AI in real estate is no longer a futuristic concept – it’s here, transforming how property professionals work across the United States. From commercial real estate firms to residential brokerages and investors, artificial intelligence is being leveraged to automate tedious tasks, uncover insights, and drive faster decisions. For VPs, directors, and owners in the CRE industry, adopting AI isn’t just a tech upgrade – it’s a strategic imperative. As one industry expert put it, “AI won’t replace real estate people. AI will replace real estate people who don’t have AI.” In other words, leveraging AI tools (often called AI agents for their ability to act autonomously on tasks) is now key to staying competitive and efficient.

Leading commercial real estate firms are rapidly embracing AI for a range of use cases, from automating tedious paperwork to uncovering hidden insights in their portfolios. Major CRE software providers are also integrating AI into their platforms, validating that this trend is here to stay. According to Knight Frank’s 2025 CRE survey, while many organizations are still early in adoption, optimism is high – nearly half of companies expect high AI adoption within a year to drive operational efficiency . The opportunity is clear: AI can handle labor-intensive processes in minutes instead of days, with greater accuracy and consistency than manual workflows.

In this post, we’ll explore the top 5 use cases for AI in commercial real estate professionals in 2025:

AI-Powered Lease Abstraction – automatically extracting key terms from leases

Automating PayApp Reviews & Invoice Processing – streamlining accounts payable with AI

Intelligent Contract Analysis – reviewing and analyzing contracts with machine speed

Offering Memorandum Drafting – generating investment memos using AI assistance

Due Diligence Document Review – accelerating property due diligence with AI insights

Each of these use cases delivers practical benefits – time savings, reduced risk, cost efficiency, and newfound insights – that can revolutionize your real estate operations. Let’s dive into each one in detail.

Download free e-book: How AI Is Revolutionizing Real Estate

1. AI-Powered Lease Abstraction in Commercial Real Estate (from Hours to Minutes)

Lease abstraction is the process of summarizing lengthy lease agreements into key terms and data points. It’s a foundational task for asset managers and lease administrators, but it’s notoriously time-consuming. In fact, manually reading and abstracting a commercial lease can take 3–5 hours per lease on average – and complex leases may require a full day’s work. This means even a modest portfolio of properties can tie up staff with weeks of tedious document review. The traditional approach also carries a risk of human error; important clauses (like renewal options or expense caps) can be missed, leading to costly mistakes down the line.

