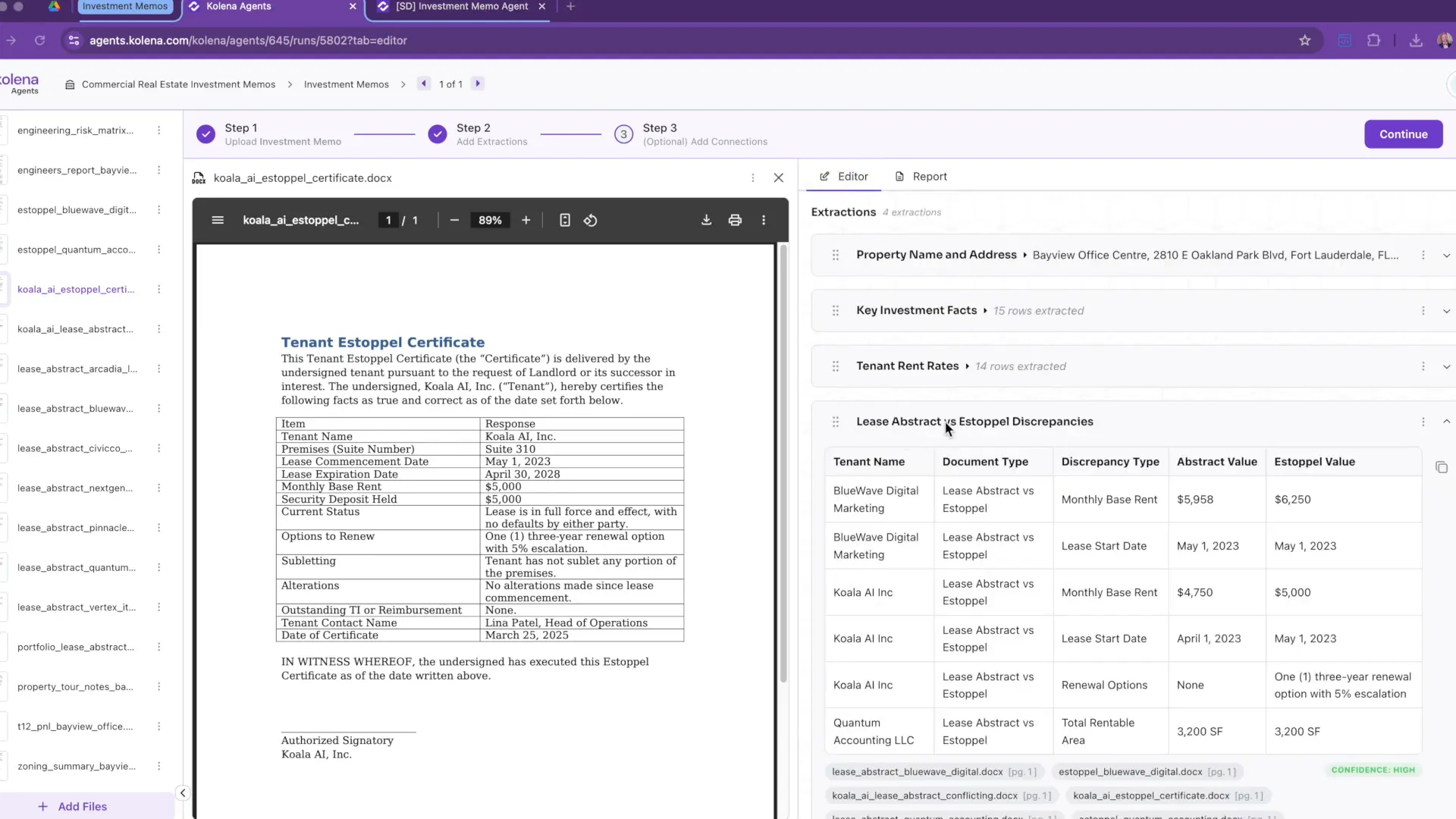

Analyzing Rent Rates through Lease Abstracts

Understanding rent rates is critical for evaluating investment opportunities. Kolena’s platform enables users to analyze lease abstracts effectively. Each lease abstract provides detailed information about tenant agreements, including monthly rent rates and any special stipulations.

When you upload multiple lease abstracts, the AI organizes this data into a clear and concise table. This format allows investors to easily compare rent rates across different tenants, facilitating better analysis of potential cash flows. The structured output simplifies the process of assessing whether the investment aligns with financial goals.