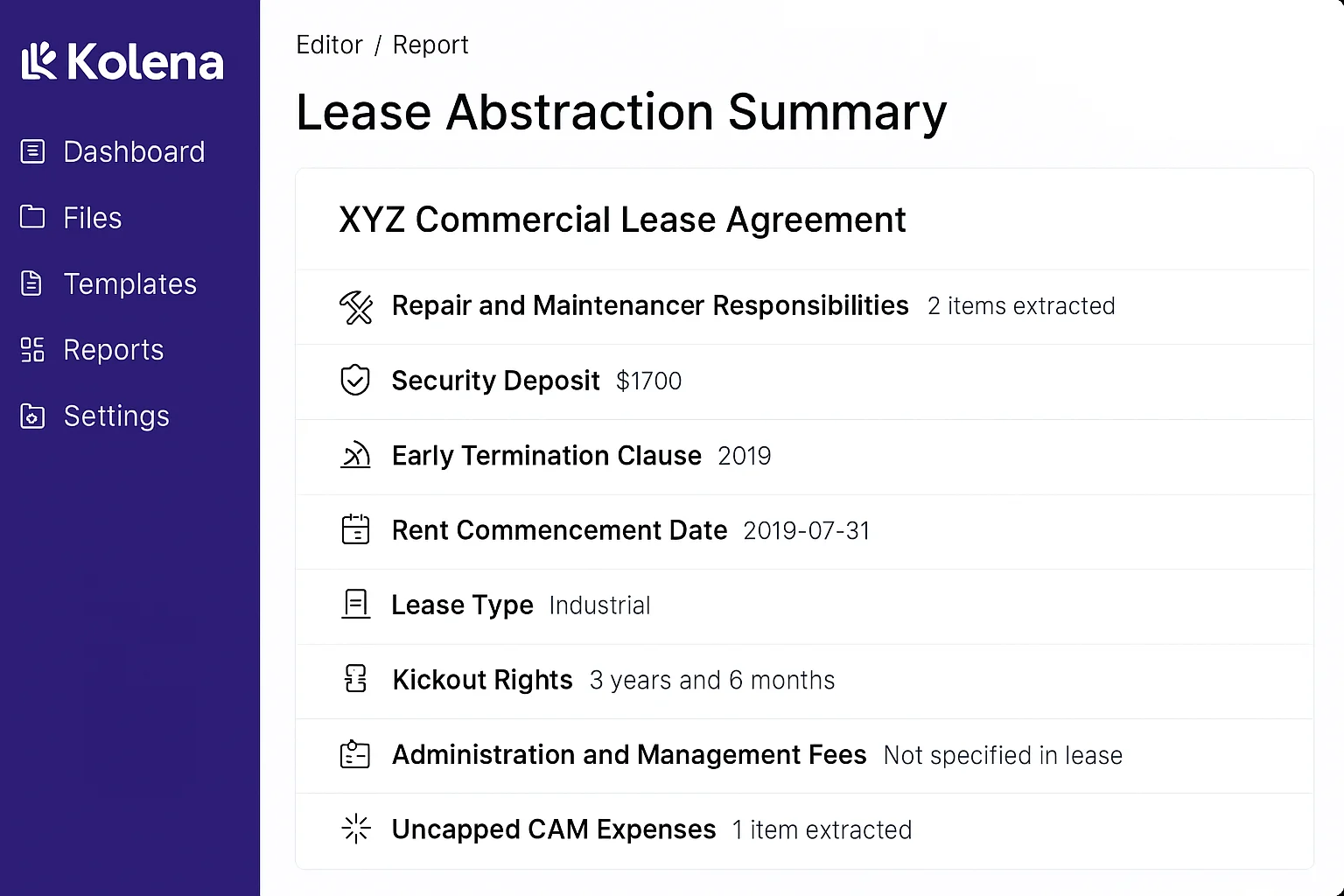

AI-powered lease abstraction is changing the game for CRE teams. Modern AI agents use OCR (optical character recognition) and NLP (natural language processing) to extract critical lease details in minutes . They can pull out tenant names, lease start and end dates, rent schedules, renewal options, security deposit info, escalation clauses, and more – essentially generating a structured lease summary that would take humans hours to compose. For example, one platform reported reducing lease processing time from about 3 hours to just 7 minutes per document in tests . Even accounting for a human review step, organizations are seeing 70–90% faster lease abstractions with AI assistance on average .

How Kolena helps: Kolena’s AI platform delivers automated lease abstraction that is both fast and accurate. It can parse through lengthy lease documents (and amendments) and output a concise summary of all key terms *“accurately and in minutes, not weeks.” By eliminating the busy work of combing through leases, Kolena’s AI agent ensures that critical details are instantly accessible and no important clause goes unnoticed. The platform even highlights discrepancies or unusual terms (for example, a missing insurance clause or an atypical escalation), providing AI-powered insights that help asset managers make informed decisions . The result is a lease administration process that’s faster, cheaper, and more reliable than ever before.

Schedule a Demo with an AI Enablement Expert

2. Automating PayApp Reviews

For development and property management executives, payment applications (PayApps) and accounts payable are critical processes often mired in paperwork. A PayApp is the detailed invoice package a contractor submits (usually monthly) to get paid for construction work completed – including forms, lien waivers, progress reports, and more. Preparing and reviewing these PayApp documents manually is slow and prone to errors. There might be back-and-forth with contractors to correct mistakes, and accounting staff must re-enter data into finance systems. It’s a labor-intensive workflow that can delay payments and tie up project cash flow.

AI automation is streamlining PayApps and invoice workflows dramatically. An AI agent acting as a “project accountant” can read incoming invoices, contractor reports, and PayApp forms, then fill in a standardized payment application template automatically. It cross-checks figures against budgets or contracts and verifies that all required documents (like insurance certificates or lien releases) are present (kolena.com). Essentially, the AI ensures the PayApp package is complete and correct before routing it for approval. By doing so, it eliminates many of the manual touchpoints.

The impact of AI on accounts payable is backed by impressive stats. Studies find that AI-based AP automation can lower invoice processing costs by about 81%, speed up processing cycle times by 73%, and cut errors nearly in half. Fewer errors mean fewer payment disputes and less time spent correcting data entry mistakes. In practical terms, invoices that might sit for days waiting for manual data entry can be processed in seconds by AI, which helps avoid late payments (and the late fees that come with them) and capture more early-payment discounts.

Key benefits of AI in invoice processing:

Faster Processing & Approvals: By reading documents and populating forms automatically, AI enables invoice packages to move to approval in a fraction of the time. Tasks that once required days of back-and-forth can often be completed the same day. This keeps projects on schedule and contractors happier. In fact, some firms have seen per-invoice processing time and costs drop by 70–80% with AI.

Lower Labor Costs: Automation lets one accounts payable clerk handle what used to take an entire team. Your finance staff can manage more properties or projects without adding headcount. Employees are freed from data-entry drudgery to focus on higher-value work like vendor management and analysis.

Reduced Errors & Discrepancies: AI greatly minimizes typos and mis-categorized entries. It can cross-check invoice line items against contracts or budgets automatically, flagging any discrepancies (e.g. a charge for materials not in the scope of work) for human review. By catching anomalies, AI helps prevent overpayments and the painful reconciliations later on.

Better Compliance & Audit Trails: Every action the AI takes can be logged, creating a detailed audit trail. If you need to prove that a PayApp was reviewed properly, the system can show a record of all checks performed. This transparency ensures compliance with internal controls and makes life easier for auditors and investors who want to see that proper AP procedures were followed.

3. Offering Memorandum Drafting with AI

In commercial real estate, preparing an Offering Memorandum (OM) or investment memorandum is a critical step when marketing a property or raising capital for a deal. These documents can be hefty – dozens of pages with property descriptions, financial summaries, lease overviews, market analysis, and more. Traditionally, drafting an OM is an intensive process: analysts gather data from multiple sources (leases, rent rolls, appraisals, market comps), then write and compile the content, all while ensuring the final product looks polished and professional. It can take days or weeks to produce a high-quality offering memo for a single asset. In fast-moving markets, that time lag can mean missed opportunities.

AI agents for document drafting, especially those powered by generative AI (like GPT models), are revolutionizing how OMs and investment memos are created. An AI can rapidly generate text and compile data for various sections of the memo. For instance, given property data and financial inputs, an AI agent could draft a property overview section, complete with a description of the asset, location highlights, and key financial metrics. It can also summarize lease abstracts into narrative form for a rent roll overview section, or turn a set of financial projections into an easily digestible summary for potential investors. In 2023, we saw early adopters using ChatGPT-style tools to help write offering memoranda – a trend that has only accelerated in 2024 and 2025 . In fact, commercial real estate firms are already using AI to streamline OM drafting as one of the first and most tangible applications in their underwriting and marketing process .

What AI-assisted OM drafting brings to the table:

Faster Document Turnaround: What used to take a team a week might now be achievable in a day with AI assistance. By automating the first draft of each section, AI dramatically shortens the content creation cycle. Humans no longer start from a blank page; instead, they review and refine AI-generated text. This means brokers and investment teams can go to market faster, giving them a competitive edge. One early case noted that an individual could generate a draft document “in minutes by inputting the relevant data,” which was described as “a huge time saver” for transactional work .

Consistent, High-Quality Content: Generative AI can be trained or prompted to write in a professional tone with consistent formatting. This ensures that every OM adheres to your firm’s style and quality standards, even if multiple people or teams are involved in preparing it. AI can also reduce the chances of omitting key information since it can be instructed to always include certain sections or data points. The result is a more reliable output that still can be polished by human experts, but with far fewer omissions or inconsistencies.

Data-Driven Insights: AI doesn’t just regurgitate data – it can highlight insights. For example, if an offering memorandum includes a section on investment highlights or risks, an AI agent could analyze the input data (leases, financials, market trends) and call out notable points: “Occupancy has averaged 95%+ over the past 5 years” or “The top tenant comprises 40% of the rent roll, indicating some concentration risk.” These are the kinds of insights an analyst would note, but an AI can surface them faster by crunching the numbers and reading the documents. Such previously unknown insights or patterns (like an upcoming cluster of lease expirations) might be caught by AI analysis and incorporated into the memo, giving investors a fuller picture.

Reduced Manual Assembly: Compiling tables, charts, and appendices in an OM is tedious work. AI can automate the creation of these elements by pulling data directly from sources. If you need a rent roll table or a lease expiry schedule, the AI can generate it from your lease abstracts. Need a location map or demographics? AI can assist in fetching relevant data and even generating simple charts. This automation of grunt work means analysts spend less time on Word and Excel drudgery and more on deal strategy.