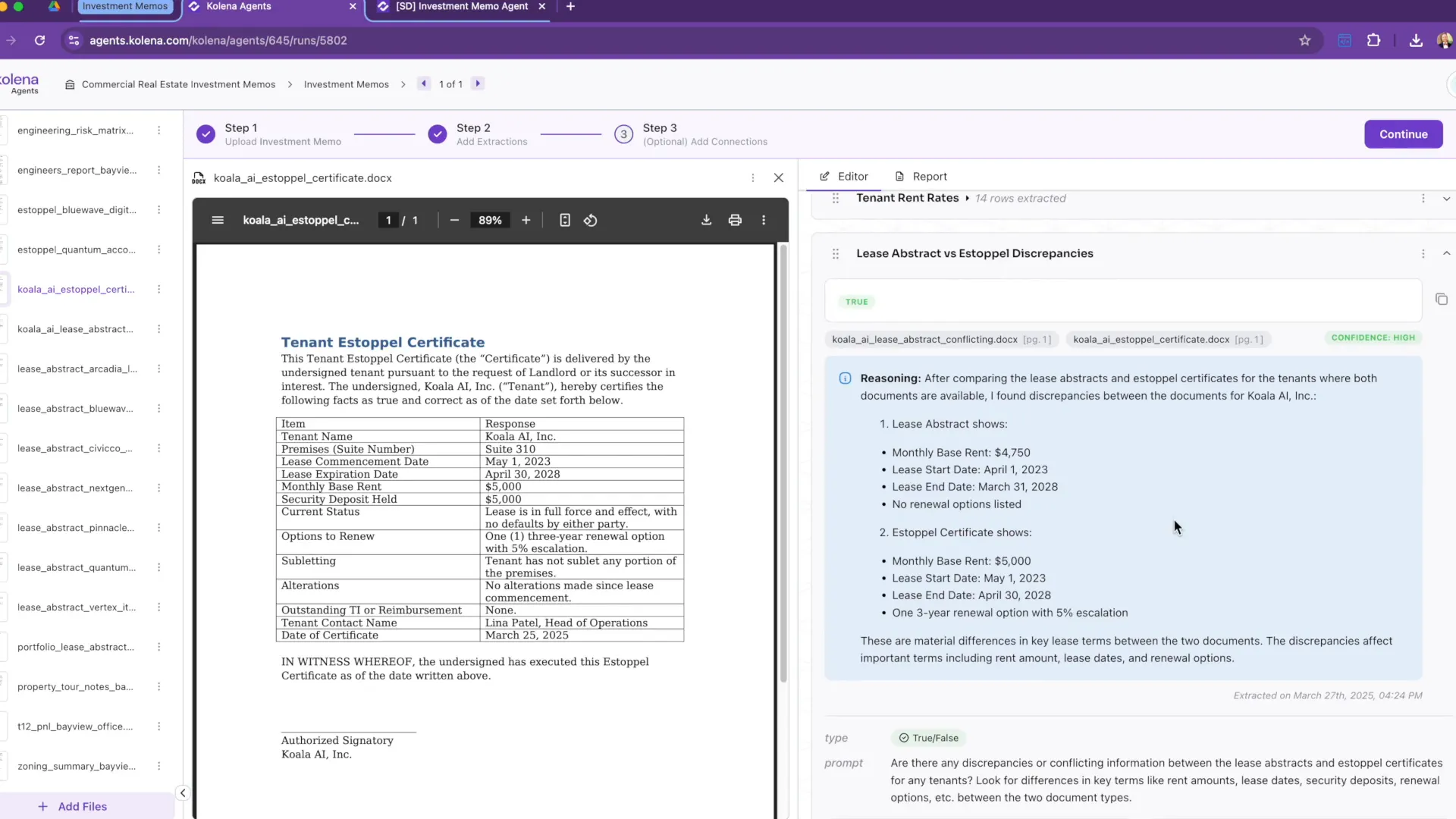

Identifying Discrepancies with Estoppel Certifications

Another significant advantage of Kolena’s AI is its ability to identify discrepancies between lease abstracts and estoppel certifications. This is crucial for validating the accuracy of lease terms and ensuring that all details match across various documents.

When discrepancies are found, the AI highlights them in a user-friendly format, often presenting them in a table for easy reference. This not only saves time but also minimizes the risk of errors that could impact investment decisions. By addressing these discrepancies early in the analysis, investors can avoid potential future complications.

Compiling Reports and Document Outputs

Once the necessary data is extracted and analyzed, the AI allows users to compile comprehensive reports. These reports serve as the investment memo, encapsulating all the essential information gathered during the analysis process.

The platform supports various formats for output, including PDF and CSV, enabling seamless integration with existing tools popular in the real estate industry. This functionality ensures that you can easily share findings with stakeholders or utilize the data for further analysis.

Automating the Investment Memo Process

Automation is a game-changer in the investment memo creation process. With Kolena’s AI platform, users can set up automated connections to data sources, such as cloud storage or property management systems. This ensures that any new documents uploaded are automatically processed according to the established agent instructions.

This automation not only streamlines the workflow but also maintains consistency in the quality of the investment memos produced. As you continue to add new documents, the system updates and generates new reports, saving you valuable time and effort.