Schedule a Demo with an AI Enablement Expert

4. Accelerating Due Diligence Reviews with AI

Due diligence is a phase in real estate acquisitions (or financing, or even large leases) where a mountain of documents must be reviewed under tight timeframes. Prospective buyers need to examine every lease, contract, title document, financial statement, inspection report, and more to identify any red flags or liabilities before a deal closes. This process can be overwhelming – it’s not uncommon for a single property deal to involve hundreds of documents. Traditionally, teams would divide and conquer, manually reading through PDFs late into the night, often over a span of several weeks, to complete due diligence. It’s a scenario ripe for burnout and oversight.

Enter AI-driven due diligence review. AI agents can drastically speed up the review of large document sets by quickly summarizing documents, extracting key facts, and even answering questions about the content. For example, an AI agent can be tasked with reading all tenant leases in a data room and producing a summary of critical lease terms for each (or a consolidated report of all leases). This alone addresses one of the most time-consuming tasks in real estate due diligence – lease reviews . Imprima, a virtual data room provider, notes that AI “Smart Summaries” can “slash hours of the most time-consuming task in real estate due diligence” by automatically extracting all key lease information into a structured summary . Beyond leases, AI can help with reviewing service contracts, permits, environmental reports, and more, highlighting important points so analysts can focus on the implications rather than the rote reading.

Benefits of using AI in CRE due diligence:

Speed to Close Deals: Time is of the essence in transactions. AI can review documents at a blistering pace, compressing the due diligence timeline significantly. What might take a team 2–3 weeks of full-time effort could potentially be done in days with AI summarizing much of the content. In one case, a CRE firm saved 7–10 business days in due diligence time on an acquisition by using an AI tool to accelerate document review . Faster due diligence means faster closings and less risk of deals falling through or getting scooped by competitors. It also frees up your acquisitions team to evaluate more opportunities in a given time.

Comprehensive Risk Identification: AI doesn’t get bleary-eyed at 2 AM – it will diligently go through every page of every document. This thoroughness helps ensure that nothing slips through the cracks. If there’s a lease with an obscure clause that could hamper your plans (say, a tenant’s right of first refusal that could impede re-development), AI will flag it by recognizing it as a deviation from the norm . AI-powered tools have been noted to provide insights into “hidden clauses” and ensure compliance with standards , effectively acting like a second pair of expert eyes on all documents. By catching issues early – from liens on title to out-of-compliance zoning reports – AI enables you to address them or negotiate around them before they become your problem post-acquisition.

Organized Data Extraction: During due diligence, stakeholders often want to see summary reports – e.g., an Excel sheet of all lease key terms, or a checklist of all contracts and their status. AI can generate these on the fly as it reviews documents. For instance, as it reads leases, it can populate a spreadsheet with each lease’s critical info (rent, term, options, etc.) without someone typing it in line by line. This not only saves labor, but gives decision-makers up-to-date data to make decisions (like calculating the weighted average lease term instantly). Having structured outputs from AI review means easier analysis of the portfolio – you can sort, filter, and quantify aspects of the deal that would be hard to do from reading PDFs alone.

Scalability and Flexibility: If you suddenly have to review an extra batch of documents or a new dataset in the eleventh hour, AI can handle the surge. Scaling up a due diligence team in-house or via consultants is expensive and time-consuming, but scaling an AI agent is as simple as providing more computing power. This flexibility ensures that no matter how large the data room, you can efficiently get through it. AI also works 24/7, so analyses can be generated overnight, ready for your team’s review each morning – effectively extending your working hours without burning out your staff.

Schedule a Demo with an AI Enablement Expert

5. Intelligent Contract Analysis for CRE Transactions

Beyond leases, commercial real estate professionals deal with many other contracts: purchase and sale agreements, loan documents, JV partnership agreements, vendor contracts, property management agreements, and more. Manually reviewing these lengthy contracts is a drain on time and resources – and any oversight can lead to legal risks or lost dollars. Contract analysis AI offers a solution by rapidly reading and analyzing contracts with a level of speed and consistency humans can’t match.

AI contract analysis software acts like a tireless legal assistant, scanning documents for key clauses, obligations, and anomalies. It can instantly find specific provisions (e.g. an indemnification clause or a rent escalation clause) across hundreds of pages, whereas a human might spend hours sifting through binders . In fact, studies indicate AI can review contracts far faster than humans with comparable or better accuracy, especially for routine extraction tasks . There’s no need to lose hours searching for a needle in a haystack when AI can retrieve it in seconds. For example, if you need to confirm all contracts have a force majeure clause, an AI agent can highlight any document that’s missing it or uses non-standard wording – a job that could take a person days to complete across a large contract portfolio.

Benefits of AI-driven contract analysis:

Efficiency and Speed: Lawyers and CRE professionals traditionally spend up to 50% of their time reviewing and drafting documents . AI slashes this burden by handling the initial review swiftly. Routine tasks like locating clauses or comparing contract terms to standards can be done in moments. This frees up your team to focus on high-value analysis and negotiation rather than grunt work. As Thomson Reuters notes, “there’s no need to spend precious hours — or even days — searching for an essential clause… when AI can find it for you in seconds.”

Risk Reduction & Consistency: AI contract review tools excel at enforcing consistency and flagging risks. They can automatically flag deviations from your standard contract language or checklist. For instance, if a lease or service contract has an unusual termination provision or missing insurance requirement, the AI will surface it for human review. This early identification of issues means fewer surprises later. One popular AI tool (Kira Systems) has been used in real estate to identify key data like option periods and renewal terms with high accuracy , ensuring nothing important is overlooked. In short, AI becomes a second set of eyes that never tires, helping catch errors or risky clauses that humans might miss late at night.

Obligation Management: Contracts often contain critical dates and obligations (renewal notice deadlines, rent increase dates, compliance requirements, etc.). AI can automatically extract these dates and duties and even integrate with calendaring or task systems. Think of it as moving from a manual tickler system to an intelligent, automated one. If a contract says a tenant must notify of renewal 180 days before lease end, an AI agent can capture that and remind your team at the right time – without anyone having to manually enter it. This proactive alerting prevents costly oversights, like missing a renewal window or a deadline to exercise an option .

Faster Deal Negotiations: In transactions, AI-assisted contract analysis lets you review counterparty documents much faster during due diligence or negotiations. If you’re acquiring a property and need to analyze all vendor contracts or service agreements in the deal, an AI can summarize each and flag unusual terms (change-of-control clauses, termination rights, etc.) in a fraction of the time. This accelerates deal cycles and lets you make informed decisions quickly. It also empowers smaller teams to handle large document volumes that previously required armies of attorneys.

How Kolena helps: Kolena AI brings contract intelligence to your fingertips. With an AI agent configured for contract review, you can upload your documents and let the system do the heavy lifting – highlighting compliance risks, pulling out key terms, and ensuring consistency across all contracts. According to Kolena’s real estate solutions page, the AI can “automatically detect compliance risks and inconsistencies in contracts, lease agreements, and financial documents,” acting as a diligent quality control assistant . For real estate deal-makers, Kolena’s AI can cross-compare documents (e.g., compare a lease abstract against the actual lease PDF to ensure accuracy, or compare different versions of a contract) in seconds. The result is greater confidence that every contract has been thoroughly vetted, without burning out your legal team. By using Kolena’s AI agents for contract analysis, CRE firms can speed up transactions, avoid costly contract surprises, and maintain a high standard of compliance with minimal manual effort.

Conclusion & Next Steps

AI has firmly planted its flag in the realm of commercial real estate. The top five use cases we’ve explored – from automating lease abstraction to streamlining due diligence – demonstrate that AI agents are not theoretical pilots but practical tools delivering value today. Forward-thinking CRE leaders are leveraging these solutions to save time, cut costs, reduce risk, and uncover insights that were previously out of reach in manual workflows. The competitive advantages are tangible: faster deal cycles, more efficient operations, and data-driven decision making. In an industry where time is money and details can make or break a deal, AI is helping real estate professionals act with greater speed and confidence.

Ready to unlock the power of AI in your real estate organization? Contact Kolena today for a demo and see how easily you can deploy AI agents for lease abstraction, contract analysis, invoice processing, and more. Let us help you transform tedious processes into automated, insight-rich workflows. The future of real estate belongs to those who embrace innovation, and with Kolena AI, you’ll be equipped to lead the way.